Question: Please answer 27, 28 and 29 ASAP (Total 26 points) Questions 2228 are based on the following information: Suppose that Kroger is an all-equity firm

Please answer 27, 28 and 29 ASAP

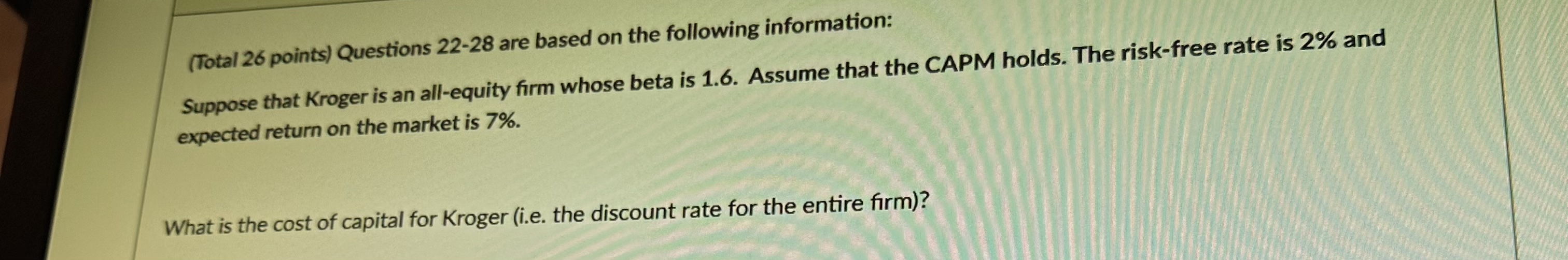

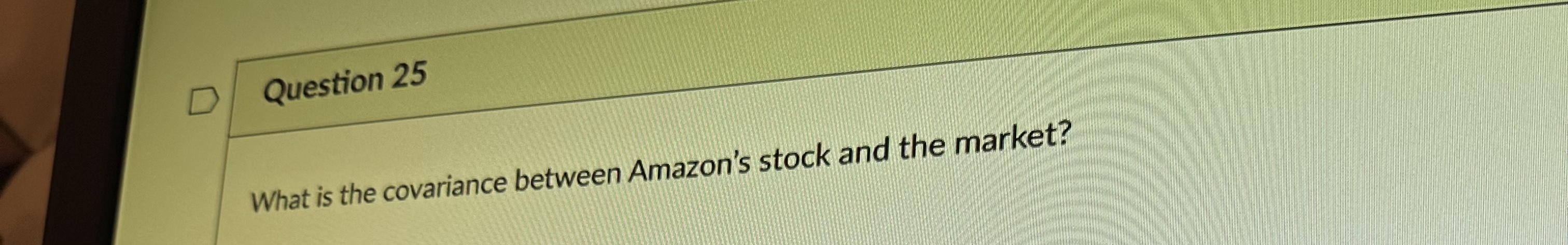

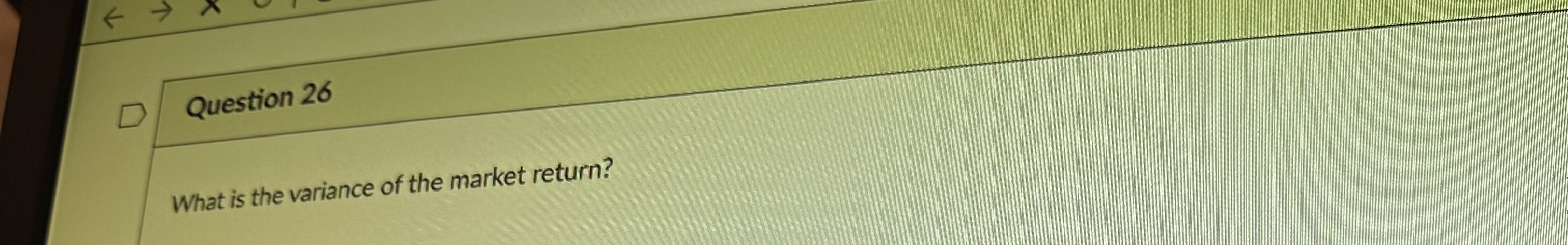

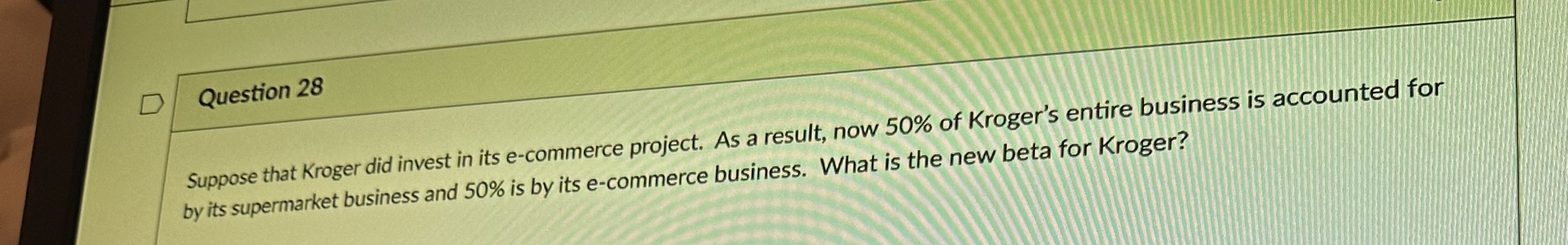

(Total 26 points) Questions 2228 are based on the following information: Suppose that Kroger is an all-equity firm whose beta is 1.6. Assume that the CAPM holds. The risk-free rate is 2% and expected return on the market is 7%. What is the cost of capital for Kroger (i.e. the discount rate for the entire firm)? What is the covariance between Amazon's stock and the market? What is the variance of the market return? Question 28 Suppose that Kroger did invest in its e-commerce project. As a result, now 50% of Kroger's entire business is accounted for by its supermarket business and 50% is by its e-commerce business. What is the new beta for Kroger? Question 27 What is Amazon's stock beta? What is the beta estimate for Kroger's e-commerce project? What is Kroger's new cost of capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts