Question: please answer 27 The info needed for question 27 is the next picture Question 27 (1 point) 20 21 Concerning question 24 above, what is

please answer 27 The info needed for question 27 is the next picture

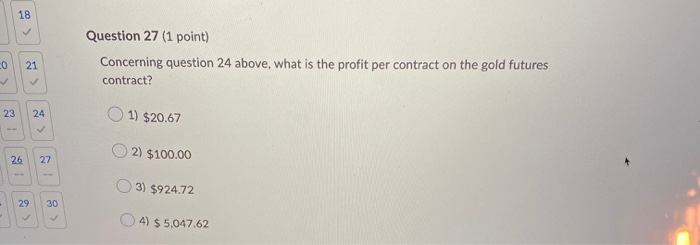

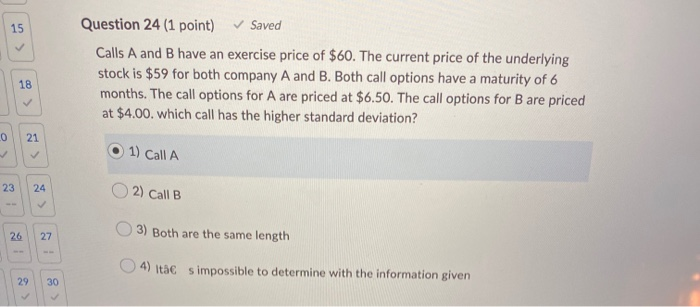

Question 27 (1 point) 20 21 Concerning question 24 above, what is the profit per contract on the gold futures contract? 23 24 1) $20.67 26 27 2) $100.00 3) $924.72 29 30 4) $5.047.62 Question 24 (1 point) Saved Calls A and B have an exercise price of $60. The current price of the underlying stock is $59 for both company A and B. Both call options have a maturity of 6 months. The call options for A are priced at $6.50. The call options for B are priced at $4.00. which call has the higher standard deviation? 021 1) Call A 23 24 2) Call B 26 27 3) Both are the same length 4) Its impossible to determine with the information given 29 30 Question 27 (1 point) 20 21 Concerning question 24 above, what is the profit per contract on the gold futures contract? 23 24 1) $20.67 26 27 2) $100.00 3) $924.72 29 30 4) $5.047.62 Question 24 (1 point) Saved Calls A and B have an exercise price of $60. The current price of the underlying stock is $59 for both company A and B. Both call options have a maturity of 6 months. The call options for A are priced at $6.50. The call options for B are priced at $4.00. which call has the higher standard deviation? 021 1) Call A 23 24 2) Call B 26 27 3) Both are the same length 4) Its impossible to determine with the information given 29 30

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts