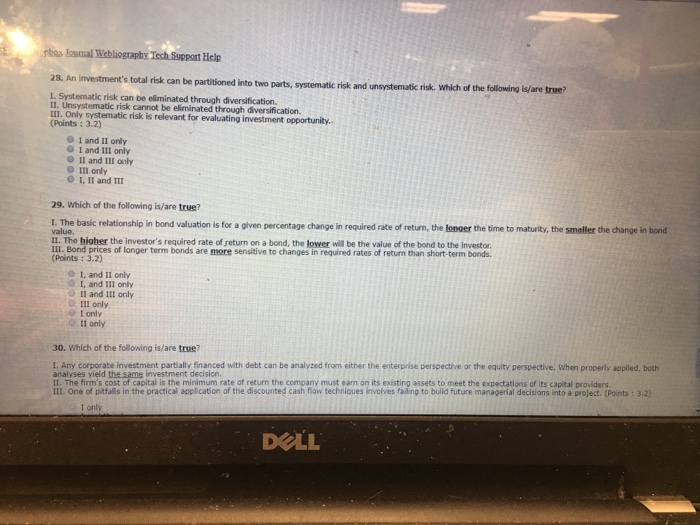

Question: Please answer 28 and 29 pbos Ional Webliogaphy Tech Support Heip 28. An investment's total risk can be partitioned into two parts, systematic risk and

pbos Ional Webliogaphy Tech Support Heip 28. An investment's total risk can be partitioned into two parts, systematic risk and unsystematic risk. which of the folowing is/are true? L. Systematic risk can be eliminated through diversification. . Unsystematic risk cannot be eliminated through diversification. Ill, Only systematic risk is relevant for evaluating investment opportunity. (Points: 3.2) O I and II only O I and III only O II and III only O II1 only O I, II and III 29. Which of the following is/are true? t. The basic relationship in bond valuation is for a given percentage change in required rate of return, the longer the time to maturity, the smeller the change in bond value. Il. The higher the investor's required rate of return on a bond, the lower will be the value of the bond to the investor. III. Bond prices of longer tem bonds are more sensitive to changes in required rates of return than short-term bonds. (Points: 3.2) e I, and I1 only 0 I, and II1 only Il and It only O IlI only I only I1 only 30. Which of the following is/are true? L Any ecorpecate inventnent peantil eaicecbe nalyd from sither the enterprise cersoedive or the equty perspective when properly seoled, both analyses yield the same investment decision. It. The firm's cost of capital is the minimum rate of return the company must earn on its existing assets to meet the expectations of its capital providers III. One of pitfalls in the practical application of the discounted cash flow techniques involves failing to build future managerial decisions into a project. (Points : 3.2) t only DOLL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts