Question: Please answer 2E thank you 2. Consider the following securities and their sensitivities to two factors (the factors have zero means): Stock A: ra,t =

Please answer 2E thank you

Please answer 2E thank you

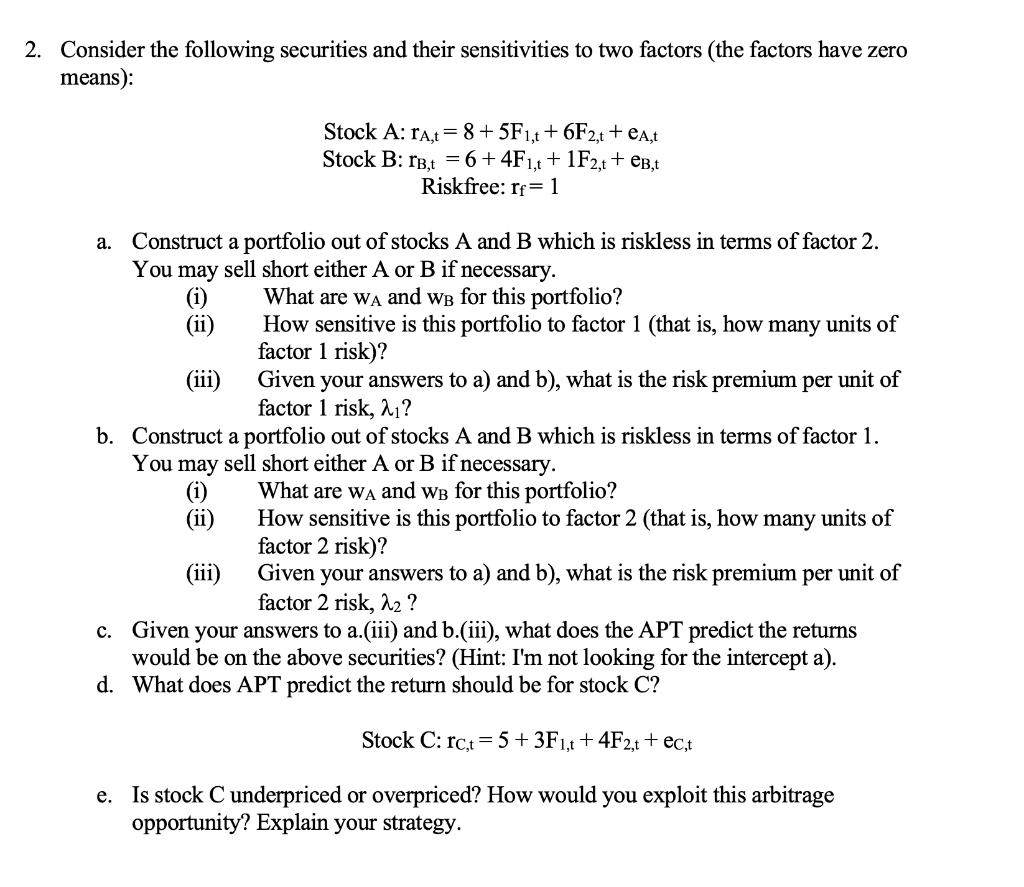

2. Consider the following securities and their sensitivities to two factors (the factors have zero means): Stock A: ra,t = 8+ 5F1,4 + 6F2,t + est Stock B: 13,1 = 6 + 4F1,0 + 1F2, + @B,t Riskfree: rf=1 a. Construct a portfolio out of stocks A and B which is riskless in terms of factor 2. You may sell short either A or B if necessary. What are wA and WB for this portfolio? (ii) How sensitive is this portfolio to factor 1 (that is, how many units of factor 1 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 1 risk, 21? b. Construct a portfolio out of stocks A and B which is riskless in terms of factor 1. You may sell sho either or B if necessary. What are wa and Wb for this portfolio? (ii) How sensitive is this portfolio to factor 2 (that is, how many units of factor 2 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 2 risk, 22 ? c. Given your answers to a.(iii) and b.(iii), what does the APT predict the returns would be on the above securities? (Hint: I'm not looking for the intercept a). d. What does APT predict the return should be for stock C? Stock C: rc,t = 5+ 3F1,1 + 4F2, + ec, e. Is stock C underpriced or overpriced? How would you exploit this arbitrage opportunity? Explain your strategy. 2. Consider the following securities and their sensitivities to two factors (the factors have zero means): Stock A: ra,t = 8+ 5F1,4 + 6F2,t + est Stock B: 13,1 = 6 + 4F1,0 + 1F2, + @B,t Riskfree: rf=1 a. Construct a portfolio out of stocks A and B which is riskless in terms of factor 2. You may sell short either A or B if necessary. What are wA and WB for this portfolio? (ii) How sensitive is this portfolio to factor 1 (that is, how many units of factor 1 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 1 risk, 21? b. Construct a portfolio out of stocks A and B which is riskless in terms of factor 1. You may sell sho either or B if necessary. What are wa and Wb for this portfolio? (ii) How sensitive is this portfolio to factor 2 (that is, how many units of factor 2 risk)? (iii) Given your answers to a) and b), what is the risk premium per unit of factor 2 risk, 22 ? c. Given your answers to a.(iii) and b.(iii), what does the APT predict the returns would be on the above securities? (Hint: I'm not looking for the intercept a). d. What does APT predict the return should be for stock C? Stock C: rc,t = 5+ 3F1,1 + 4F2, + ec, e. Is stock C underpriced or overpriced? How would you exploit this arbitrage opportunity? Explain your strategy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts