Question: please answer #3 3. What is the total return for each bond in each year? Round your answers to two decimal places. Excel Activity: Bond

please answer #3

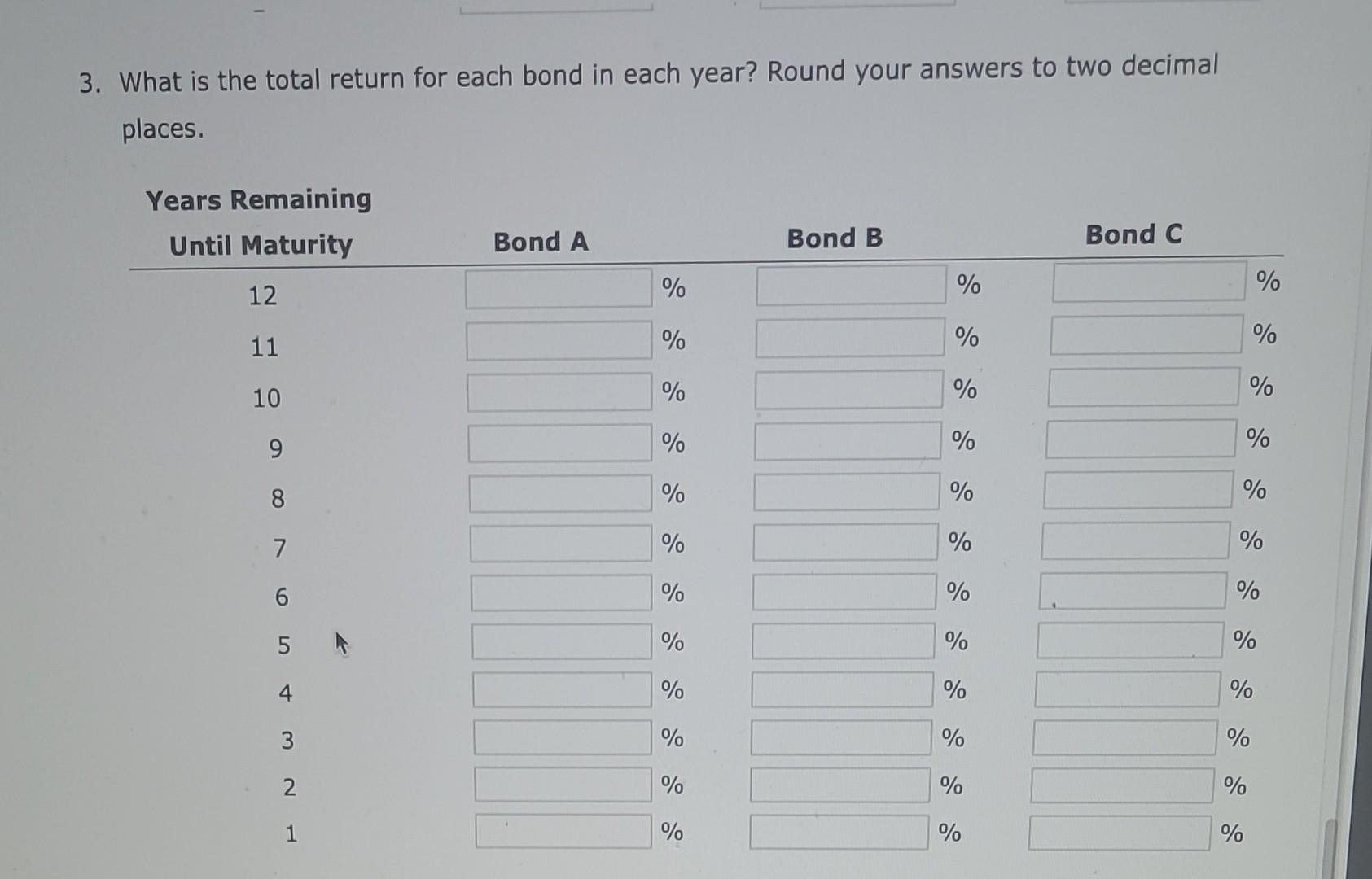

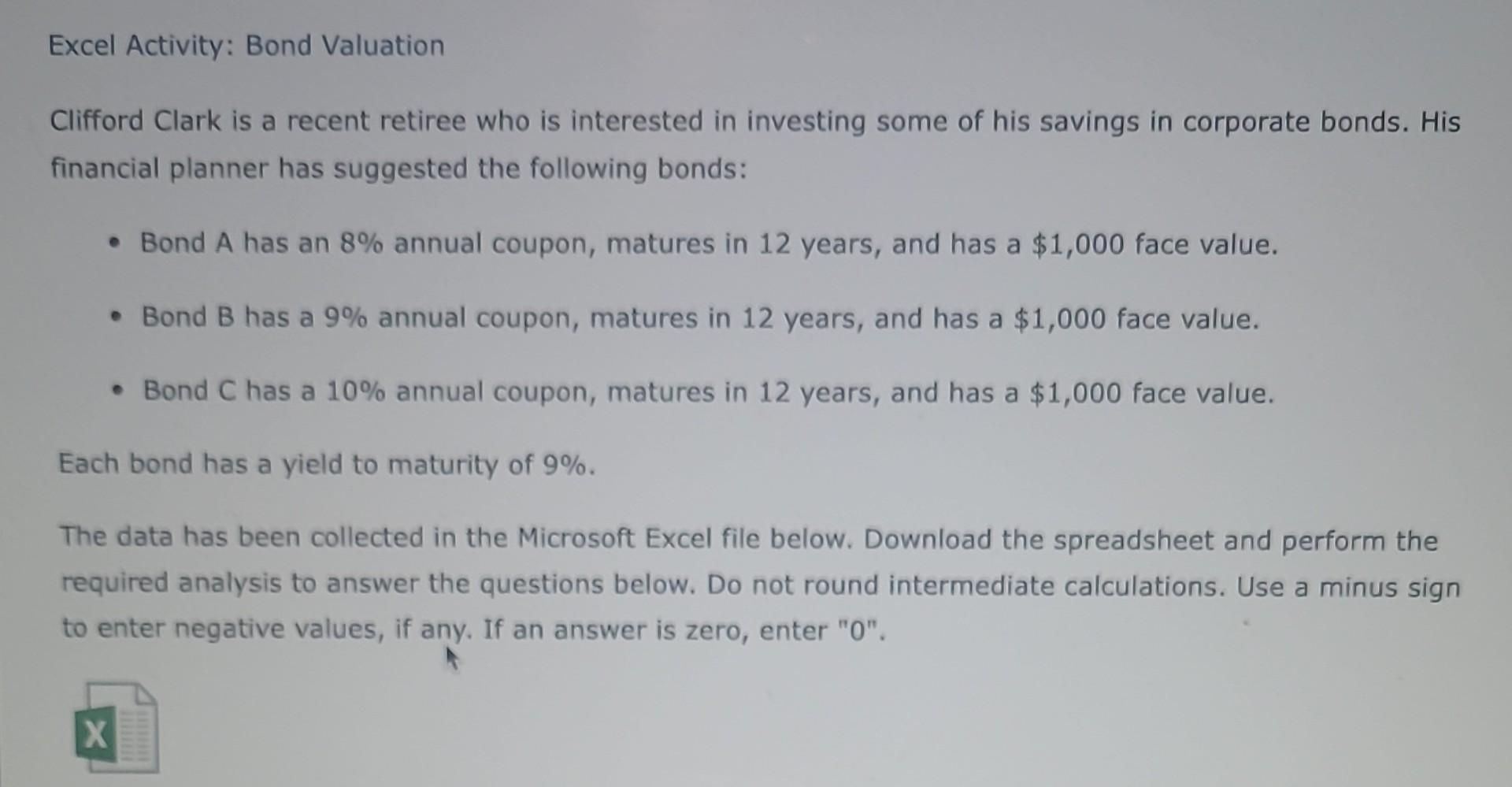

3. What is the total return for each bond in each year? Round your answers to two decimal places. Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 9\% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has a 10% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 9%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter " 0 ". 3. What is the total return for each bond in each year? Round your answers to two decimal places. Excel Activity: Bond Valuation Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 9\% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has a 10% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 9%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter " 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts