Question: Please answer #3 and #4 from part B. 3. Sit Down, Corp. is a chair manufacturer that reports the following information from the current period

Please answer #3 and #4 from part B.

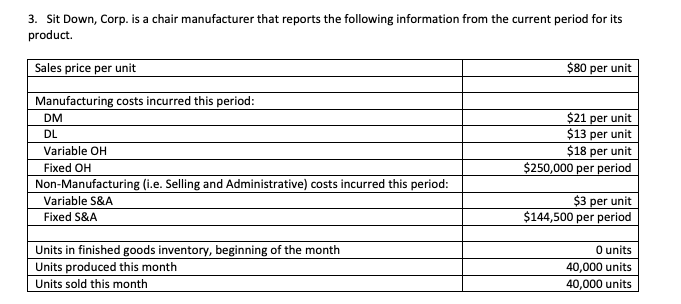

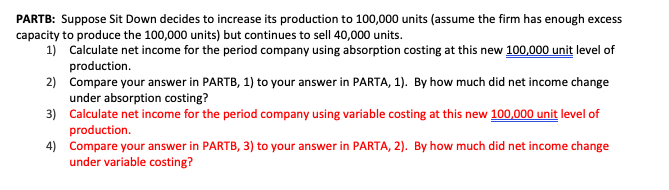

3. Sit Down, Corp. is a chair manufacturer that reports the following information from the current period for its product. Sales price per unit $80 per unit Manufacturing costs incurred this period: DM DL Variable OH Fixed OH Non-Manufacturing (i.e. Selling and Administrative) costs incurred this period: Variable S&A Fixed S&A $21 per unit $13 per unit $18 per unit $250,000 per period $3 per unit $144,500 per period Units in finished goods inventory, beginning of the month Units produced this month Units sold this month O units 40,000 units 40,000 units PARTB: Suppose Sit Down decides to increase its production to 100,000 units (assume the firm has enough excess capacity to produce the 100,000 units) but continues to sell 40,000 units. 1) Calculate net income for the period company using absorption costing at this new 100,000 unit level of production 2) Compare your answer in PARTB, 1) to your answer in PARTA, 1). By how much did net income change under absorption costing? 3) Calculate net income for the period company using variable costing at this new 100,000 unit level of production 4) Compare your answer in PARTB, 3) to your answer in PARTA, 2). By how much did net income change under variable costing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts