Question: Please answer 3 and 4. Very desperate!! Problem 1 - Use of Leverage in Recapitalization Bronco Corp (Bronco) currently has no debt in its capital

Please answer 3 and 4. Very desperate!!

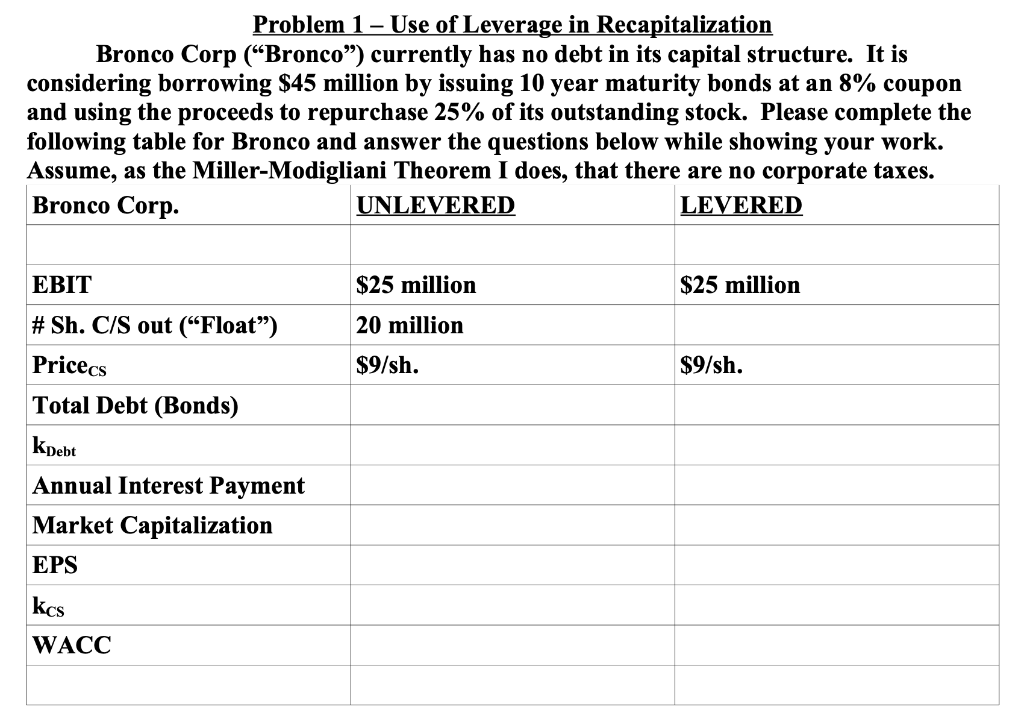

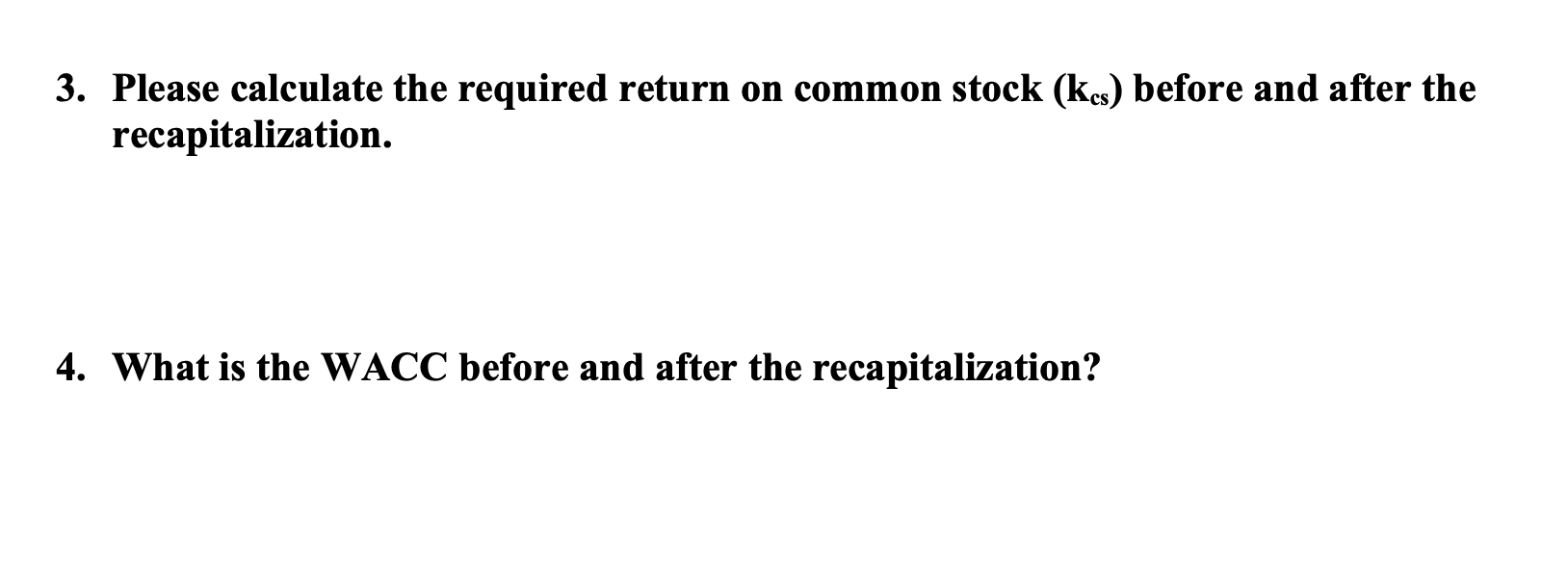

Problem 1 - Use of Leverage in Recapitalization Bronco Corp (Bronco) currently has no debt in its capital structure. It is considering borrowing $45 million by issuing 10 year maturity bonds at an 8% coupon and using the proceeds to repurchase 25% of its outstanding stock. Please complete the following table for Bronco and answer the questions below while showing your work. Assume, as the Miller-Modigliani Theorem I does, that there are no corporate taxes. Bronco Corp. UNLEVERED LEVERED EBIT $25 million $25 million #Sh. C/S out (Float") 20 million Pricecs $9/sh. $9/sh. Total Debt (Bonds) kDebt Annual Interest Payment Market Capitalization EPS |kes WACC 3. Please calculate the required return on common stock (kcs) before and after the recapitalization. 4. What is the WACC before and after the recapitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts