Question: please answer 3 questions thank you Which statement is TRUE regarding oil and gas limited partnership interests? A The primary tax benefit of an exploratory

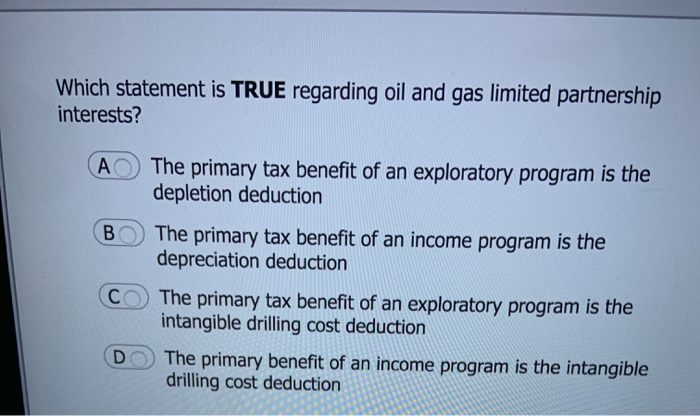

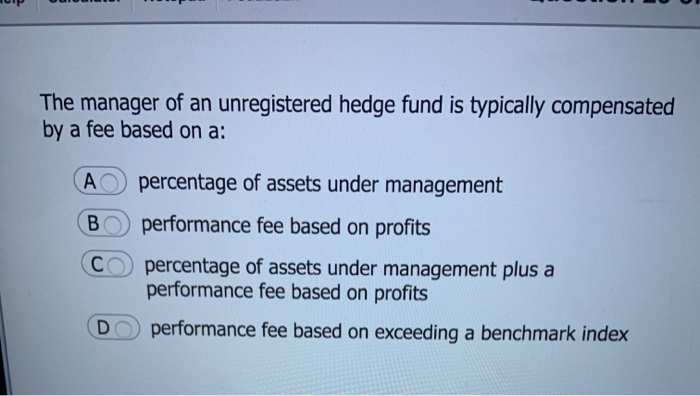

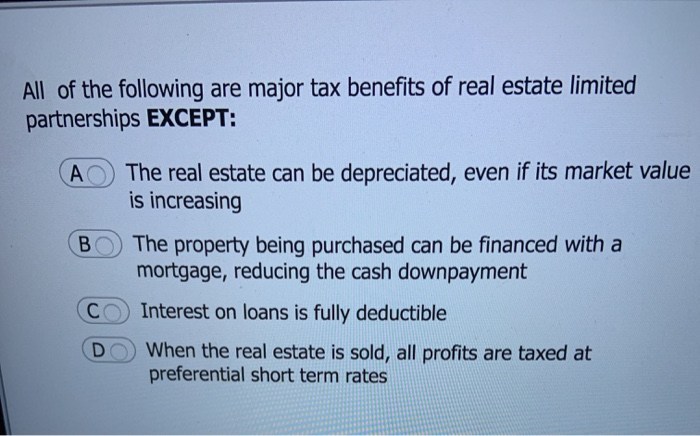

Which statement is TRUE regarding oil and gas limited partnership interests? A The primary tax benefit of an exploratory program is the depletion deduction ) The primary tax benefit of an income program is the depreciation deduction (B () The primary tax benefit of an exploratory program is the intangible drilling cost deduction DO The primary benefit of an income program is the intangible drilling cost deduction The manager of an unregistered hedge fund is typically compensated by a fee based on a: A B percentage of assets under management performance fee based on profits C percentage of assets under management plus a performance fee based on profits DO performance fee based on exceeding a benchmark index All of the following are major tax benefits of real estate limited partnerships EXCEPT: A The real estate can be depreciated, even if its market value is increasing BO The property being purchased can be financed with a mortgage, reducing the cash downpayment (CO) Interest on loans is fully deductible DO When the real estate is sold, all profits are taxed at preferential short term rates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts