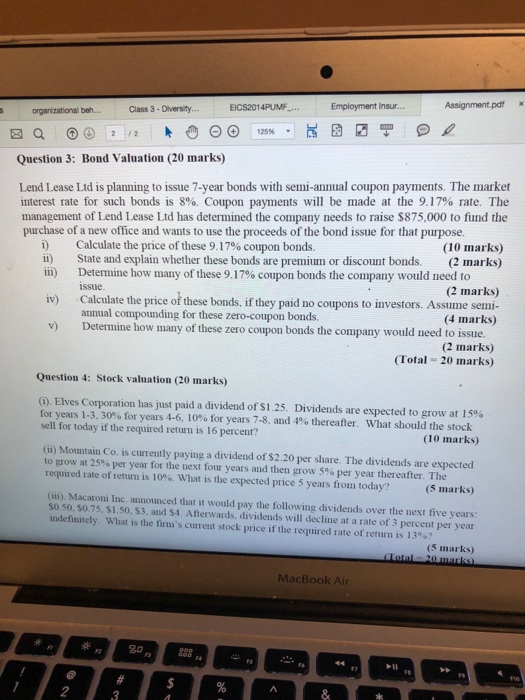

Question: Please answer 3-4, needs to show workings no excel Assignment.pd x Employment Insur Class 3 Diversity. EICS2014PUMF Question 3: Bond Valuation (20 marks) Lend Lease

Assignment.pd x Employment Insur Class 3 Diversity. EICS2014PUMF Question 3: Bond Valuation (20 marks) Lend Lease Ltd is planning to issue 7-year bonds with semi-annual coupon payments. The market interest rate for such bonds is 8%. Coupon payments will be made at the 9.17% rate. The management of Lend Lease Ltd has determined the company needs to raise $875,000 to fund the purchase of a new office and wants to use the proceeds of the bond issue for that purpose. (10 marks) Calculate the price of these 917% coupon bonds. State and explain whether these bonds are premium or discount bonds. (2 marks) Determine how many of these 9.17% coupon bonds the company would need to issue i) iii) (2 marks) iv) Calculate the price of these bonds, if they paid no coupons to investors. Assume semi- (4 marks) annual compounding for these zero-coupon bonds v) Determine how many of these zero coupon bonds the company would need to issue. (2 marks) 20 marks) (Total Question 4: Stock valuation (20 marks) (i). Elves Corporation has just paid a dividend of si 25, Dividends are expected to grow at 15% for years 1-3, 30% for years 4-6. I0% for years 7-8 and 4% thereafter. sell for today if the required returm is 16 percent? what should the stock (10 marks) (ii) Mountain Co. is currently paying a dividend of $2.20 per share. The dividends are expected to grow at 25% per year for the next four years and then grow 5% per year thereafter. The required rate of return is 10%, what is the expected price 5 years from today? (5 marks) (il). Macaroni Inc. announced that it would pay the following dividends over the next five years: S0.50. $0.75, $1.50, 53, and S4. Afterwards, dividends will decline at a rate of 3 percent per year indefinitely what is the firm's current stock price if the required rate of return is 13%? (3 marks) MacBook Air 44 11

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts