Question: Please answer 4 & 5 Question #4 is based on the following information. Helen Bower, owner of Helen's Fashion Designs, is planning to request a

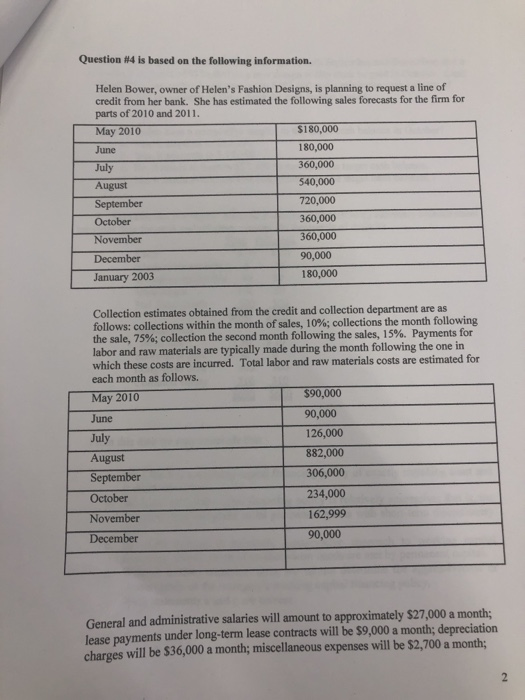

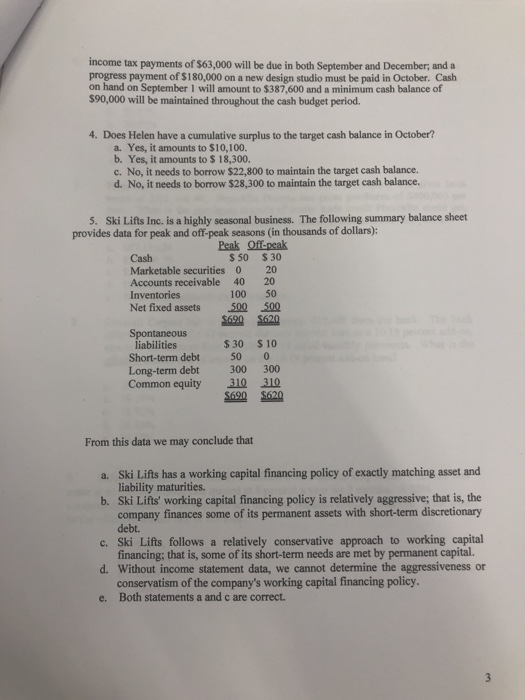

Question #4 is based on the following information. Helen Bower, owner of Helen's Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2010 and 2011. May 2010 $180,000 180,000 360,000 540,000 720,000 360,000 360,000 90,000 180,000 June August September October November December January 2003 Collection estimates obtained from the credit and collection department are as follows: collections within the month of sales, 10%; collections the month following the sale, 75%; collection the second month following the sales, 15%. Payments for labor and raw materials are typically made during the month following the one in which these costs are incurred. Total labor and raw materials costs are estimated for each month as follows. $90,000 90,000 126,000 882,000 306,000 234,000 162,999 90,000 May 2010 June July August September October November December General and administrative salaries will amount to approximately $27,000 a month; lease payments under long-term lease contracts will be $9,000 a month; depreciation charges will be $36,000 a month; miscellaneous expenses will be $2,700 a month; income tax payments of $63,000 will be due in both September and December, and a progress payment of $180,000 on a new design studio must be paid in October. Cash on hand on September 1 will amount to $387,600 and a minimum cash balance of $90,000 will be maintained throughout the cash budget period 4. Does Helen have a cumulative surplus to the target cash balance in October? a. Yes, it amounts to $10,100. b. Yes, it amounts to $ 18,300. c. No, it needs to borrow $22,800 to maintain the target cash balance. d. No, it needs to borrow $28,300 to maintain the target cash balance. 5. Ski Lifts Inc. is a highly seasonal business. The following summary balance sheet provides data for peak and off-peak seasons (in thousands of dollars): Peak Off peak $ 50 $30 Cash Marketable securities 0 20 Accounts receivable 40 20 Inventories Net fixed assets 500 100 50 Spontaneous liabilities Short-term debt 50 0 Long-term debt 300 300 Common equity 31, $30 $ 10 S690 $620 From this data we may conclude that a. Ski Lifts has a working capital financing policy of exactly matching asset and b. Ski Lifts' working capital financing policy is relatively aggressive; that is, the liability maturities. company finances some of its permanent assets with short-term discretionary debt. financing; that is, some of its short-term needs are met by permanent capital. conservatism of the company's working capital financing policy. c. Ski Lifts follows a relatively conservative approach to working capital d. Without income statement data, we cannot determine the aggressiveness or Both statements a and c are correct. e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts