Question: please answer 4 and 5 4.(4 points) On 01-01-19, G purchased a machine for $5,000,000. Installation costs incurred and paid for on 01-01-19 were $15,000.

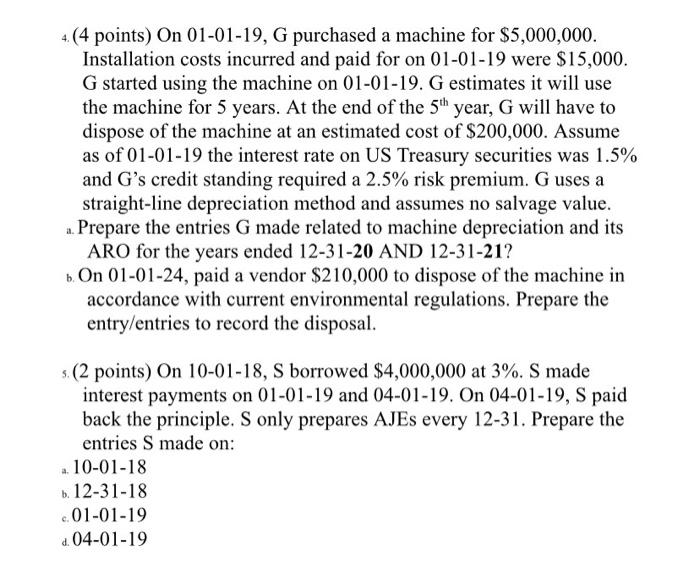

4.(4 points) On 01-01-19, G purchased a machine for $5,000,000. Installation costs incurred and paid for on 01-01-19 were $15,000. G started using the machine on 01-01-19. G estimates it will use the machine for 5 years. At the end of the 5th year, G will have to dispose of the machine at an estimated cost of $200,000. Assume as of 01-01-19 the interest rate on US Treasury securities was 1.5% and G's credit standing required a 2.5% risk premium. G uses a straight-line depreciation method and assumes no salvage value. 2. Prepare the entries G made related to machine depreciation and its ARO for the years ended 12-31-20 AND 12-31-21? b. On 01-01-24, paid a vendor $210,000 to dispose of the machine in accordance with current environmental regulations. Prepare the entry/entries to record the disposal. s (2 points) On 10-01-18, S borrowed $4,000,000 at 3%. S made interest payments on 01-01-19 and 04-01-19. On 04-01-19, S paid back the principle. S only prepares AJEs every 12-31. Prepare the entries S made on: 10-01-18 b. 12-31-18 ..01-01-19 . 04-01-19 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts