Question: Please answer 4 and 5 and show how to do thank you 4. 5. 4 Exercise 16-9 (Algo) Financial Ratios for Assessing Profitability and Managing

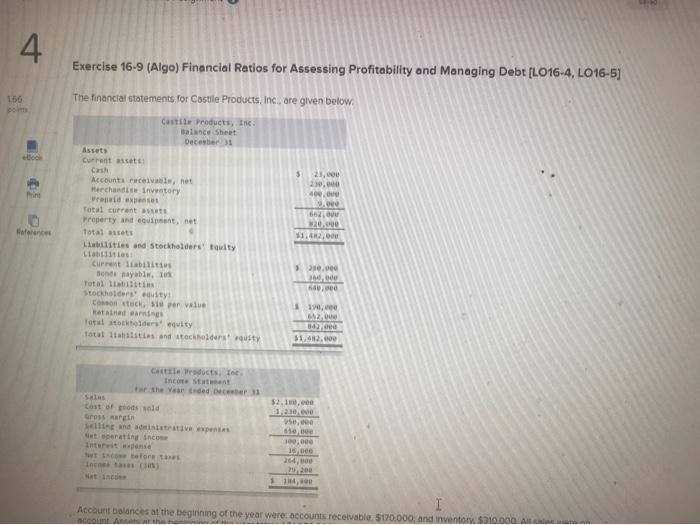

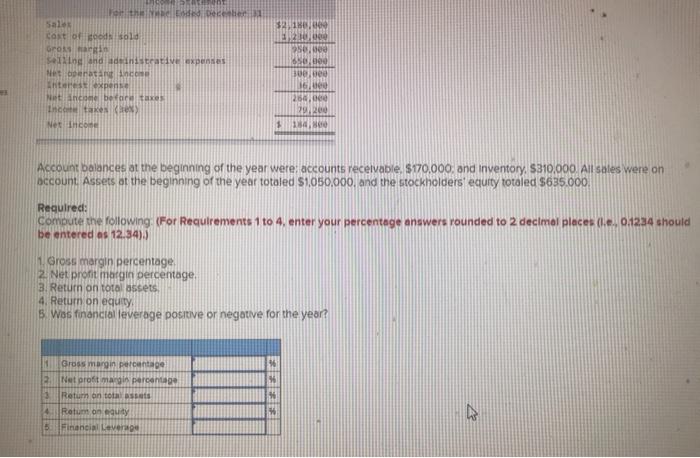

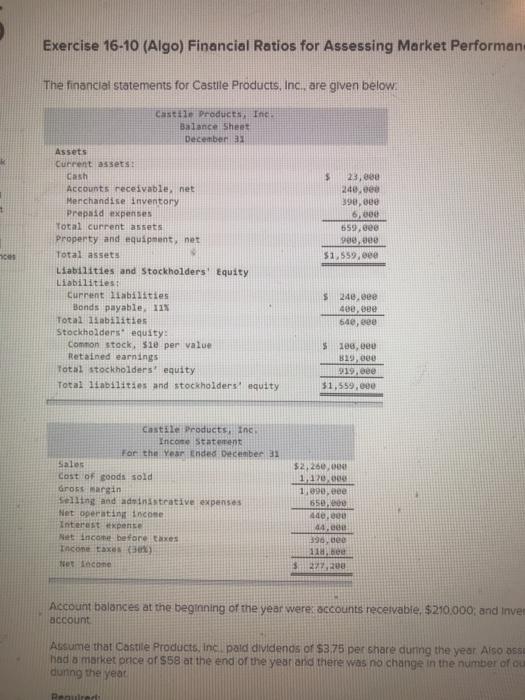

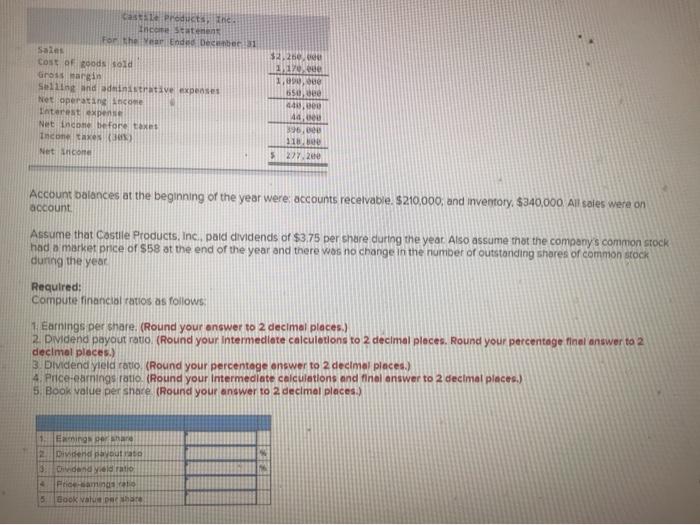

4 Exercise 16-9 (Algo) Financial Ratios for Assessing Profitability and Managing Debt [L016-4, L016-5) The financial statements for Castile Products, Inc. are given below. Castile Products, Inc. Balance Sheet December 31 5 21,000 230,00 600.0 9. 662,00 Hata 11, 42,00 Current assets Cash Accounts receive not Merchandise inventory redes Total current to Property and equipment, het Total assets Liabilities and Stockholders Tuity Latitis Current liabilit Bondo mayable, Total liabilities Stockholders' muity Contact per value tada Total desequity Total tahsis and to holders musty 20.000 . 110, 000 51,682,00 Cele Wroducts, Intant the Vanded DP sas Cost o od Gross and distrative spent toperating in 52.110,000 950, 100,00 16 204, 2200 11 I Account balances at the beginning of the year were accounts receivable $170,000, and inventor. $310.000 All account A 3210 For the Decler Sale Cart of seeds sold Grosin Sening and distrative expenses Natan terest expense Nince between Inde taken Kerex Net Inco 850 ue 215.00 29720 1 Account balances at the beginning of the year were: accounts receivable $170,000, and Inventory S310,000. All sales were on account Assets at the beginning of the year totaled $1,050.000, and the stockholders' equity totaled $635.000. Required: Compute the following (For Requirements 1 to 4, enter your percentage answers rounded to 2 decimal places (..., 0:1234 should be entered as 12.34):) 1. Gross margin percentage 2. Net profit margin percentage 3. Return on total assets 4. Return on equity 5 Was financial leverage positive or negative for the year? 1 Gross margin percentage 2. Net profit margin percentage 3 Return on tosis 4 Rotunnon ty 5 Financial Lever Exercise 16-10 (Algo) Financial Ratios for Assessing Market Performan The financial statements for Castile Products, Inc., are given below Castile Products Inc Balance Sheet December Assets Current assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Total current assets Property and equipment, net Total assets Liabilities and Stockholders' Equity Liabilities Current liabilities Bonds payable 11% Total liabilities Stockholders equity Common stock, Sie per value Retained earnings Total stockholders' equity Total liabilities and stockholders equity 5 23,00 240.00 390,000 6,000 659.000 see, eee $1,559.000 $ 24e, see 400.ee 64e, eee $ 108,00 819,000 919, Bee $1,359,000 Castile Products and Income Statement For the Year Ended December 31 Sales cost of goods sold drost margin selling and administrative expenses Net operating income Interest pente Net Income before taxes Income taxe det tacone $2,250,000 110.000 1,090.ee 650, ade, 44,00 396, de 118, we 3 277,200 Account balances at the beginning of the year were accounts receivable, $210.000; and Inven account Assume that Castile Products, incpaid dividends of $3,75 per share during the year Also SSE had a market price of $58 at the end of the year and there was no change in the number of ou during the year Penure 32,250, 217, Cast Products the The Statens For the End December 31 Sales cost of goods sold Gross margin Selling and administrative expenses Net operating income Interest expense Net Income before taxe Incone taxe Net Income 650, 440,000 44, 395.000 110, 5 227.2 Account balances at the beginning of the year were accounts receivable. $210,000, and inventory $340,000. All sales were on account Assume that Castile Products, Inc., paid dividends of $3.75 per share during the year. Also assume that the company's common stock had a market price of $58 at the end of the year and there was no change in the number of outstanding shores of common stock during the year Required: Compute financial ratios as follows: 1 Earnings per share. (Round your answer to 2 decimal places.) 2. Dividend payout ratio (Round your intermediate calculations to 2 decimal places. Round your percentage final answer to 2 decimal places.) 3. Dividend yield rauo. (Round your percentage answer to 2 decimal places.) Price earnings ratio (Round your intermediate calculations and final answer to 2 decimal places.) 5. Book value per Share (Round your answer to 2 decimal places.) 1. Eins er han 2 Dividend your hvidend viele ratio Price and 5 Book value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts