Question: Please answer #4 Problem 3: (9 points) John obtained a 5%, $400,000, 30-year home mortgage loan 15 years ago. Assume that this year (15 years

Please answer #4

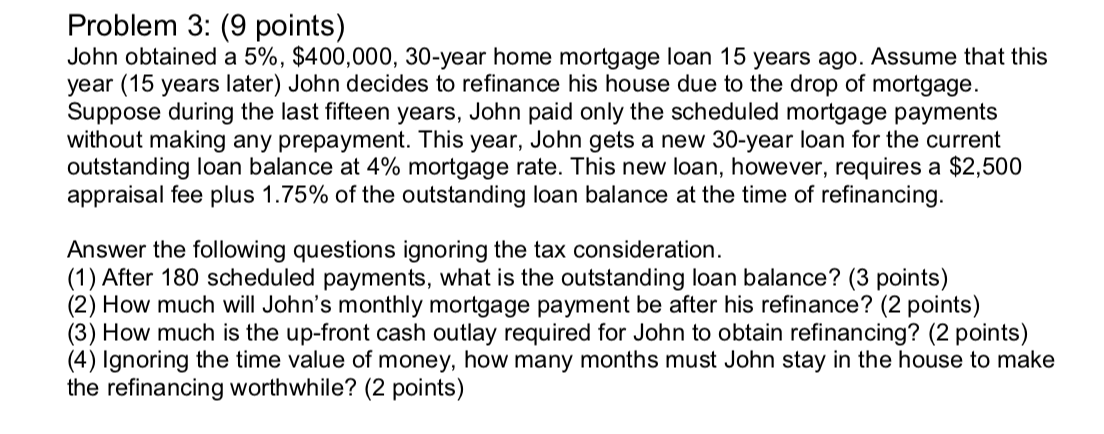

Problem 3: (9 points) John obtained a 5%, $400,000, 30-year home mortgage loan 15 years ago. Assume that this year (15 years later) John decides to refinance his house due to the drop of mortgage. Suppose during the last fifteen years, John paid only the scheduled mortgage payments without making any prepayment. This year, John gets a new 30-year loan for the current outstanding loan balance at 4% mortgage rate. This new loan, however, requires a $2,500 appraisal fee plus 1.75% of the outstanding loan balance at the time of refinancing. Answer the following questions ignoring the tax consideration. (1) After 180 scheduled payments, what is the outstanding loan balance? (3 points) (2) How much will John's monthly mortgage payment be after his refinance? (2 points) (3) How much is the up-front cash outlay required for John to obtain refinancing? (2 points) (4) Ignoring the time value of money, how many months must John stay in the house to make the refinancing worthwhile? (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts