Question: please answer 48,49,50 Question 48 (1 point) 3 Assume that a stock had an expected return of 11.7 percent and a standard deviation of 12.59

please answer 48,49,50

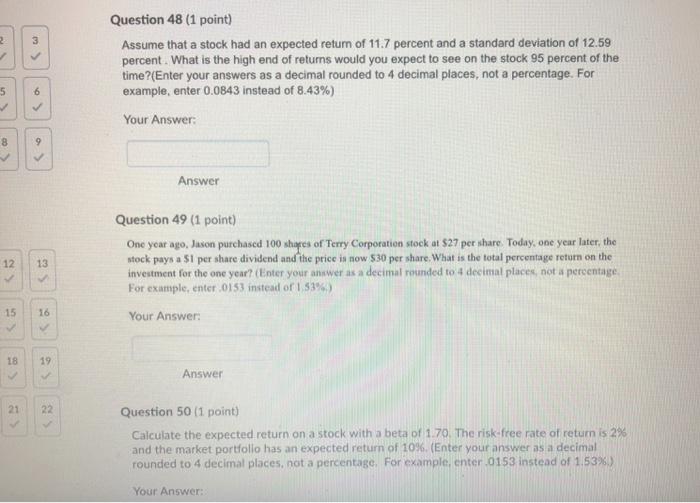

please answer 48,49,50Question 48 (1 point) 3 Assume that a stock had an expected return of 11.7 percent and a standard deviation of 12.59 percent. What is the high end of returns would you expect to see on the stock 95 percent of the time?(Enter your answers as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0.0843 instead of 8.43%) Your Answer: Answer Question 49 (1 point) One year ago, Jason purchased 100 shares of Terry Corporation stock at $27 per share. Today, one year later, the stock pays a SI per share dividend and the price is now $30 per share. What is the total percentage return on the investment for the one year? (Enter your answer as a decimal rounded to 4 decimal places, not a percentage. 12 13 For example, enter "0153 instead of 1.53%.) 15 16 Your Answer 18 19 Answer 21 22 Question 50 (1 point) Calculate the expected return on a stock with a beta of 1.70. The risk-free rate of return is 2% and the market portfolio has an expected return of 10%. (Enter your answer as a decimal rounded to 4 decimal places, not a percentage. For example, enter 0153 instead of 1.53%) Your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts