Question: please answer #5 4. A firm is expecting to receive $100M in 6 months and wishes to invest it for another 6 months. But the

please answer #5

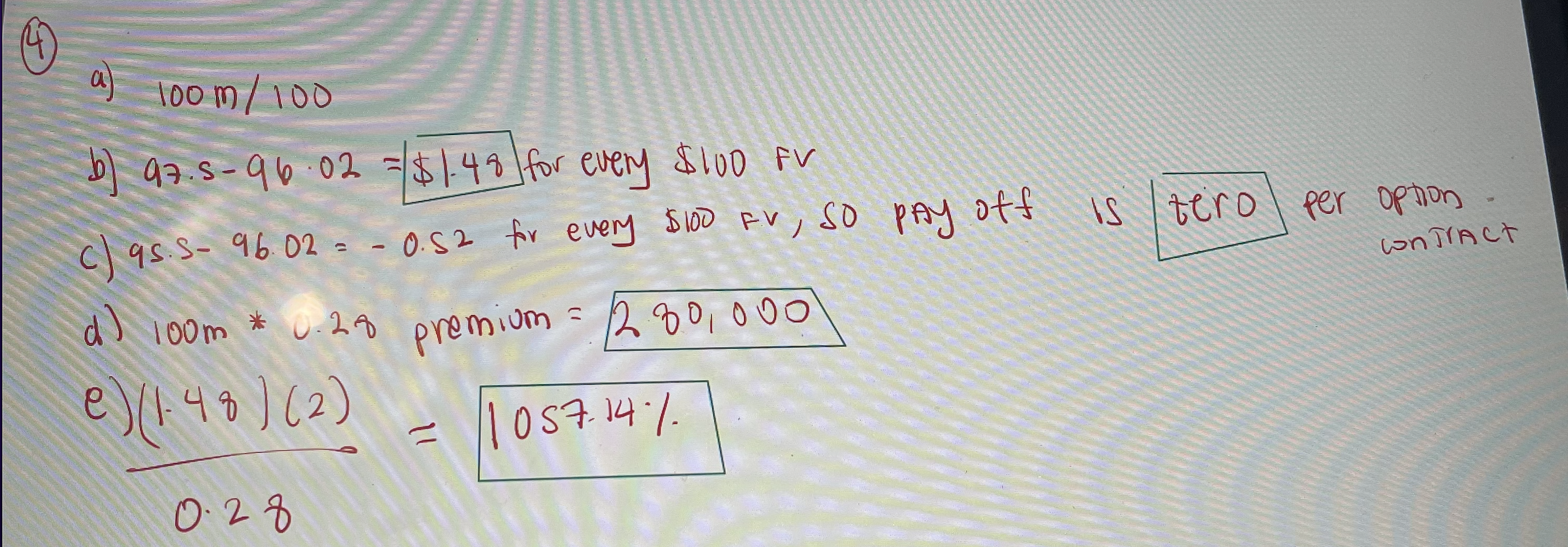

4. A firm is expecting to receive $100M in 6 months and wishes to invest it for another 6 months. But the firm is worried about a potential decline in interest rates. Because of their flexibility, the firm decides to use call options on the 6-month T-bill. A call option on the 6-month T-bill with 6-month maturity exists with strike $96.02 (per $100 face value) and $0.28 premium. The current price of the 6- month T-bill is $95.24 per 100 face value.

a) How many call options does the firm need? b) What is the option payoff if 6-month T-bill price is $97.5 at option's maturity? c) What is the option payoff if 6-month T-bill price is $95.5 at option's maturity? d) What is the total cost of purchasing call options at t=0? e) What is the gross annualized ROI if 6-month T-bill price is $97.5 at option's maturity?

This is what I got for question 4:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts