Question: Please answer 5,6,7,8 > > Question 4 2.86 pts Suppose Bronze Star Investment, Inc., a Cincinnati-based investment firm, invested $20,000 to buy 1,500 shares of

Please answer 5,6,7,8

Please answer 5,6,7,8

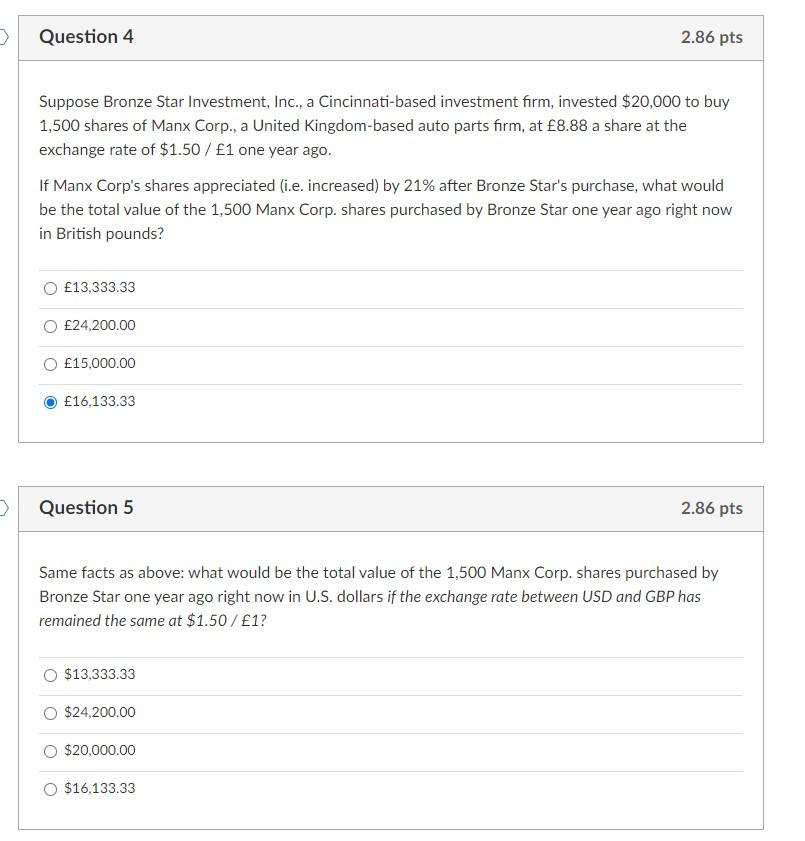

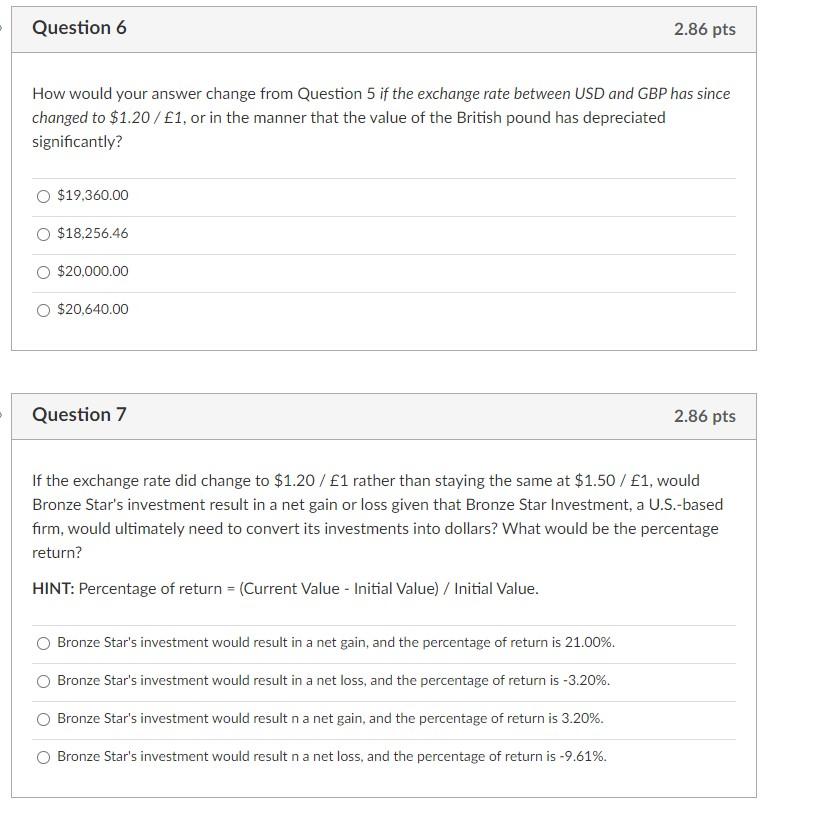

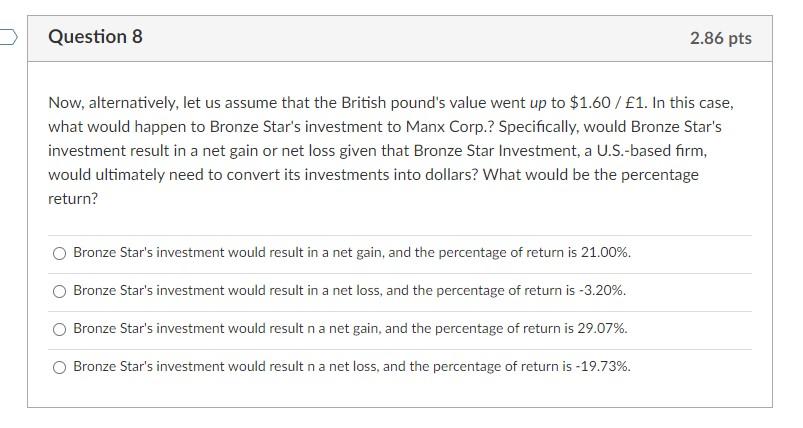

> > Question 4 2.86 pts Suppose Bronze Star Investment, Inc., a Cincinnati-based investment firm, invested $20,000 to buy 1,500 shares of Manx Corp., a United Kingdom-based auto parts firm, at 8.88 a share at the exchange rate of $1.50 / 1 one year ago. If Manx Corp's shares appreciated (i.e. increased) by 21% after Bronze Star's purchase, what would be the total value of the 1,500 Manx Corp. shares purchased by Bronze Star one year ago right now in British pounds? 13,333.33 24,200.00 15,000.00 16,133.33 Question 5 2.86 pts Same facts as above: what would be the total value of the 1,500 Manx Corp. shares purchased by Bronze Star one year ago right now in U.S. dollars if the exchange rate between USD and GBP has remained the same at $1.50 / 1? $13,333.33 $24,200.00 $20,000.00 $16.133.33 Question 6 2.86 pts How would your answer change from Question 5 if the exchange rate between USD and GBP has since changed to $1.20/1, or in the manner that the value of the British pound has depreciated significantly? $19,360.00 $18,256.46 $20,000.00 $20,640.00 Question 7 2.86 pts If the exchange rate did change to $1.20 / 1 rather than staying the same at $1.50 / 1, would Bronze Star's investment result in a net gain or loss given that Bronze Star Investment, a U.S.-based firm, would ultimately need to convert its investments into dollars? What would be the percentage return? HINT: Percentage of return = (Current Value - Initial Value) / Initial Value. Bronze Star's investment would result in a net gain, and the percentage of return is 21.00%. Bronze Star's investment would result in a net loss, and the percentage of return is -3.20%. Bronze Star's investment would result n a net gain, and the percentage of return is 3.20%. Bronze Star's investment would result na net loss, and the percentage of return is -9.61%. Question 8 2.86 pts Now, alternatively, let us assume that the British pound's value went up to $1.60 / 1. In this case, what would happen to Bronze Star's investment to Manx Corp.? Specifically, would Bronze Star's investment result in a net gain or net loss given that Bronze Star Investment, a U.S.-based firm, would ultimately need to convert its investments into dollars? What would be the percentage return? Bronze Star's investment would result in a net gain, and the percentage of return is 21.00%. Bronze Star's investment would result in a net loss, and the percentage of return is -3.20%. Bronze Star's investment would result na net gain, and the percentage of return is 29.07%. Bronze Star's investment would result na net loss, and the percentage of return is -19.73%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts