Question: please answer 5-9 Use the information in the table to solve Problems 5-9. Suppose the following information represents the return for General Motors (GM) and

please answer 5-9

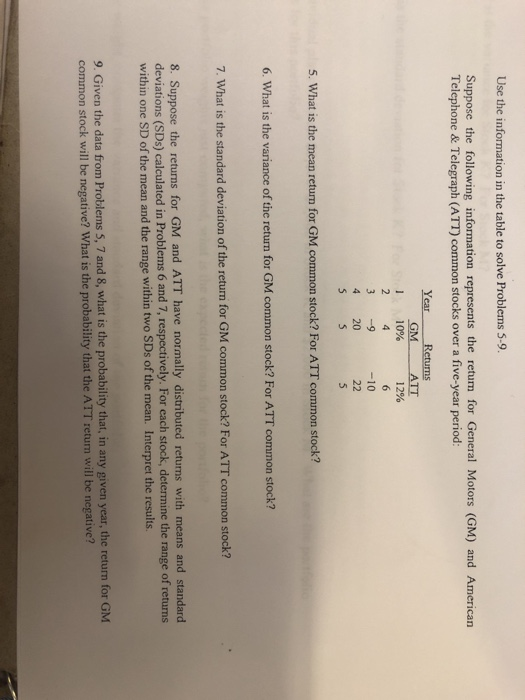

please answer 5-9Use the information in the table to solve Problems 5-9. Suppose the following information represents the return for General Motors (GM) and American Telephone & Telegraph (ATT) common stocks over a five-year period: Year 2 3 4 5 Retums GM ATT 10% 12% 4 -9 -10 20 22 5 5 5. What is the mean return for GM common stock? For ATT common stock? 6. What is the variance of the return for GM common stock? For ATT common stock? 7. What is the standard deviation of the return for GM common stock? For ATT common stock? 8. Suppose the returns for GM and ATT have normally distributed retums with means and standard deviations (SDs) calculated in Problems 6 and 7, respectively. For each stock, determine the range of retums within one SD of the mean and the range within two SDs of the mean. Interpret the results. 9. Given the data from Problems 5, 7 and 8, what is the probability that, in any given year, the return for GM common stock will be negative? What is the probability that the ATT retum will be negative

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts