Question: Please answer #6 & #7 6. Four years ago you bought a 10 percent coupon, 10-year bond that paid interest annually. However, this bond was

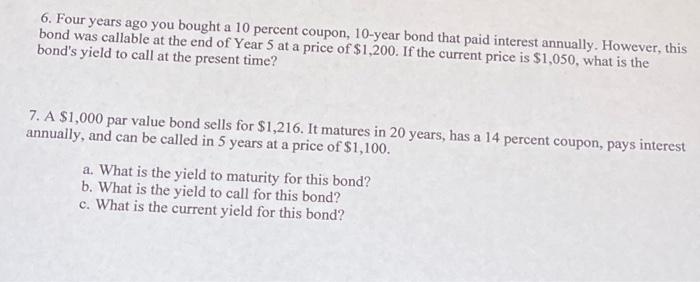

6. Four years ago you bought a 10 percent coupon, 10-year bond that paid interest annually. However, this bond was callable at the end of Year 5 at a price of $1,200. If the current price is $1,050, what is the bond's yield to call at the present time? 7. A $1,000 par value bond sells for $1,216. It matures in 20 years, has a 14 percent coupon, pays interest annually, and can be called in 5 years at a price of $1,100. a. What is the yield to maturity for this bond? b. What is the yield to call for this bond? c. What is the current yield for this bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts