Question: Please answer 6, 7 and 8 and explain why you picked that answer. 6. Which of the following statements is CORRECT? a. Corporations face few

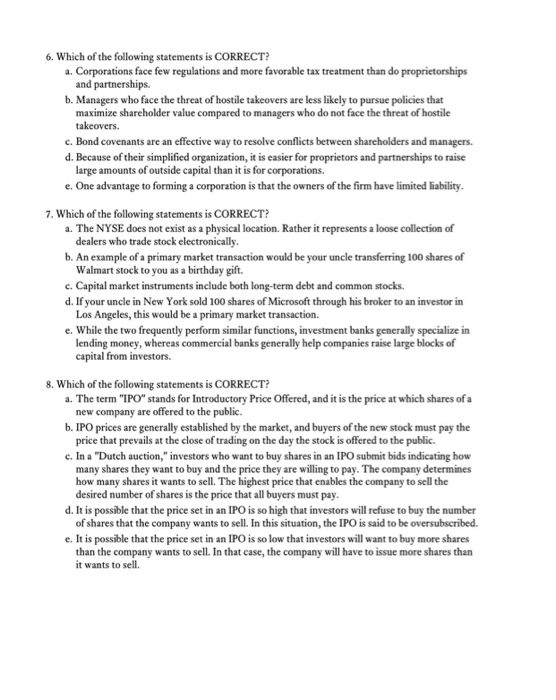

6. Which of the following statements is CORRECT? a. Corporations face few regulations and more favorable tax treatment than do proprietorships and partnerships. b. Managers who face the threat of hostile takeovers are less likely to pursue policies that maximize shareholder value compared to managers who do not face the threat of hostile takeovers c. Bond covenants are an effective way to resolve conflicts between shareholders and managers. d. Because of their simplified organization, it is easier for proprietors and partnerships to raise large amounts of outside capital than it is for corporations. e. One advantage to forming a corporation is that the owners of the firm have limited liability 7. Which of the following statements is CORRECT? a. The NYSE does not exist as a physical location. Rather it represents a loose collection of dealers who trade stock electronically b. An example of a primary market transaction would be your uncle transferring 100 shares of Walmart stock to you as a birthday gift. c. Capital market instruments include both long-term debt and common stocks. d. If your uncle in New York sold 100 shares of Microsoft through his broker to an investor in Los Angeles, this would be a primary market transaction. e. While the two frequently perform similar functions, investment banks generally specialize in lending money, whereas commercial banks generally help companies raise large blocks of capital from investors. 8. Which of the following statements is a. The term "IPO" stands for Introductory Price Offered, and it is the price at which shares of a b. IPO prices are generally established by the market, and buyers of the new stock must pay the c. In a "Dutch auction," investors who want to buy shares in an IPO submit bids indicating how new company are offered to the public. price that prevails at the close of trading on the day the stock is offered to the public. many shares they want to buy and the price they are willing to pay. The company determines how many shares it wants to sell. The highest price that enables the company to sell the desired number of shares is the price that all buyers must pay d. It is possible that the price set in an IPO is so high that investors will refuse to buy the number of shares that the company wants to sell. In this situation, the IPO is said to be oversubscribed. e. It is possible that the price set in an IPO is so low that investors will want to buy more shares than the company wants to sell. In that case, the company will have to issue more shares than it wants to sell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts