Question: please answer 7-10 Consider the zero coupon bond yields listed below. The yields are expressed as bond equivalent yields. 6 months 2% 1 year 2.2%

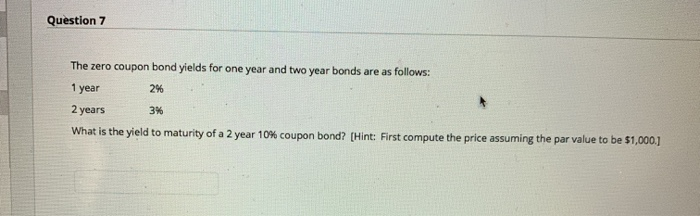

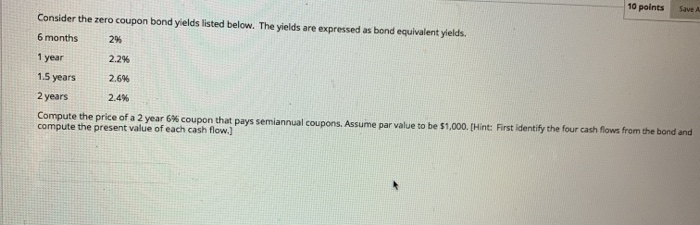

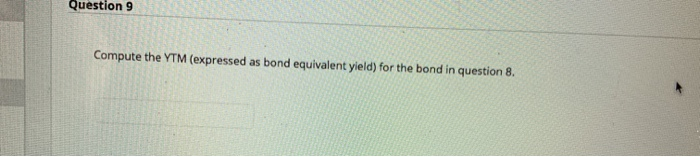

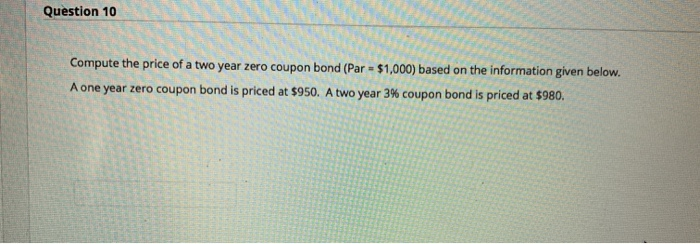

Consider the zero coupon bond yields listed below. The yields are expressed as bond equivalent yields. 6 months 2% 1 year 2.2% 1.5 years 2.6% 2 years 2.4% Compute the price of a 2 year 6 coupon that pays semiannual coupons. Assume par value to be 51,000. (Hint: First identify the four cash flows from the bond and compute the present value of each cash flow.] Question 9 Compute the YTM (expressed as bond equivalent yield) for the bond in question 8. Question 10 Compute the price of a two year zero coupon bond (Par - $1,000) based on the information given below. A one year zero coupon bond is priced at $950. A two year 3% coupon bond is priced at $980

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts