Question: please answer 7,8 and 9 using the information and show all work. thanks! 6. If interest rates increase by 20 basis points G.e, AR 20

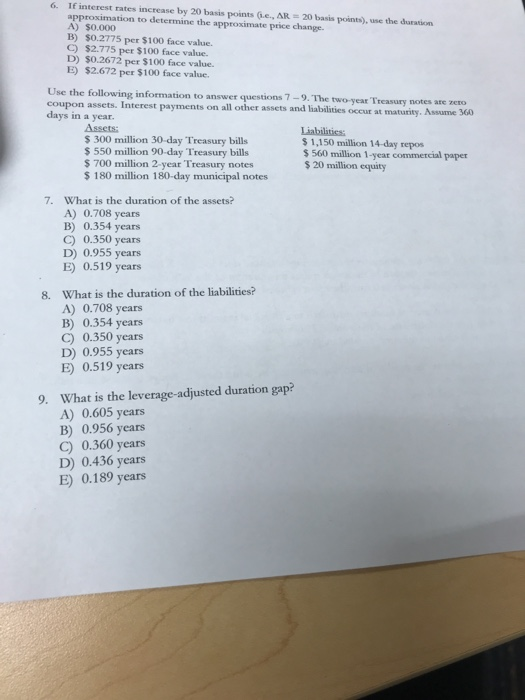

6. If interest rates increase by 20 basis points G.e, AR 20 basis points), use the duration approximation to determine the approximate price change. A) $0.000 B) $0.2775 per $100 face value. C) $2.775 per $100 face value D) $0.2672 per $100 face value. E) $2.672 per $100 face value. Use the following information to answer questions 7 coupon assets. Interest payments on all other assets and habilities occur at days in a year. -9. The two-year Treasury notes are zero Assets: Liabilities $ 1,150 million 14-day repos S 560 million 1-year commercial paper $ 20 million equity $ 300 million 30-day Treasury bills S550 million 90-day Treasury bills s 700 million 2 year Treasury notes $ 180 million 180-day municipal notes 7. What is the duration of the assets? A) 0.708 years B) 0.354 years C) 0.350 years D) 0.955 years E) 0.519 years What is the duration of the liabilities? A) 0.708 years B) 0.354 years C) 0.350 years D) 0.955 years E) 0.519 years 8. What is the leverage-adjusted duration gap? A) 0.605 years B) 0.956 years C) 0.360 years D) 0.436 years E) 0.189 years 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts