Question: Please answer 8 simple finance multiple choice! ( NO EXPLAINATION NEEDED) All of the following are sources of financial risk except select one: fidility liquidity

Please answer 8 simple finance multiple choice! ( NO EXPLAINATION NEEDED)

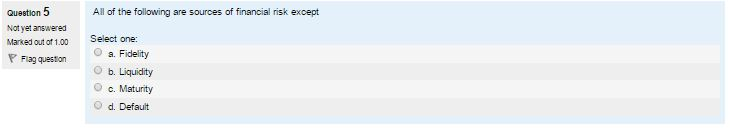

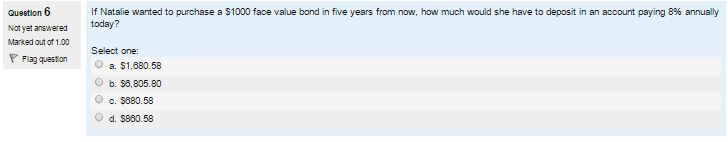

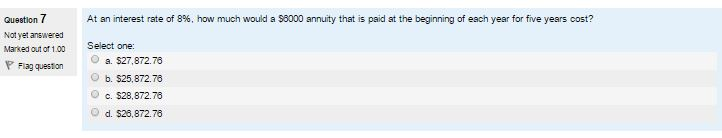

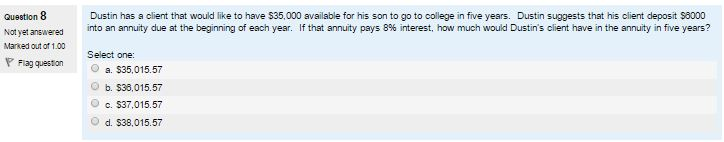

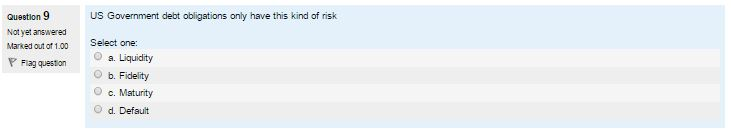

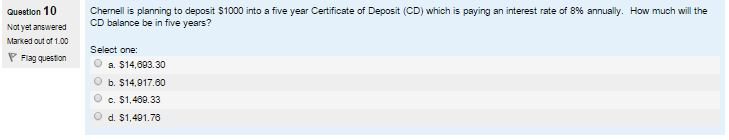

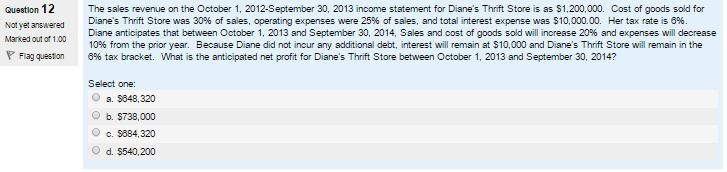

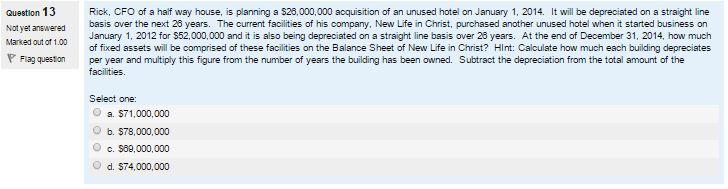

All of the following are sources of financial risk except select one: fidility liquidity maturity default If Natal e wanted to purchase a 51000 face value bond in five years from now. How much would she have to deposit in an account paying 8% annually today? Select one: $ 1.680.58 $6.805.80 $680.58 $850.58 At an :rnerest rate of 8%. how much would a S5000 annuity that is paid at the beginning of each year for five years cost? Select one: $27.872.7 $25.872.76 $28.872.76 $26.872.76 US Government debt obligations only have this kind of risk Select one: Liquidity Fidelity Maturity Default Cheme s plann;r>g to deposit S1CKX) into a five year Certificate of Deposit (CD) which is paying an interest rate of 8% annuaiiy. How much will the CD balance be in five years? Select one: $14.993.30 $14.917.60 $1.469.33 $1.491.76 A long-term borvd would be purchased in a Seiect one: Capital market Money Market Grocery market Farmers market The sales revenue on the Qctooer 1. 2012-Sept ember 30. 2013 income statement for Dianes Thrift Store s as SI. 200.000. Cost of goods so!d for Diane's Thrift Store was 30% of sales. operating expenses were 25% of sales. and tota merest expense was S10.000.00. Her tax rate is 6%. Diane antic pates that between Cctooer 1. 2013 and September 30. 2014. Sales and cost of goods soid will increase 20% and expenses will decrease 10% from the pr-or year. Because D ane drt not incur any additional debt, interest will rema n at S10.000 and Diane's Thrift Store w: rema n in the 6% tax bracket. What is the ante pated net profit for Diane s Thrift Store between Qctober 1. 2013 and September 30. 2014? Select one: $848.320 $738.000 $584.320 $540.200 Rick. CFO of a half way house, is planning a $26,003,000 acquisition of an unused hotei on January 1. 2014. It will be depreciated on a straight line basis over the next 26 years. The current facilities of his company. New Life in Christ, purchased another unused hotei when it started busness on January 1. 2012 for S52.000.000 and it is also be ng depreciated on a straight line bas s over 26 yea's. At the end of December 31. 2014. how much of fixed assets will be comprised of these facilities on the Balance Sheet of New Life in Christ? Hint: Calculate how much each buying depreciates per year and multiply this figure from the number of years the building has been owned. Subtract the depreciation from the total amount of the facilities. Select one: $71.000.000 $78.000.000 $69.000.000 $74.000.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts