Question: please answer 9 Case study 1. Sung Industries manufactures tracking devices. They use a job order costing system. Manufacturing overheads are absorbed based on direct

please answer 9

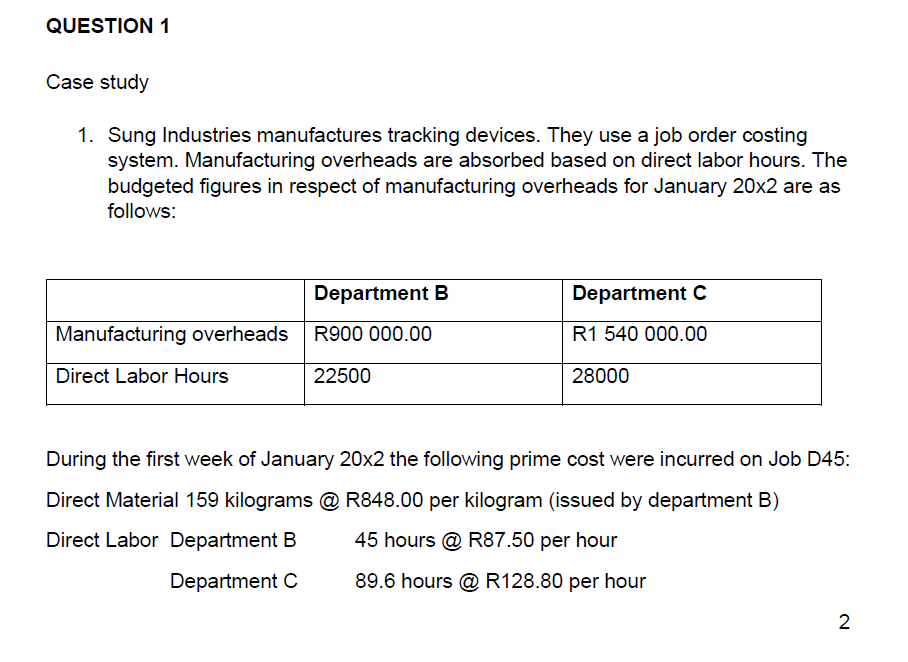

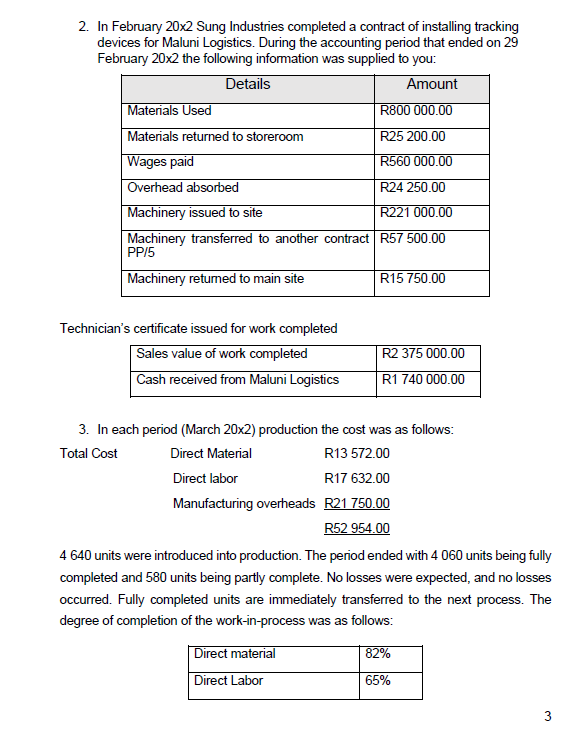

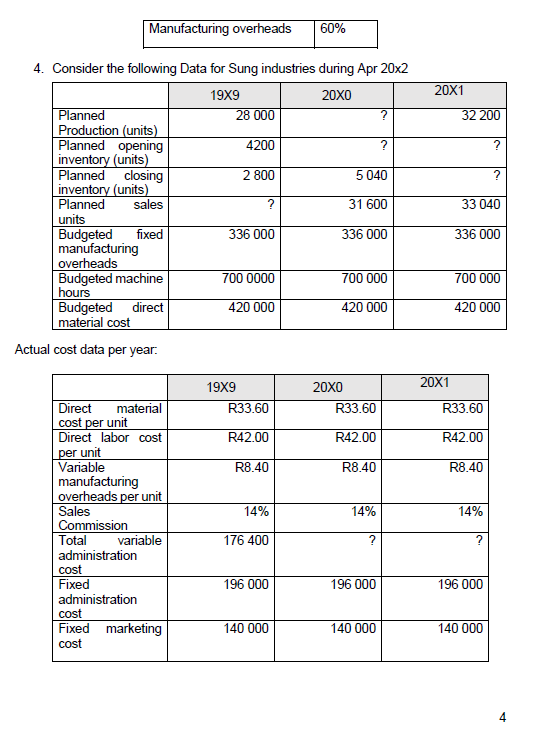

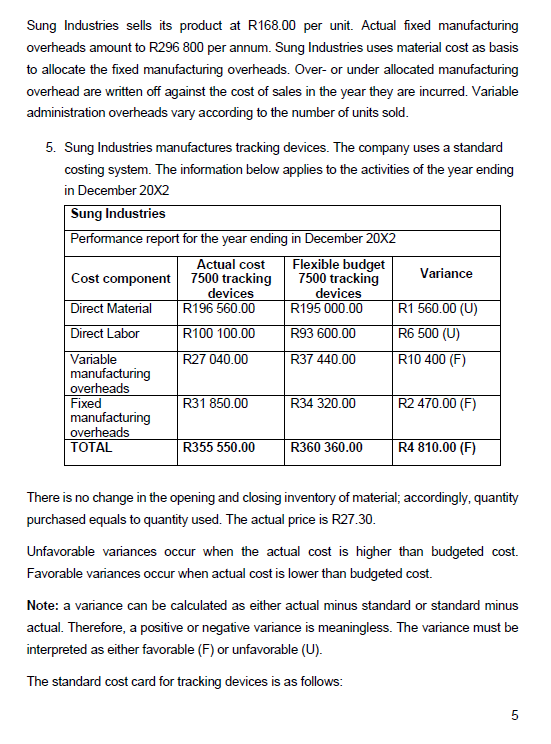

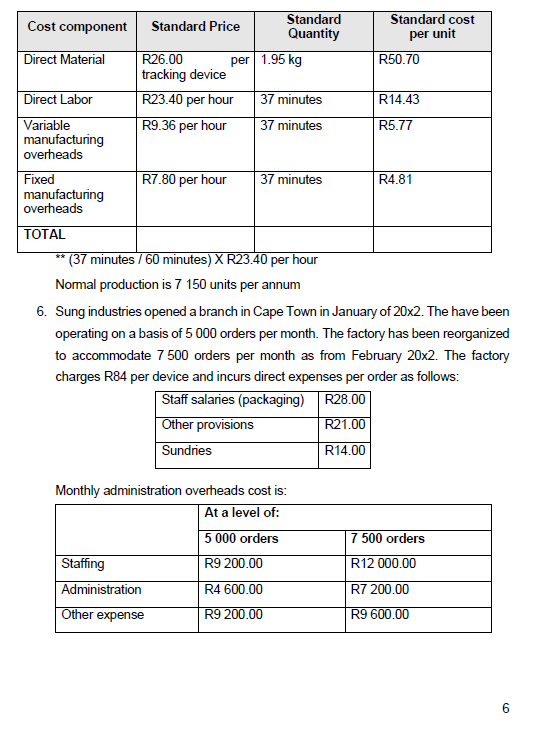

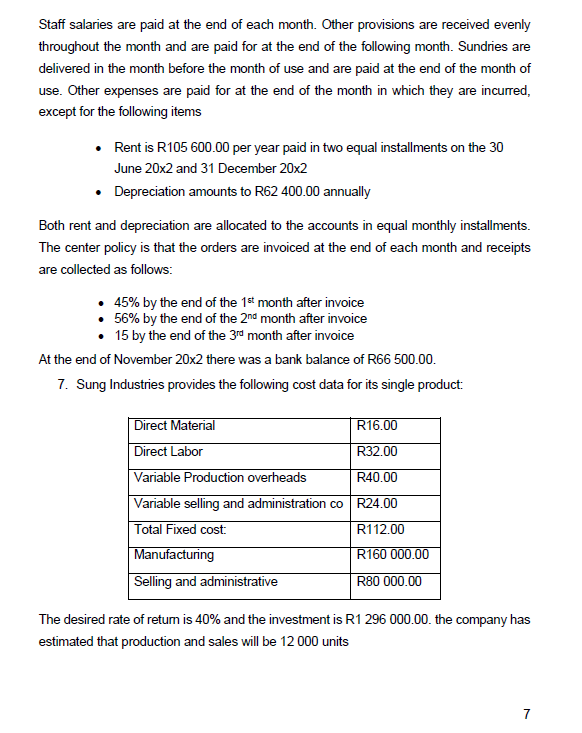

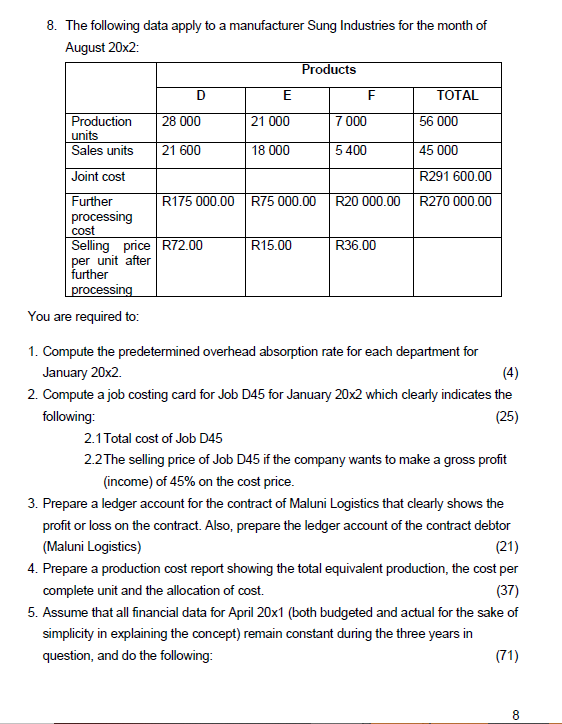

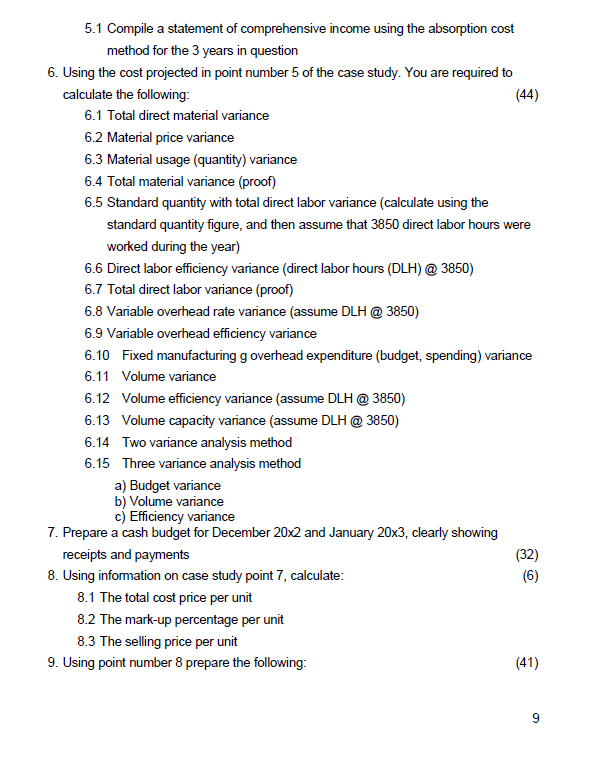

Case study 1. Sung Industries manufactures tracking devices. They use a job order costing system. Manufacturing overheads are absorbed based on direct labor hours. The budgeted figures in respect of manufacturing overheads for January 202 are as follows: During the first week of January 202 the following prime cost were incurred on Job D45: Direct Material 159 kilograms @ R848.00 per kilogram (issued by department B) Direct Labor Department B 45 hours @ R87.50 per hour Department C 89.6 hours @ R128.80 per hour 2. In February 202 Sung Industries completed a contract of installing tracking devices for Maluni Logistics. During the accounting period that ended on 29 February 202 the following information was supplied to you: Technician's certificate issued for work completed 3. In each period (March 20x2) production the cost was as follows: Total Cost 4640 units were introduced into production. The period ended with 4060 units being fully completed and 580 units being partly complete. No losses were expected, and no losses occurred. Fully completed units are immediately transferred to the next process. The degree of completion of the work-in-process was as follows: 4. Consider the following Data for Sung industries during Apr 202 Actual cost data per year: Sung Industries sells its product at R168.00 per unit. Actual fixed manufacturing overheads amount to R296 800 per annum. Sung Industries uses material cost as basis to allocate the fixed manufacturing overheads. Over- or under allocated manufacturing overhead are written off against the cost of sales in the year they are incurred. Variable administration overheads vary according to the number of units sold. 5. Sung Industries manufactures tracking devices. The company uses a standard costing system. The information below applies to the activities of the year ending in December 202 There is no change in the opening and closing inventory of material; accordingly, quantity purchased equals to quantity used. The actual price is R27.30. Unfavorable variances occur when the actual cost is higher than budgeted cost. Favorable variances occur when actual cost is lower than budgeted cost. Note: a variance can be calculated as either actual minus standard or standard minus actual. Therefore, a positive or negative variance is meaningless. The variance must be interpreted as either favorable (F) or unfavorable (U). The standard cost card for tracking devices is as follows: Normal production is 7150 units per annum 6. Sung industries opened a branch in Cape Town in January of 202. The have been operating on a basis of 5000 orders per month. The factory has been reorganized to accommodate 7500 orders per month as from February 20x2. The factory charges R84 per device and incurs direct expenses per order as follows: Monthly administration overheads cost is: Staff salaries are paid at the end of each month. Other provisions are received evenly throughout the month and are paid for at the end of the following month. Sundries are delivered in the month before the month of use and are paid at the end of the month of use. Other expenses are paid for at the end of the month in which they are incurred, except for the following items - Rent is R105 600.00 per year paid in two equal installments on the 30 June 20x2 and 31 December 202 - Depreciation amounts to R62 400.00 annually Both rent and depreciation are allocated to the accounts in equal monthly installments. The center policy is that the orders are invoiced at the end of each month and receipts are collected as follows: - 45% by the end of the 1st month after invoice - 56% by the end of the 2nd month after invoice - 15 by the end of the 3rd month after invoice At the end of November 20x2 there was a bank balance of R66 500.00. 7. Sung Industries provides the following cost data for its single product: The desired rate of return is 40% and the investment is R1296000.00. the company has estimated that production and sales will be 12000 units 8. The following data apply to a manufacturer Sung Industries for the month of Auruint onvo You are required to: 1. Compute the predetermined overhead absorption rate for each department for January 202. 2. Compute a job costing card for Job D45 for January 202 which clearly indicates the following: 2.1Total cost of Job D45 2.2The selling price of Job D45 if the company wants to make a gross profit (income) of 45% on the cost price. 3. Prepare a ledger account for the contract of Maluni Logistics that clearly shows the profit or loss on the contract. Also, prepare the ledger account of the contract debtor (Maluni Logistics) 4. Prepare a production cost report showing the total equivalent production, the cost per complete unit and the allocation of cost. 5. Assume that all financial data for April 201 (both budgeted and actual for the sake of simplicity in explaining the concept) remain constant during the three years in question, and do the following: 5.1 Compile a statement of comprehensive income using the absorption cost method for the 3 years in question 6. Using the cost projected in point number 5 of the case study. You are required to calculate the following: 6.1 Total direct material variance 6.2 Material price variance 6.3 Material usage (quantity) variance 6.4 Total material variance (proof) 6.5 Standard quantity with total direct labor variance (calculate using the standard quantity figure, and then assume that 3850 direct labor hours were worked during the year) 6.6 Direct labor efficiency variance (direct labor hours (DLH) @ 3850) 6.7 Total direct labor variance (proof) 6.8 Variable overhead rate variance (assume DLH @ 3850) 6.9 Variable overhead efficiency variance 6.10 Fixed manufacturing g overhead expenditure (budget, spending) variance 6.11 Volume variance 6.12 Volume efficiency variance (assume DLH @ 3850) 6.13 Volume capacity variance (assume DLH @ 3850) 6.14 Two variance analysis method 6.15 Three variance analysis method a) Budget variance b) Volume variance c) Efficiency variance 7. Prepare a cash budget for December 202 and January 203, clearly showing receipts and payments 8. Using information on case study point 7 , calculate: 8.1 The total cost price per unit 8.2 The mark-up percentage per unit 8.3 The selling price per unit 9. Using point number 8 prepare the following: 9.1 A schedule showing distribution joint cost using the net realizable value method 9.2 A statement of comprehensive income for the month of August 202 Case study 1. Sung Industries manufactures tracking devices. They use a job order costing system. Manufacturing overheads are absorbed based on direct labor hours. The budgeted figures in respect of manufacturing overheads for January 202 are as follows: During the first week of January 202 the following prime cost were incurred on Job D45: Direct Material 159 kilograms @ R848.00 per kilogram (issued by department B) Direct Labor Department B 45 hours @ R87.50 per hour Department C 89.6 hours @ R128.80 per hour 2. In February 202 Sung Industries completed a contract of installing tracking devices for Maluni Logistics. During the accounting period that ended on 29 February 202 the following information was supplied to you: Technician's certificate issued for work completed 3. In each period (March 20x2) production the cost was as follows: Total Cost 4640 units were introduced into production. The period ended with 4060 units being fully completed and 580 units being partly complete. No losses were expected, and no losses occurred. Fully completed units are immediately transferred to the next process. The degree of completion of the work-in-process was as follows: 4. Consider the following Data for Sung industries during Apr 202 Actual cost data per year: Sung Industries sells its product at R168.00 per unit. Actual fixed manufacturing overheads amount to R296 800 per annum. Sung Industries uses material cost as basis to allocate the fixed manufacturing overheads. Over- or under allocated manufacturing overhead are written off against the cost of sales in the year they are incurred. Variable administration overheads vary according to the number of units sold. 5. Sung Industries manufactures tracking devices. The company uses a standard costing system. The information below applies to the activities of the year ending in December 202 There is no change in the opening and closing inventory of material; accordingly, quantity purchased equals to quantity used. The actual price is R27.30. Unfavorable variances occur when the actual cost is higher than budgeted cost. Favorable variances occur when actual cost is lower than budgeted cost. Note: a variance can be calculated as either actual minus standard or standard minus actual. Therefore, a positive or negative variance is meaningless. The variance must be interpreted as either favorable (F) or unfavorable (U). The standard cost card for tracking devices is as follows: Normal production is 7150 units per annum 6. Sung industries opened a branch in Cape Town in January of 202. The have been operating on a basis of 5000 orders per month. The factory has been reorganized to accommodate 7500 orders per month as from February 20x2. The factory charges R84 per device and incurs direct expenses per order as follows: Monthly administration overheads cost is: Staff salaries are paid at the end of each month. Other provisions are received evenly throughout the month and are paid for at the end of the following month. Sundries are delivered in the month before the month of use and are paid at the end of the month of use. Other expenses are paid for at the end of the month in which they are incurred, except for the following items - Rent is R105 600.00 per year paid in two equal installments on the 30 June 20x2 and 31 December 202 - Depreciation amounts to R62 400.00 annually Both rent and depreciation are allocated to the accounts in equal monthly installments. The center policy is that the orders are invoiced at the end of each month and receipts are collected as follows: - 45% by the end of the 1st month after invoice - 56% by the end of the 2nd month after invoice - 15 by the end of the 3rd month after invoice At the end of November 20x2 there was a bank balance of R66 500.00. 7. Sung Industries provides the following cost data for its single product: The desired rate of return is 40% and the investment is R1296000.00. the company has estimated that production and sales will be 12000 units 8. The following data apply to a manufacturer Sung Industries for the month of Auruint onvo You are required to: 1. Compute the predetermined overhead absorption rate for each department for January 202. 2. Compute a job costing card for Job D45 for January 202 which clearly indicates the following: 2.1Total cost of Job D45 2.2The selling price of Job D45 if the company wants to make a gross profit (income) of 45% on the cost price. 3. Prepare a ledger account for the contract of Maluni Logistics that clearly shows the profit or loss on the contract. Also, prepare the ledger account of the contract debtor (Maluni Logistics) 4. Prepare a production cost report showing the total equivalent production, the cost per complete unit and the allocation of cost. 5. Assume that all financial data for April 201 (both budgeted and actual for the sake of simplicity in explaining the concept) remain constant during the three years in question, and do the following: 5.1 Compile a statement of comprehensive income using the absorption cost method for the 3 years in question 6. Using the cost projected in point number 5 of the case study. You are required to calculate the following: 6.1 Total direct material variance 6.2 Material price variance 6.3 Material usage (quantity) variance 6.4 Total material variance (proof) 6.5 Standard quantity with total direct labor variance (calculate using the standard quantity figure, and then assume that 3850 direct labor hours were worked during the year) 6.6 Direct labor efficiency variance (direct labor hours (DLH) @ 3850) 6.7 Total direct labor variance (proof) 6.8 Variable overhead rate variance (assume DLH @ 3850) 6.9 Variable overhead efficiency variance 6.10 Fixed manufacturing g overhead expenditure (budget, spending) variance 6.11 Volume variance 6.12 Volume efficiency variance (assume DLH @ 3850) 6.13 Volume capacity variance (assume DLH @ 3850) 6.14 Two variance analysis method 6.15 Three variance analysis method a) Budget variance b) Volume variance c) Efficiency variance 7. Prepare a cash budget for December 202 and January 203, clearly showing receipts and payments 8. Using information on case study point 7 , calculate: 8.1 The total cost price per unit 8.2 The mark-up percentage per unit 8.3 The selling price per unit 9. Using point number 8 prepare the following: 9.1 A schedule showing distribution joint cost using the net realizable value method 9.2 A statement of comprehensive income for the month of August 202

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts