Question: please answer a and b asap for a good rating As a result of improvements in product engineering. United Automation is able to sell one

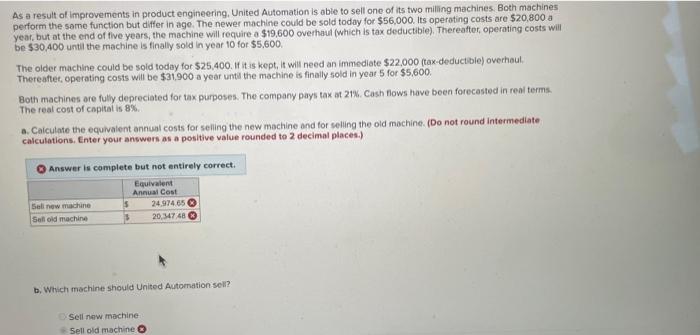

As a result of improvements in product engineering. United Automation is able to sell one of its two milling machines. Both machines perform the same function but differ in age. The newer machine could be sold today for $56,000. its operating costs are $20,800 a year, but at the end of tive years, the machine will require a $19,600 overhaul (which is tax deductibie), Thereafter, operating costs will be $30.400 until the machine is finally sold in year 10 fot $5,600. The older machine could be soid today for $25,400. If it is kept, it will need an immediate $22,000 (tax-deductbie) overhaul. Thereaftec, operating costs will be $31,900 a year until the machine is finally sold in yeat 5 for $5,600. Both machines are fully depreciated for tax purposes. The company pays tax at 21%. Cash flows have been forecasted in real terms. The real cost of capitat is 8%. a. Caiculate the equivalent annual costs for selling the new machine and for selling the old machine. (Do not round intermediate. calculations. Enter your answers as a positive value rounded to 2 decimal places.) Answer is complete but not entirely correct. b. Which machine should United Automation sell? Sell naw machine Sell old machine 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts