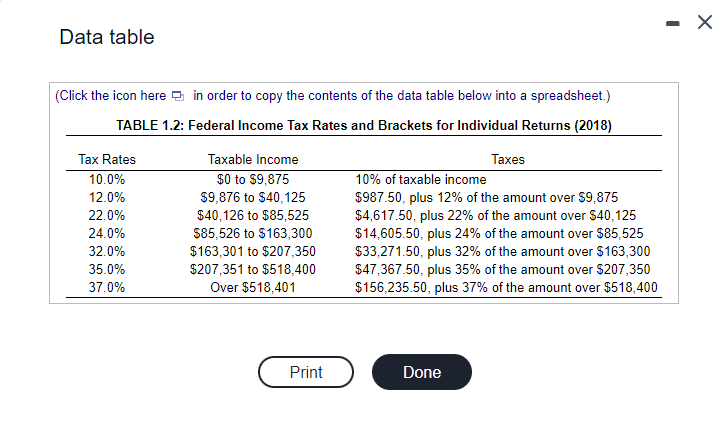

Question: PLEASE ANSWER A and B Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.)

PLEASE ANSWER A and B

Data table (Click the icon here in order to copy the contents of the data table below into a spreadsheet.) TABLE 1.2: Federal Income Tax Rates and Brackets for Individual Returns (2018) Using the individual tax rate schedule perform the following: a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of partnership earnings before taxes: $9,800; $79,800; $300,000; $492,000; $1.3 million; $1.5 million; and $2.3 million. b. Plot the average tax rates (measured on the y-axis) against the pretax income levels (measured on the x-axis). What generalization can be made concerning the relationship between these variables? a. Calculate the tax liability, after-tax earnings, and average tax rates for the following levels of partnership earnings before taxes: $9,800; $79,800; $300,000; $492,000; $1.3 million; $1.5 million; and \$2.3 million. (Round dollars to the nearest cent and round percentages to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts