Question: Please answer A and B (Everything) During 20X8, the following transfers and transactions between funds took place in the City of Matthew. 1. On March

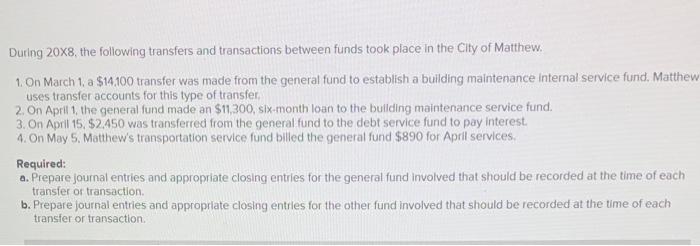

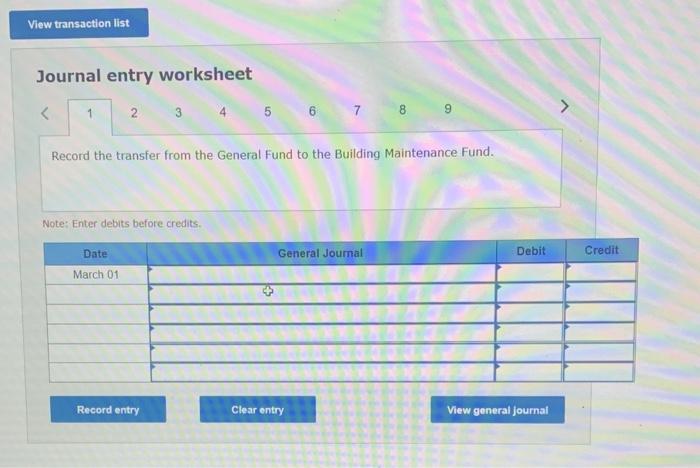

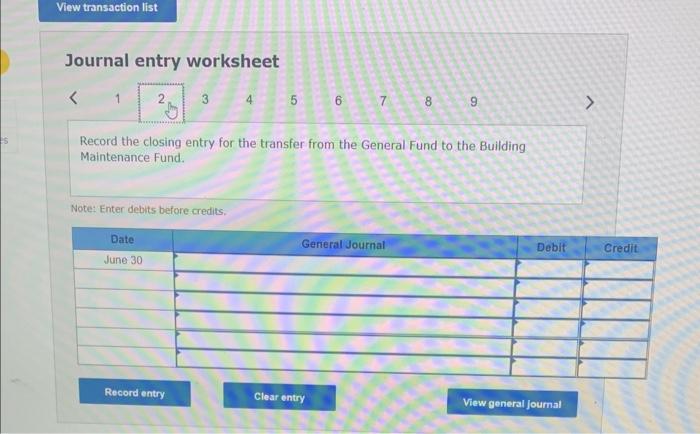

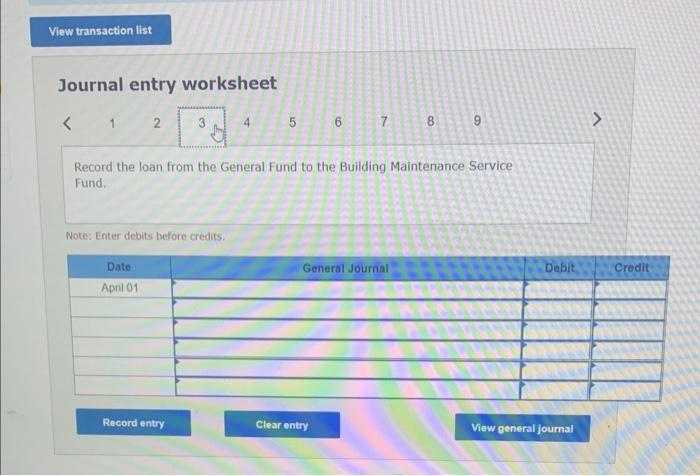

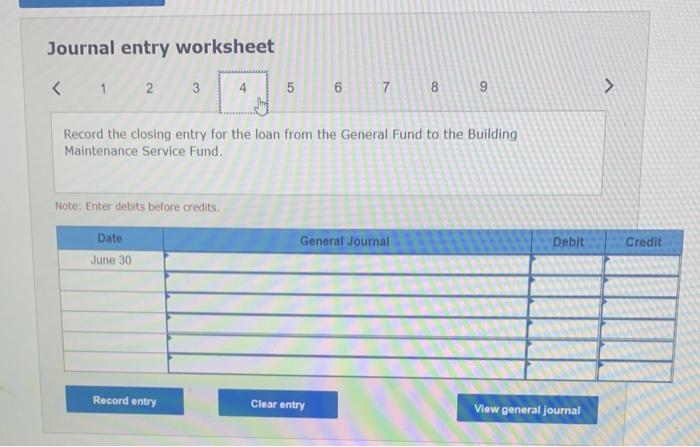

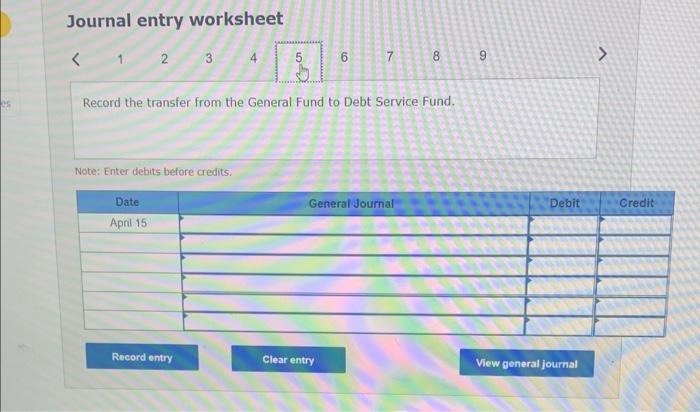

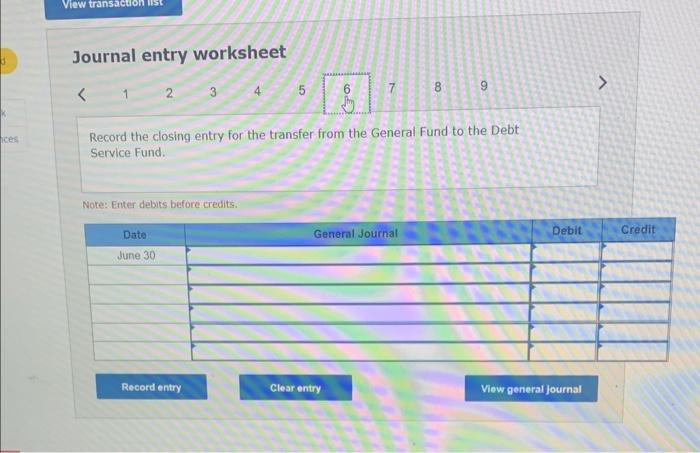

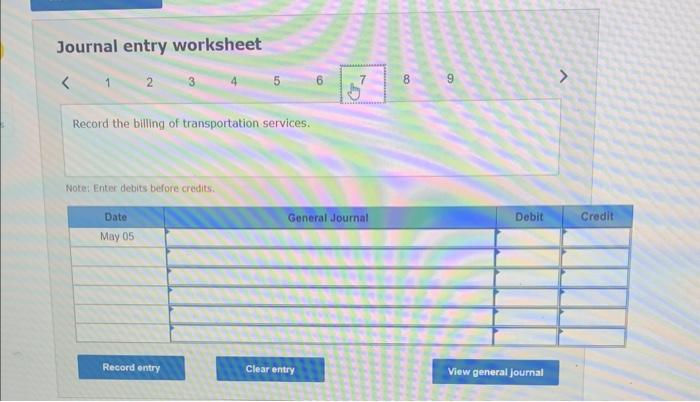

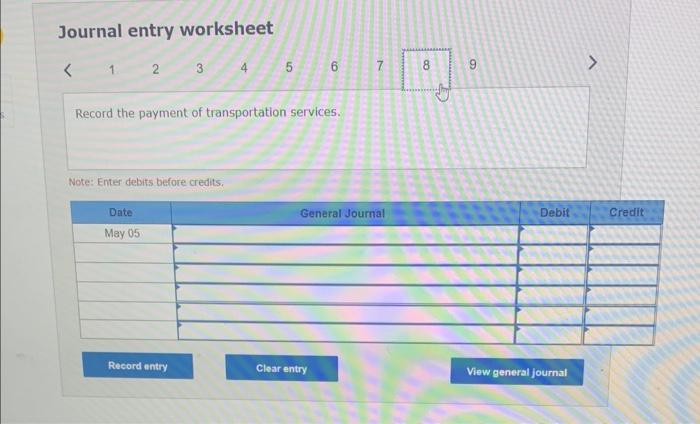

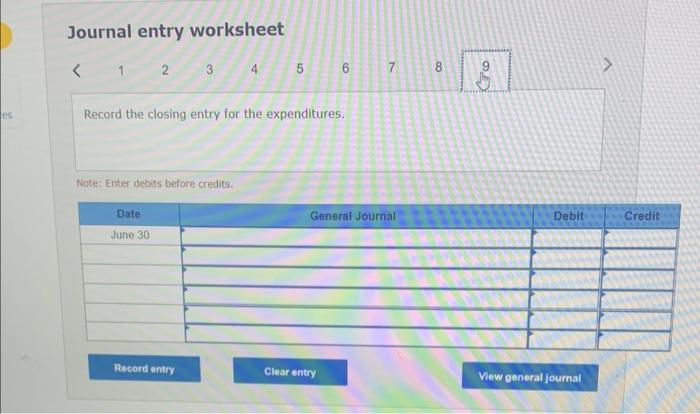

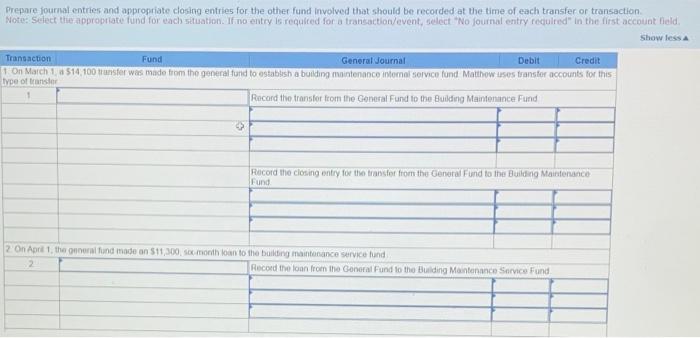

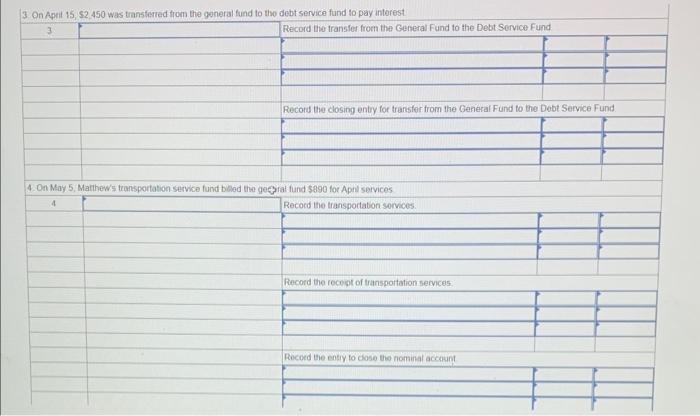

During 20X8, the following transfers and transactions between funds took place in the City of Matthew. 1. On March 1, a $14.100 transfer was made from the general fund to establish a building maintenance internal service fund. Matthew uses transfer accounts for this type of transfer. 2. On April 1, the general fund made an $11,300, six-month loan to the buliding maintenance service fund. 3. On April 15. $2.450 was transferred from the general fund to the debt service fund to pay interest. 4. On May 5. Matthew's transportation service fund billed the general fund $890 for April services. Required: a. Prepare journal entries and appropriate closing entries for the general fund involved that should be recorded at the time of each transfer or transaction. b. Prepare journal entries and appropriate closing entries for the other fund involved that should be recorded at the time of each transfer or transaction. Journal entry worksheet 2345789 Record the transfer from the General Fund to the Building Maintenance Fund. Note: Enter debits before credits. Journal entry worksheet Record the closing entry for the transfer from the General Fund to the Building Maintenance Fund. Note: Enter debits before credits; Journal entry worksheet 789 Record the loan from the General Fund to the Building Maintenance Service Fund. Note: Enter debits before credits. Journal entry worksheet 789 Record the closing entry for the loan from the General Fund to the Building Maintenance Service Fund. Note: Enter debits before credits. Journal entry worksheet 78 Record the transfer from the General Fund to Debt Service Fund. Note: Enter debits before credits: Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts