Question: Please answer A and B P4-31. Compute and Interpret Liquidity, Solvency, and Coverage Ratios Information from the balance sheet, income statement, and statement of cash

Please answer A and B

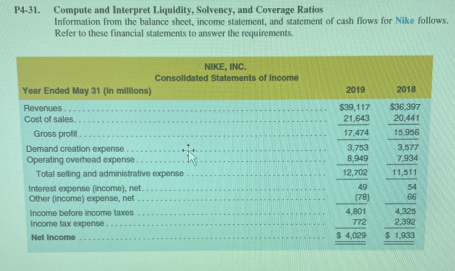

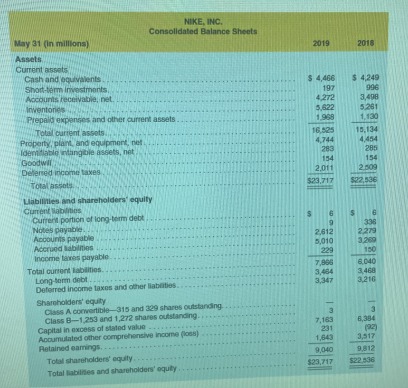

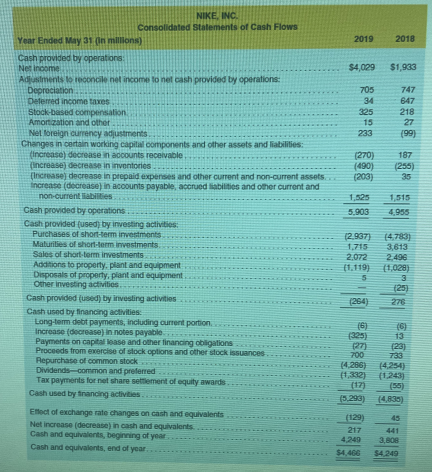

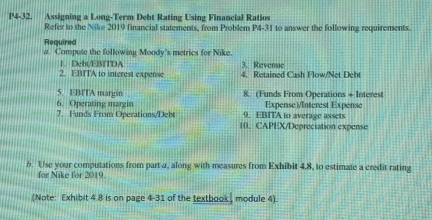

P4-31. Compute and Interpret Liquidity, Solvency, and Coverage Ratios Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements. NIKE, INC. Consolidated Balance Sheets May 31 (in millions) 2019 Assets. Current assets: Cish and oquvalents. Short-term imestments. Accounts receivable, net. Irventones Prepald expenses and other current assets Total curient assets. Property, plant, and equipmert, net. loentilablo niting ble assets, net. Goodinil Delered ingome taxes. Total asest: \begin{tabular}{r|r|r} $4,466 & $4,249 \\ 197 & 996 \\ 4,272 & 3,496 \\ 5,622 & 5.261 \\ 1,969 & 1,130 \\ \hline 16,525 & 15,134 \\ 4,744 & 4,454 \\ 283 \\ 194 & 285 \\ 2.011 & 154 \\ \hline$23,717 & 2.009 \\ \hline \hline \end{tabular} Labillies and shareholders' equity Current lablitios Curfer portion of long-term debt. Notes paynbie. Accounits payabie Acerued liabilities income tanes payable Total cureent labilitios. Longtarm debt ... Deterred income taxes and other llabetias . Sharoholders' equity Class A comertible-315 and 329 shares outstanding. Class B1,253 and 1,272 shases outstanding. Capital in excess of stated value .................. Acoumulated other comprehensive income (loss) Petained earnings. Total shareholders' equly. Total labilites and shareholders' oquily NIKE, INC. Consolidated Statements of Cash Flows Year Ended May 31 (Cr milisons) 20192018 Cash provided by operations: Nerinome: Adjustments ts reconcie net income to net cash provided by operations: Deprectation Deferred insome tures Stock-based compersation. Amortzation and othet. Net boreign currency adjustrents. $4,029$1,933 Changes in certain working capilar components and other ascets and liabilities: (incretse) docrease in accounts recelvable. (increase) decrease in invontories. (incenase decrease in ptepaid expenses and other current and non-current assets. increase (decrease) in acoounts payable, accrued liabitties and oeher current and non-current fibilities. Cash provided by operations. 705343251523374764721827(99) Cash provided (used) by investing activies: Purchases of shont-erem invertments Maturilies of shortelerm investments. Sales of short-torm investments, Addtions to peoperty, ptant and equipment Disposals of propperty, plant and equipment. other investing activitios. Cash provided (used) by investing activities Cash used by finaneing activilies: Long-ern debt payments, including curtert portion. Increase (docerease) in notes payable. Payments on cap tat base and oher financing coligations Procoeds from exercise of slock options and other stock issuances. Aepurchase of comminon stock. Dividends-cormmon and preferred Tax payments for net share sethement of equity awards. 5,9031,5254,9551,515 Cash used by trancing activtses. Elloct of exchango rate changes on cash and equivalents Net increase (decrease) in cush and equivalents. Cash and equivalents, begining of year Cash and equivalents, end of year: 32. Assigning a Long-Term Debt Rating Using Finanelal Ratios Refer wo the Rike 2019 financial statemens, from Probkem P4-31 to answer the following requirements: b. Use your computations from part a, along with measures from Exhibit 4.8, to estimale a credit rating for Nike lor 2019. (Note: Exhibit 4.8 is on page 431 of the texthoos, module 4 ). P4-31. Compute and Interpret Liquidity, Solvency, and Coverage Ratios Information from the balance sheet, income statement, and statement of cash flows for Nike follows. Refer to these financial statements to answer the requirements. NIKE, INC. Consolidated Balance Sheets May 31 (in millions) 2019 Assets. Current assets: Cish and oquvalents. Short-term imestments. Accounts receivable, net. Irventones Prepald expenses and other current assets Total curient assets. Property, plant, and equipmert, net. loentilablo niting ble assets, net. Goodinil Delered ingome taxes. Total asest: \begin{tabular}{r|r|r} $4,466 & $4,249 \\ 197 & 996 \\ 4,272 & 3,496 \\ 5,622 & 5.261 \\ 1,969 & 1,130 \\ \hline 16,525 & 15,134 \\ 4,744 & 4,454 \\ 283 \\ 194 & 285 \\ 2.011 & 154 \\ \hline$23,717 & 2.009 \\ \hline \hline \end{tabular} Labillies and shareholders' equity Current lablitios Curfer portion of long-term debt. Notes paynbie. Accounits payabie Acerued liabilities income tanes payable Total cureent labilitios. Longtarm debt ... Deterred income taxes and other llabetias . Sharoholders' equity Class A comertible-315 and 329 shares outstanding. Class B1,253 and 1,272 shases outstanding. Capital in excess of stated value .................. Acoumulated other comprehensive income (loss) Petained earnings. Total shareholders' equly. Total labilites and shareholders' oquily NIKE, INC. Consolidated Statements of Cash Flows Year Ended May 31 (Cr milisons) 20192018 Cash provided by operations: Nerinome: Adjustments ts reconcie net income to net cash provided by operations: Deprectation Deferred insome tures Stock-based compersation. Amortzation and othet. Net boreign currency adjustrents. $4,029$1,933 Changes in certain working capilar components and other ascets and liabilities: (incretse) docrease in accounts recelvable. (increase) decrease in invontories. (incenase decrease in ptepaid expenses and other current and non-current assets. increase (decrease) in acoounts payable, accrued liabitties and oeher current and non-current fibilities. Cash provided by operations. 705343251523374764721827(99) Cash provided (used) by investing activies: Purchases of shont-erem invertments Maturilies of shortelerm investments. Sales of short-torm investments, Addtions to peoperty, ptant and equipment Disposals of propperty, plant and equipment. other investing activitios. Cash provided (used) by investing activities Cash used by finaneing activilies: Long-ern debt payments, including curtert portion. Increase (docerease) in notes payable. Payments on cap tat base and oher financing coligations Procoeds from exercise of slock options and other stock issuances. Aepurchase of comminon stock. Dividends-cormmon and preferred Tax payments for net share sethement of equity awards. 5,9031,5254,9551,515 Cash used by trancing activtses. Elloct of exchango rate changes on cash and equivalents Net increase (decrease) in cush and equivalents. Cash and equivalents, begining of year Cash and equivalents, end of year: 32. Assigning a Long-Term Debt Rating Using Finanelal Ratios Refer wo the Rike 2019 financial statemens, from Probkem P4-31 to answer the following requirements: b. Use your computations from part a, along with measures from Exhibit 4.8, to estimale a credit rating for Nike lor 2019. (Note: Exhibit 4.8 is on page 431 of the texthoos, module 4 )

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts