Question: please answer a and b Rex's RVs currently sells 150 Class A motor homes, 240 Class C motor homes, and 275 pop-up trailers each year.

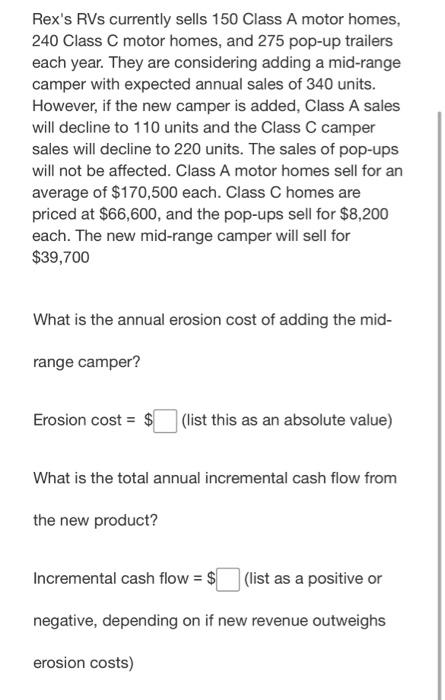

Rex's RVs currently sells 150 Class A motor homes, 240 Class C motor homes, and 275 pop-up trailers each year. They are considering adding a mid-range camper with expected annual sales of 340 units. However, if the new camper is added, Class A sales will decline to 110 units and the Class C camper sales will decline to 220 units. The sales of pop-ups will not be affected. Class A motor homes sell for an average of $170,500 each. Class C homes are priced at $66,600, and the pop-ups sell for $8,200 each. The new mid-range camper will sell for $39,700 What is the annual erosion cost of adding the midrange camper? Erosion cost =$ (list this as an absolute value) What is the total annual incremental cash flow from the new product? Incremental cash flow =$ (list as a positive or negative, depending on if new revenue outweighs erosion costs)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts