Question: please answer A and B years 1 and 2 Question Help Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows

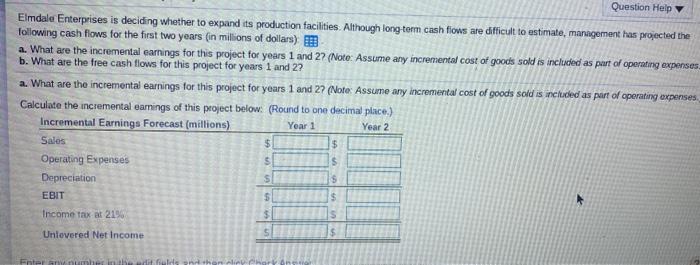

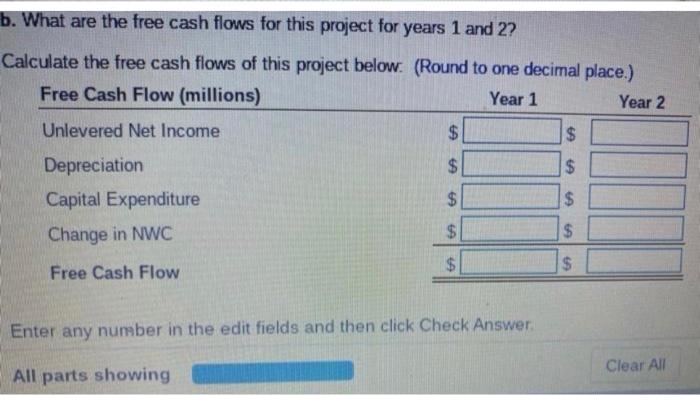

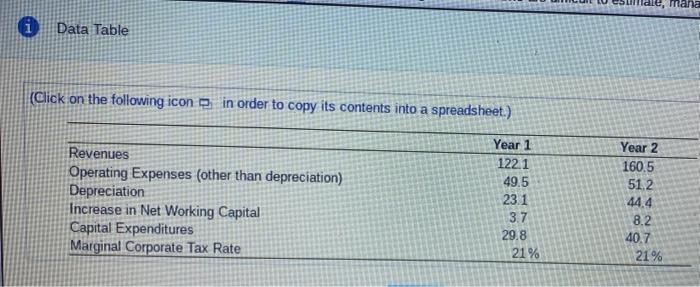

Question Help Elmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars) a. What are the incremental earnings for this project for years 1 and 27 (Note: Assume any incremental cost of goods sold is included as part of operating expenses b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 27 (Note: Assume any incremental cost of goods sold is included as part of operating expenses Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Year 1 Year 2 Sales Operating Expenses $ $ Depreciation $ EBIT $ Income Tax at 21% Uniovered Net Income 5 $ $ 5 $ Enterim dit is b. What are the free cash flows for this project for years 1 and 2? Calculate the free cash flows of this project below. (Round to one decimal place.) Free Cash Flow (millions) Year 1 Year 2 $ $ $ Unlevered Net Income Depreciation Capital Expenditure Change in NWC $ $ $ $ $ Free Cash Flow Enter any number in the edit fields and then click Check Answer Clear All All parts showing mana i Data Table (Click on the following icon in order to copy its contents into a spreadsheet.) Revenues Operating Expenses (other than depreciation) Depreciation Increase in Net Working Capital Capital Expenditures Marginal Corporate Tax Rate Year 1 1221 49.5 23.1 3.7 29.8 21% Year 2 160.5 51.2 44.4 8.2 40.7 21%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts