Question: Please answer A & B :) An investor has two bonds in her portfolio, Bond C and Bond Z. Each bund matures in 4 years,

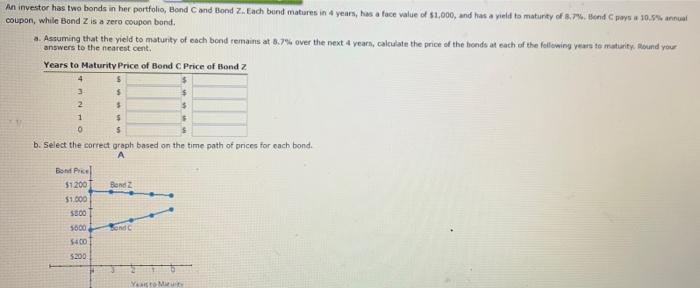

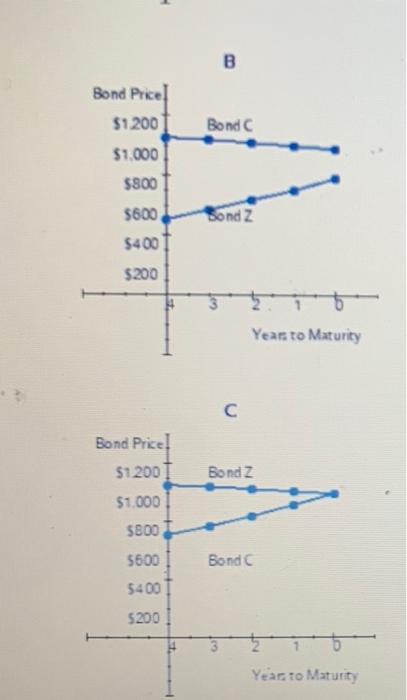

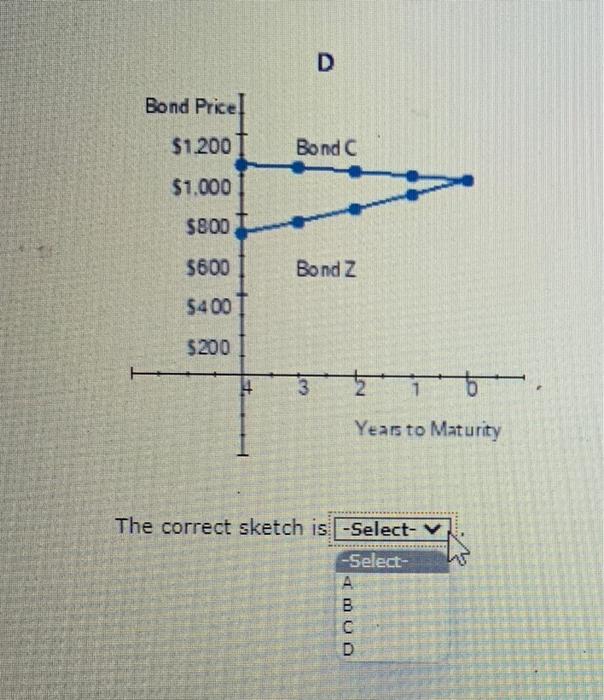

An investor has two bonds in her portfolio, Bond C and Bond Z. Each bund matures in 4 years, has a face value of $1,000, and has a yield to maturity of 8.7%. Bond C pays a 10.5% annual coupon, while Bond Z is a zero coupon bond. a. Assuming that the yield to maturity of each bond remains at 8.7% over the next 4 years, calculate the price of the honds at each of the following years to maturity. Round your answers to the nearest cent. Years to Maturity Price of Bond C Price of Bond Z 3 2 1 b. Select the correct graph based on the time path of prices for each bond. A Bond Price $1.200 $1.000 $800 $ $ $ $ 1600 $400 $200 Bond 2 Bond C Yeasto Micuity Bond Price $1.200 $1,000 $800 $600, $400 $200 Bond Price $1.200 $1.000 $800 $600 $400 $200 B Bond C Bond Z 2 Year to Maturity Bond Z Bond C Year to Maturity Bond Price. Price] T $1.200 $1.000 $800 $600 $400 $200 4 D Bond C Bond Z 216. Years to Maturity The correct sketch is -Select- V -Select- ABCD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts