Question: please answer A, B, and C below The following is a forecast for a potential acquisition You think you will need to offer $56 million

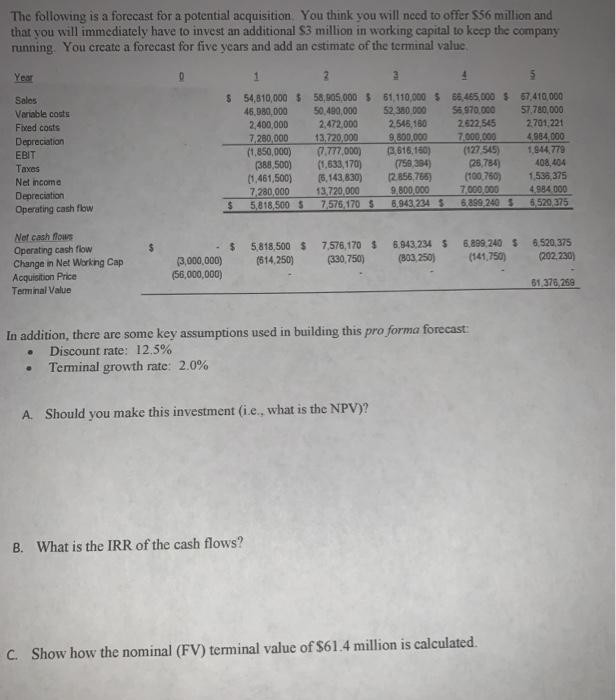

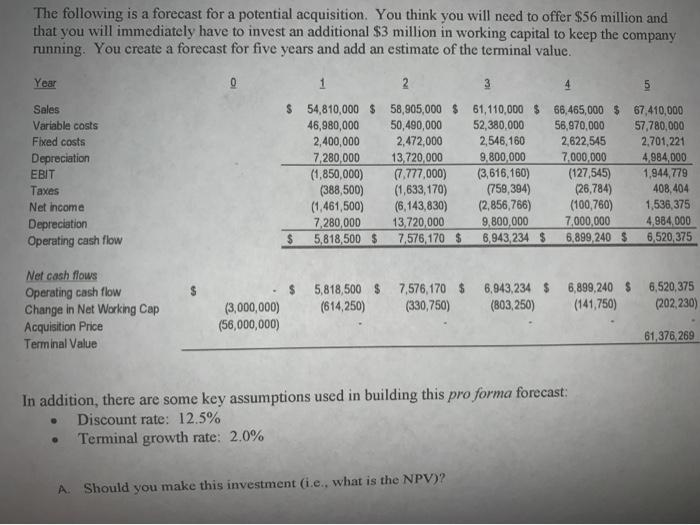

The following is a forecast for a potential acquisition You think you will need to offer $56 million and that you will immediately have to invest an additional S3 million in working capital to keep the company running. You create a forecast for five years and add an estimate of the terminal value Year 1 3 4 Sales Variable costs Fixed costs Depreciation EBIT Taxes Net income Depreciation Operating cash flow $ 54,810,000 $ 58,805,000$ 61, 110 000 $ 65,465,000 $67,410,000 45,980,000 50,490,000 52 380 000 56.970,000 57,780,000 2,400,000 2,472,000 2,545,160 2622,545 2,701,221 7,280,000 13,720,000 9,800,000 7.000.000 4984.000 (1.850,000) (7.717.000) 3,616,180) (127 545) 1,944,779 (388,500) (1,633,170) (758,354) 26,784) 408,404 (1.461,500) 6,143,830) (2.856,765) (100,760) 1,536, 375 7280,000 13,720,000 9,800.000 7.000.000 4.984.000 $ 5,818.500 5 7,575,1705 6.943.2345 6,899 240 5 5520,375 $ 5.818,500 $ (514,250) Net cash flows Operating cash flow Change in Net Working Cap Acquisition Price Terminal Value 7,576,170 $ (330,750) 6.943.2345 (B03 250) 6.899,240 $ (141,750) 6.520,375 202.230) 3,000,000) (56,000,000) 61,376,269 In addition, there are some key assumptions used in building this pro forma forecast: Discount rate: 12.5% Terminal growth rate: 2.0% . A. Should you make this investment (i.e., what is the NPV)? B. What is the IRR of the cash flows? C. Show how the nominal (FV) terminal value of $61.4 million is calculated. The following is a forecast for a potential acquisition. You think you will need to offer $56 million and that you will immediately have to invest an additional $3 million in working capital to keep the company running. You create a forecast for five years and add an estimate of the terminal value. Year OI 1 Sales Variable costs Fixed costs Depreciation EBIT Taxes Net income Depreciation Operating cash flow 1 2. 3 5 $ 54,810,000 $ 58,905,000 $ 61,110,000 $ 66,465,000 $ 67,410,000 46,980,000 50,490,000 52,380,000 56,970,000 57,780,000 2,400,000 2,472,000 2,546,160 2,622,545 2,701,221 7.280,000 13,720,000 9,800,000 7,000,000 4.984,000 (1,850,000) (7.777,000) (3,616,160) (127,545) 1,944,779 (388,500) (1,633,170) (758,394) (26,784) 408,404 (1,461,500) (6,143,830) (2,856,766) (100,760) 1,536, 375 7.280,000 13,720,000 9,800,000 7,000,000 4,984,000 $ 5,818,500 $ 7.576,170 $ 6,943, 234 $ 6,899,240 $ 6.520 375 Net cash flows Operating cash flow Change in Net Working Cap Acquisition Price Terminal Value 5,818,500 $ (614,250) 7,576,170 $ (330,750) 6,943,234 $ (803,250) 6,899,240 $ 6,520,375 (141,750) (202,230) (3,000,000) (58,000,000) 61,376,269 In addition, there are some key assumptions used in building this pro forma forecast: Discount rate: 12.5% Terminal growth rate: 2.0% A. Should you make this investment (i.e., what is the NPV)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts