Question: Please answer a) b) and c) of this problem and show all work. Thank you! Penn River Ltd. Is considering an investment in a new

Please answer a) b) and c) of this problem and show all work. Thank you!

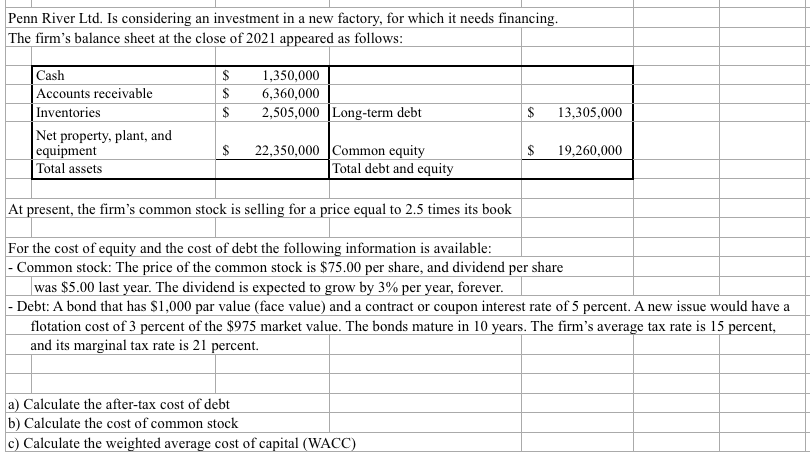

Penn River Ltd. Is considering an investment in a new factory, for which it needs financing. The firm's balance sheet at the close of 2021 appeared as follows: Cash Accounts receivable Inventories Net property, plant, and equipment Total assets $ $ $ $ 1,350,000 6,360,000 2,505,000 Long-term debt 22,350,000 Common equity Total debt and equity $ 13,305,000 a) Calculate the after-tax cost of debt b) Calculate the cost of common stock c) Calculate the weighted average cost of capital (WACC) $ 19,260,000 At present, the firm's common stock is selling for a price equal to 2.5 times its book For the cost of equity and the cost of debt the following information is available: - Common stock: The price of the common stock is $75.00 per share, and dividend per share was $5.00 last year. The dividend is expected to grow by 3% per year, forever. - Debt: A bond that has $1,000 par value (face value) and a contract or coupon interest rate of 5 percent. A new issue would have a flotation cost of 3 percent of the $975 market value. The bonds mature in 10 years. The firm's average tax rate is 15 percent, and its marginal tax rate is 21 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts