Question: Please answer A, B, and C Please show your work. Please explain your reasoning. You buy a share of Stock A (today) at a price

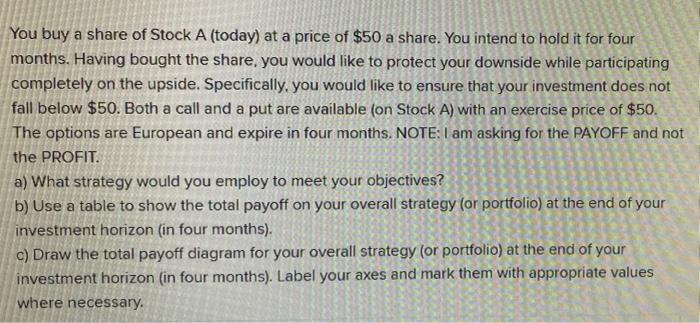

You buy a share of Stock A (today) at a price of $50 a share. You intend to hold it for four months. Having bought the share, you would like to protect your downside while participating completely on the upside. Specifically, you would like to ensure that your investment does not fall below $50. Both a call and a put are available (on Stock A) with an exercise price of $50. The options are European and expire in four months. NOTE: I am asking for the PAYOFF and not the PROFIT. a) What strategy would you employ to meet your objectives? b) Use a table to show the total payoff on your overall strategy for portfolio) at the end of your investment horizon (in four months). c) Draw the total payoff diagram for your overall strategy for portfolio) at the end of your investment horizon (in four months). Label your axes and mark them with appropriate values where necessary

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts