Question: Please answer a, b, and c with calculations Problem 1 - Equity Method Investment On January 1, 20X4, LOWTOP invested cash in the common stock

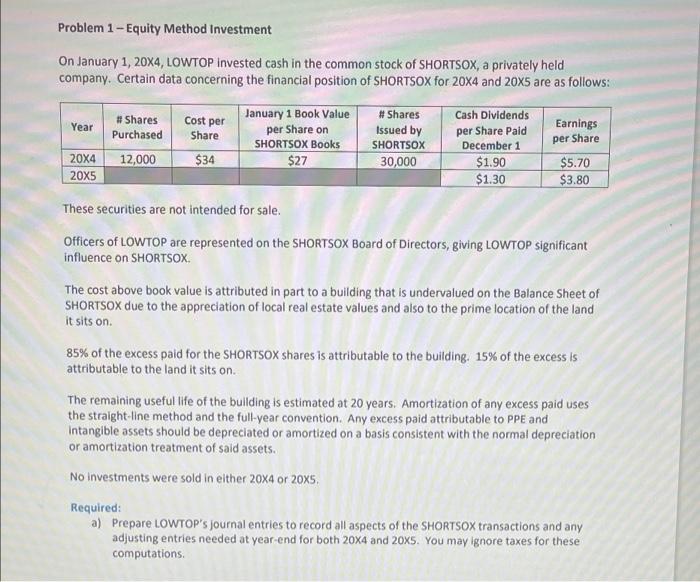

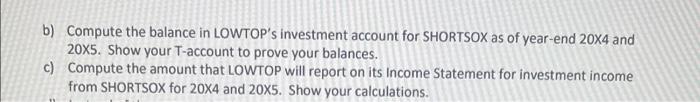

Problem 1 - Equity Method Investment On January 1, 20X4, LOWTOP invested cash in the common stock of SHORTSOX, a privately held company. Certain data concerning the financial position of SHORTSOX for 20x4 and 20x5 are as follows: Year # Shares Purchased 12,000 Cost per Share $34 January 1 Book Value per Share on SHORTSOX Books #Shares Issued by SHORTSOX 30,000 Cash Dividends per Share Paid December 1 $1.90 $1.30 $27 Earnings per Share $5.70 $3.80 20X4 20x5 These securities are not intended for sale. Officers of LOWTOP are represented on the SHORTSOX Board of Directors, giving LOWTOP significant influence on SHORTSOX The cost above book value is attributed in part to a building that is undervalued on the Balance Sheet of SHORTSOX due to the appreciation of local real estate values and also to the prime location of the land it sits on. 85% of the excess paid for the SHORTSOX shares is attributable to the building, 15% of the excess is attributable to the land it sits on The remaining useful life of the building is estimated at 20 years. Amortization of any excess paid uses the straight line method and the full-year convention. Any excess paid attributable to PPE and Intangible assets should be depreciated or amortized on a basis consistent with the normal depreciation or amortization treatment of said assets. No Investments were sold in elther 20X4 or 20x5. Required: a) Prepare LOWTOP's journal entries to record all aspects of the SHORTSOX transactions and any adjusting entries needed at year-end for both 20x4 and 20x5. You may ignore taxes for these computations b) Compute the balance in LOWTOP's investment account for SHORTSOX as of year-end 20x4 and 20X5. Show your T-account to prove your balances. c) Compute the amount that LOWTOP will report on its Income Statement for investment income from SHORTSOX for 20x4 and 20X5. Show your calculations. Problem 1 - Equity Method Investment On January 1, 20X4, LOWTOP invested cash in the common stock of SHORTSOX, a privately held company. Certain data concerning the financial position of SHORTSOX for 20x4 and 20x5 are as follows: Year # Shares Purchased 12,000 Cost per Share $34 January 1 Book Value per Share on SHORTSOX Books #Shares Issued by SHORTSOX 30,000 Cash Dividends per Share Paid December 1 $1.90 $1.30 $27 Earnings per Share $5.70 $3.80 20X4 20x5 These securities are not intended for sale. Officers of LOWTOP are represented on the SHORTSOX Board of Directors, giving LOWTOP significant influence on SHORTSOX The cost above book value is attributed in part to a building that is undervalued on the Balance Sheet of SHORTSOX due to the appreciation of local real estate values and also to the prime location of the land it sits on. 85% of the excess paid for the SHORTSOX shares is attributable to the building, 15% of the excess is attributable to the land it sits on The remaining useful life of the building is estimated at 20 years. Amortization of any excess paid uses the straight line method and the full-year convention. Any excess paid attributable to PPE and Intangible assets should be depreciated or amortized on a basis consistent with the normal depreciation or amortization treatment of said assets. No Investments were sold in elther 20X4 or 20x5. Required: a) Prepare LOWTOP's journal entries to record all aspects of the SHORTSOX transactions and any adjusting entries needed at year-end for both 20x4 and 20x5. You may ignore taxes for these computations b) Compute the balance in LOWTOP's investment account for SHORTSOX as of year-end 20x4 and 20X5. Show your T-account to prove your balances. c) Compute the amount that LOWTOP will report on its Income Statement for investment income from SHORTSOX for 20x4 and 20X5. Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts