Question: please answer a b c and d thanks !! HBM, Inc has the following capital structure: The common stock is currently selling for $12 a

please answer a b c and d thanks !!

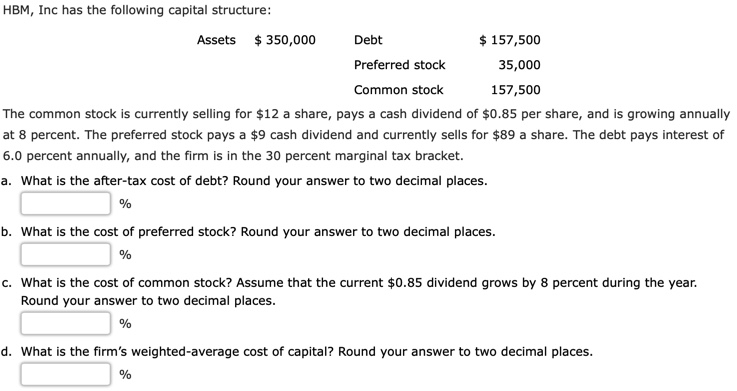

HBM, Inc has the following capital structure: The common stock is currently selling for $12 a share, pays a cash dividend of $0.85 per share, and is growing annually at 8 percent. The preferred stock pays a $9 cash dividend and currently sells for $89 a share. The debt pays interest of 6.0 percent annually, and the firm is in the 30 percent marginal tax bracket. a. What is the after-tax cost of debt? Round your answer to two decimal places. % b. What is the cost of preferred stock? Round your answer to two decimal places. % c. What is the cost of common stock? Assume that the current $0.85 dividend grows by 8 percent during the year. Round your answer to two decimal places. % d. What is the firm's weighted-average cost of capital? Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts