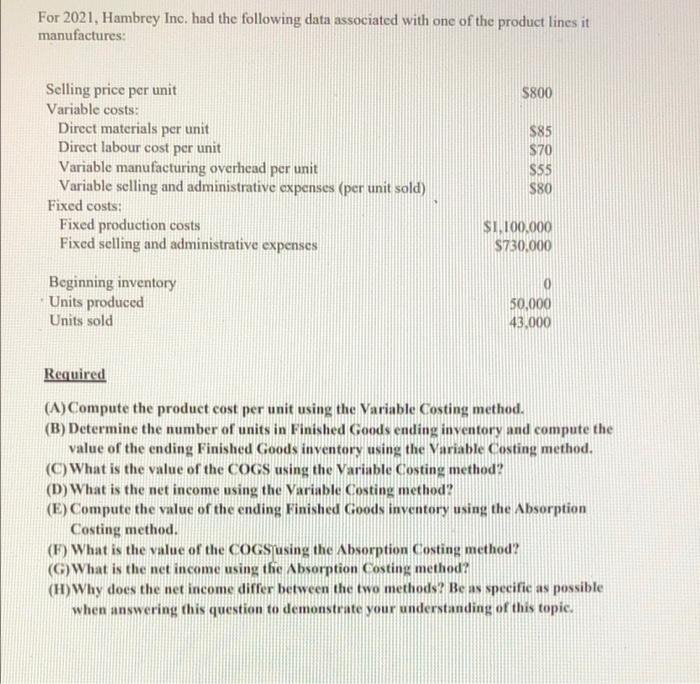

Question: please answer A, B, C, D, E, F, G, H For 2021, Hambrey Inc, had the following data associated with one of the product lines

For 2021, Hambrey Inc, had the following data associated with one of the product lines it manufactures: 5800 Selling price per unit Variable costs: Direct materials per unit Direct labour cost per unit Variable manufacturing overhead per unit Variable selling and administrative expenses (per unit sold) Fixed costs: Fixed production costs Fixed selling and administrative expenses 585 S70 S55 S80 $1,100,000 S730,000 Beginning inventory Units produced Units sold 50,000 43.000 Required (A) Compute the product cost per unit using the Variable Costing method. (B)Determine the number of units in Finished Goods ending inventory and compute the value of the ending Finished Goods inventory using the Variable Costing method. (C)What is the value of the COGS using the Variable Costing method? (D) What is the net income using the Variable Costing method? (E) Compute the value of the ending Finished Goods inventory using the Absorption Costing method. (F) What is the value of the COGS'using the Absorption Costing method? (G) What is the net income using the Absorption Costing method? (H)Why does the net income differ between the two methods? Beas specific as possible when answering this question to demonstrate your understanding of this topic

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts