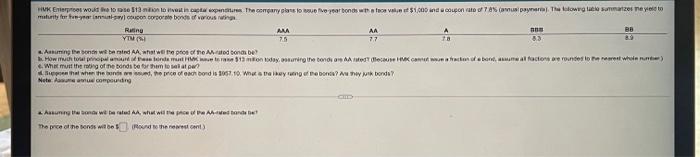

Question: please answer a, b, c, d HMK Enterprises would like to raise $13 million to invest in capital expenditures. The company plans to issue 5

HUK Enoos would lose Station test in carpinst the companys i nove poor bonds was to $1.000 and convato of Tampere The lowest sumarizes ne yet to mality con cordone bones of various Rating MA BB YTM 76 ta 83 Antung bone w bard Antwerproof Matod ons be How to oplemente me 512 monday.coming the borduan Alod (lecane Hive.com un atract bort meal factors are rounded to a whole nu What mult trong of the bonds to them to per that when the bound the coach bond is 1067.10. We hebben een ik benda Noter compoudre Anung hewlerated A, while we tandene The price or no sons where we cant)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts