Question: Please answer A, B,C D, E. For Question #1, please answer for 2.48335 , 2.4384 and 2.6456. P&G India. Procter and Gamble's affiliate in India,

Please answer A, B,C D, E. For Question #1, please answer for 2.48335 , 2.4384 and 2.6456.

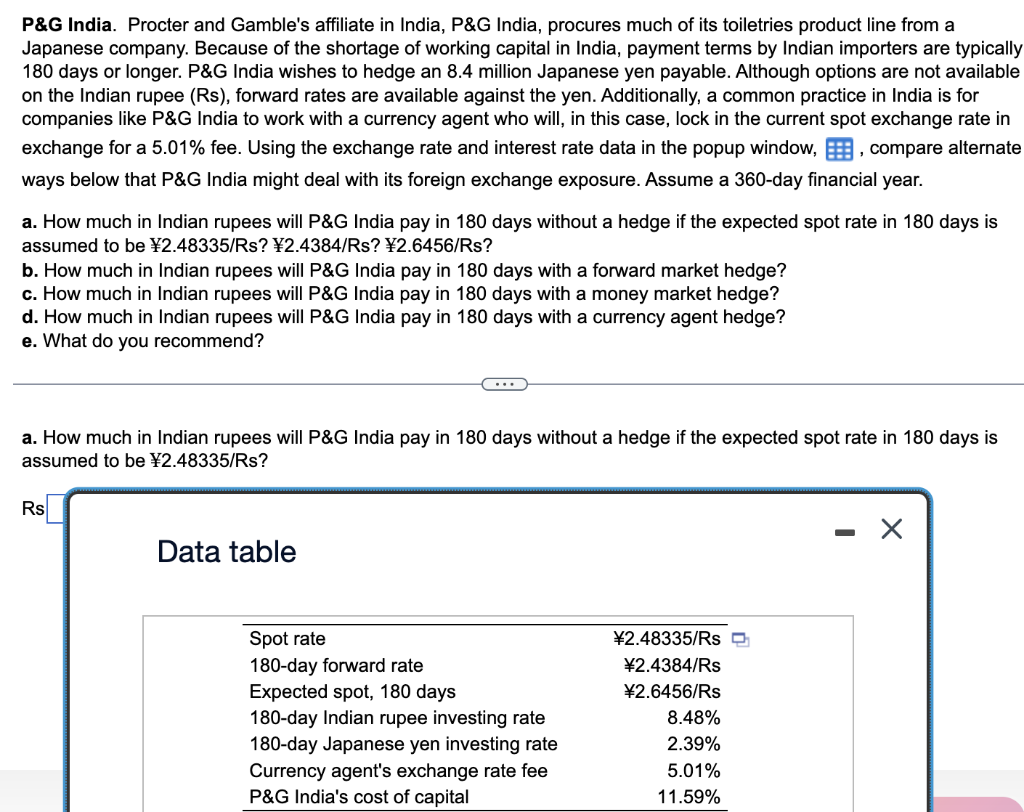

P\&G India. Procter and Gamble's affiliate in India, P\&G India, procures much of its toiletries product line from a Japanese company. Because of the shortage of working capital in India, payment terms by Indian importers are typically 180 days or longer. P\&G India wishes to hedge an 8.4 million Japanese yen payable. Although options are not available on the Indian rupee (Rs), forward rates are available against the yen. Additionally, a common practice in India is for companies like P\&G India to work with a currency agent who will, in this case, lock in the current spot exchange rate in exchange for a 5.01% fee. Using the exchange rate and interest rate data in the popup window, , compare alternate ways below that P\&G India might deal with its foreign exchange exposure. Assume a 360-day financial year. a. How much in Indian rupees will P\&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be 2.48335/Rs?2.4384/Rs?2.6456/Rs? b. How much in Indian rupees will P\&G India pay in 180 days with a forward market hedge? c. How much in Indian rupees will P\&G India pay in 180 days with a money market hedge? d. How much in Indian rupees will P\&G India pay in 180 days with a currency agent hedge? e. What do you recommend? a. How much in Indian rupees will P\&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be 2.48335/Rs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts