Question: Please Answer A, C, D, & E below Butterfly Tractors had $16.00 million in sales last year. Cost of goods sold was $8.40 million, depreciation

Please Answer A, C, D, & E below

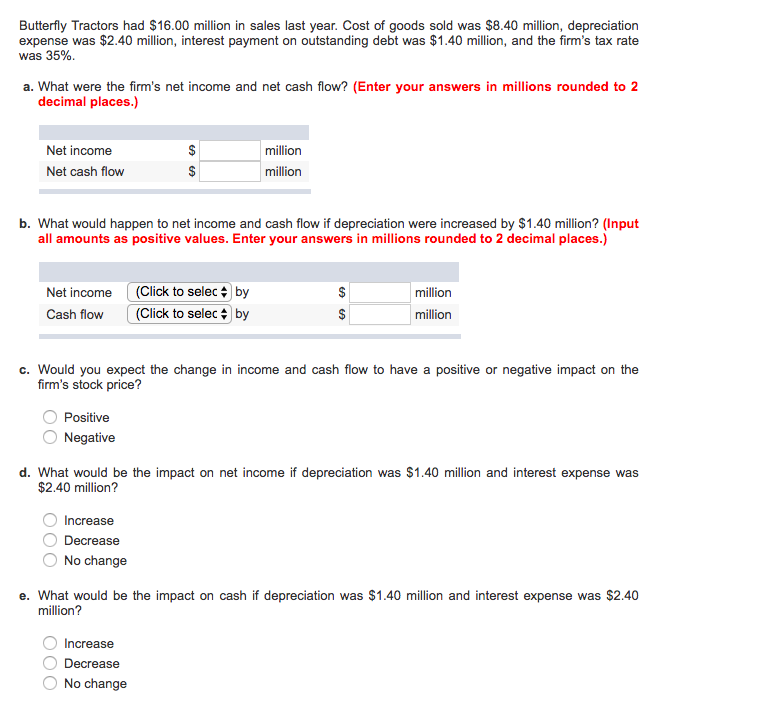

Butterfly Tractors had $16.00 million in sales last year. Cost of goods sold was $8.40 million, depreciation expense was $2.40 million, interest payment on outstanding debt was $1.40 million, and the firm's tax rate was 35%. a. What were the firm's net income and net cash flow? (Enter your answers in millions rounded to 2 decimal places.) b. What would happen to net income and cash flow if depreciation were increased by $1.40 million? (Input all amounts as positive values. Enter your answers in millions rounded to 2 decimal places.) c. Would you expect the change in income and cash flow to have a positive or negative impact on the firm's stock price? Positive Negative d. What would be the impact on net income if depreciation was $1.40 million and interest expense was $2.40 million? Increase Decrease No change e. What would be the impact on cash if depreciation was $1.40 million and interest expense was $2.40 million? Increase Decrease No change

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts