Question: please answer a Take a look at the ROE - Dupont Analysis below. You will notice, of the three (3) firms, two of them have

please answer a

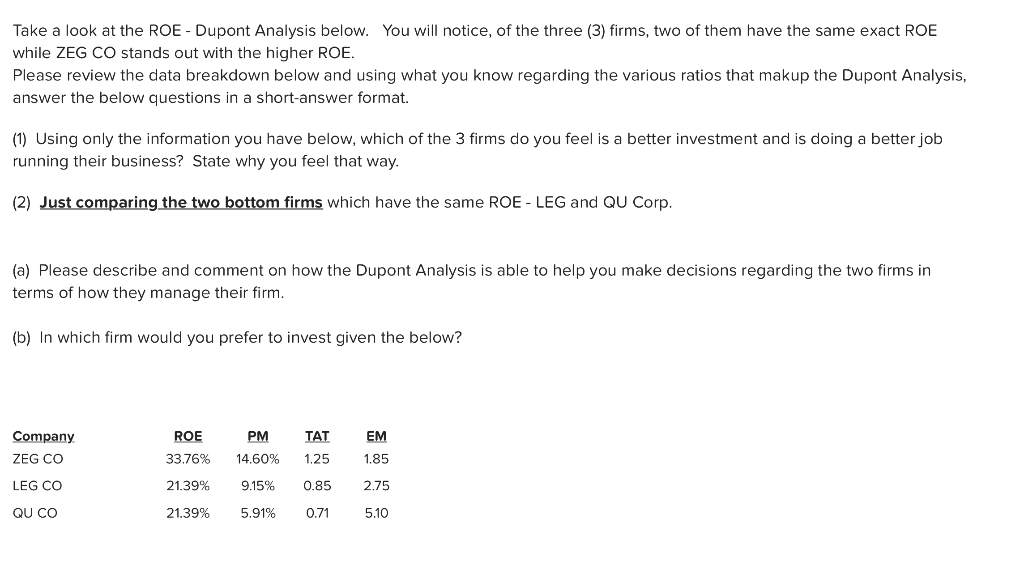

Take a look at the ROE - Dupont Analysis below. You will notice, of the three (3) firms, two of them have the same exact ROE while ZEG CO stands out with the higher ROE. Please review the data breakdown below and using what you know regarding the various ratios that makup the Dupont Analysis, answer the below questions in a short-answer format. (1) Using only the information you have below, which of the 3 firms do you feel is a better investment and is doing a better job running their business? State why you feel that way. (2) Just comparing the two bottom firms which have the same ROE - LEG and QU Corp. (a) Please describe and comment on how the Dupont Analysis is able to help you make decisions regarding the two firms in terms of how they manage their firm. (b) In which firm would you prefer to invest given the below? Company ZEG CO ROEPMTATEM 33.76% 14.60% 1.25 1.85 21.39% 9.15% 0.85 2.75 21.39% 5.91% 0.71 5.10 LEG CO QU CO Take a look at the ROE - Dupont Analysis below. You will notice, of the three (3) firms, two of them have the same exact ROE while ZEG CO stands out with the higher ROE. Please review the data breakdown below and using what you know regarding the various ratios that makup the Dupont Analysis, answer the below questions in a short-answer format. (1) Using only the information you have below, which of the 3 firms do you feel is a better investment and is doing a better job running their business? State why you feel that way. (2) Just comparing the two bottom firms which have the same ROE - LEG and QU Corp. (a) Please describe and comment on how the Dupont Analysis is able to help you make decisions regarding the two firms in terms of how they manage their firm. (b) In which firm would you prefer to invest given the below? Company ZEG CO ROEPMTATEM 33.76% 14.60% 1.25 1.85 21.39% 9.15% 0.85 2.75 21.39% 5.91% 0.71 5.10 LEG CO QU CO

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts