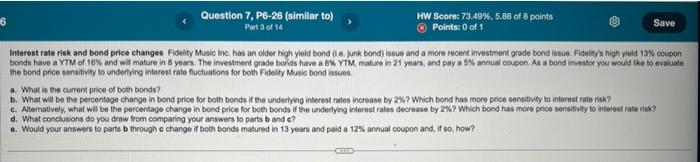

Question: Please answer A through E! all components needed to answer the questions are in the picture. thank you! bends have a YTM of 16% and

bends have a YTM of 16% and wit mature in 8 years. The ifivestment grade borids have a Bx. YTM, mature in 21 years, and pay a 5% anoual coupon. As a bond investar you would ike to evaluale the bond price sensitivity to underlying interest rate fuctuatons for both Fidelity Music bond issues. a. What is the currem price of both bonds? b. What will be the percentege change in bond price for both bends if the undelying interest rates increase by 2W? Which bond has more price senalivity to interest rate risk? c. Alematively, what well be the percentage change in bond price for boen bonds if the undedying interest rates decrease by 2% ? Which bond has more price sensitity to inserest rate nsk? d. What conclusions do you draw troen comparing your answers to parts b and c? e. Would your answers to parts b through e change if boen bonds matured in 13 years and paid a 12 th areual coupon and, if so, how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts