Question: please answer a to c and I will give u a like!!! thankyou Question 1 (21 marks) Happy Company is an all-equity firm with a

please answer a to c and I will give u a like!!! thankyou

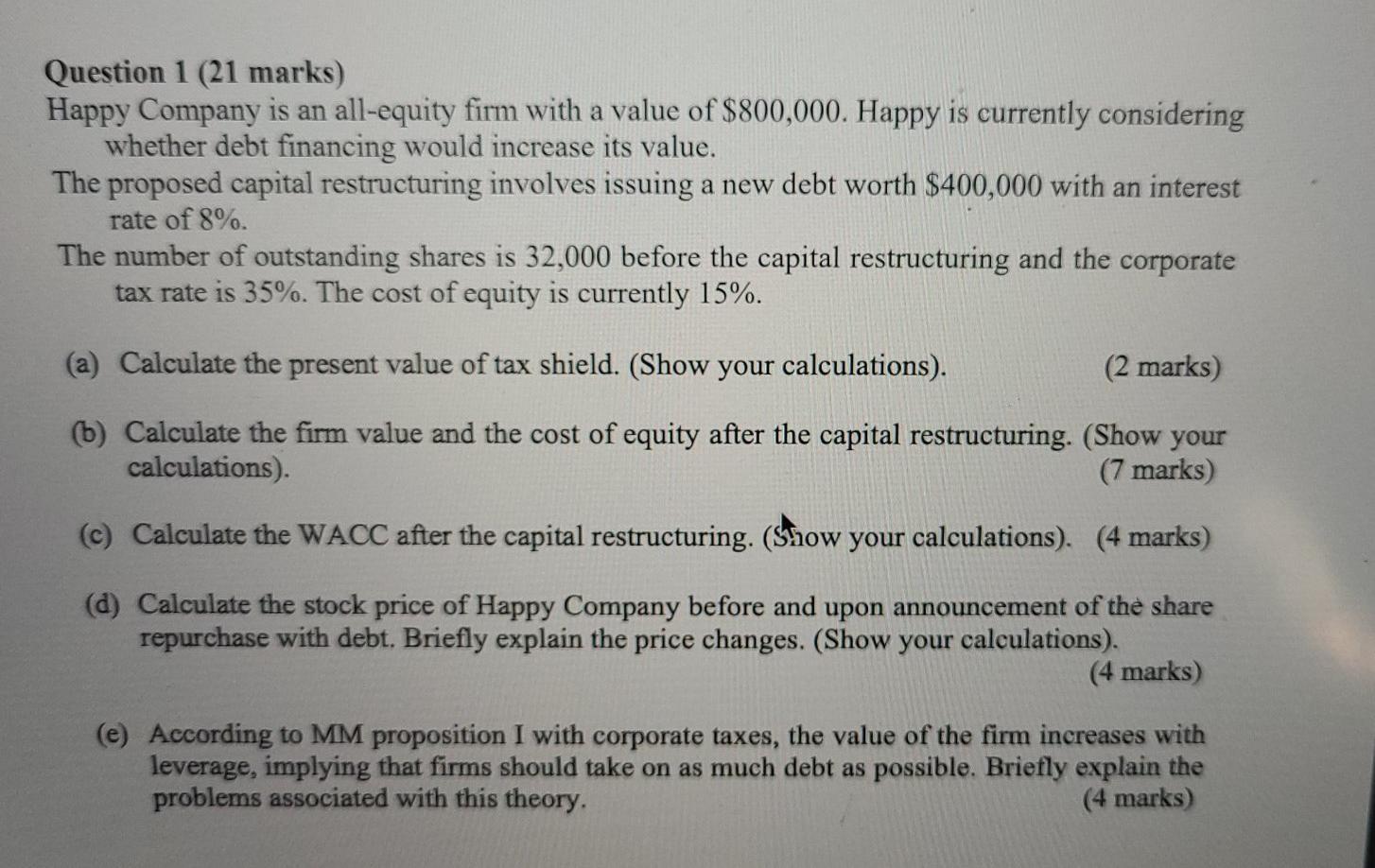

Question 1 (21 marks) Happy Company is an all-equity firm with a value of $800,000. Happy is currently considering whether debt financing would increase its value. The proposed capital restructuring involves issuing a new debt worth $400,000 with an interest rate of 8%. The number of outstanding shares is 32,000 before the capital restructuring and the corporate tax rate is 35%. The cost of equity is currently 15%. (a) Calculate the present value of tax shield. (Show your calculations). (2 marks) (b) Calculate the firm value and the cost of equity after the capital restructuring. (Show your calculations) (7 marks) (c) Calculate the WACC after the capital restructuring. (Show your calculations). (4 marks) (d) Calculate the stock price of Happy Company before and upon announcement of the share repurchase with debt. Briefly explain the price changes. (Show your caleulations). (4 marks) (e) According to MM proposition I with corporate taxes, the value of the firm increases with leverage, implying that firms should take on as much debt as possible. Briefly explain the problems associated with this theory. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts