Question: please answer a to d please show all steps and everything necessary The RBC (Royal Bank of Canada) uses online banking to market two new

please answer a to d please show all steps and everything necessary

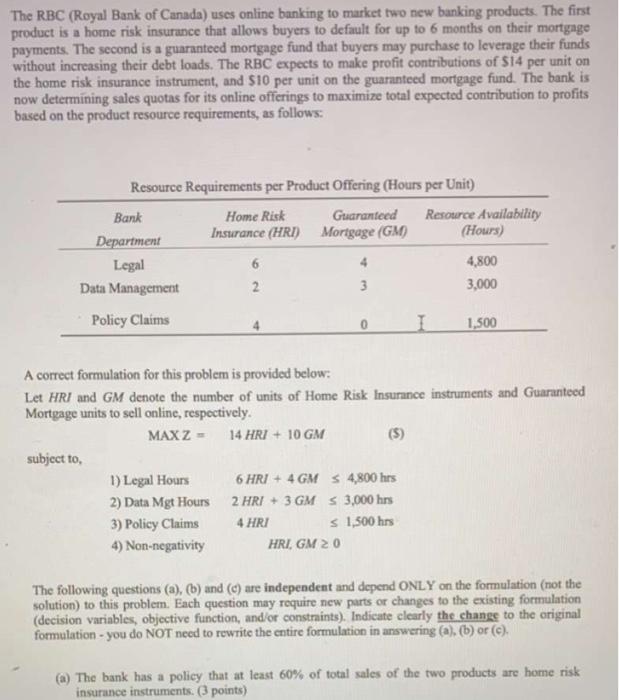

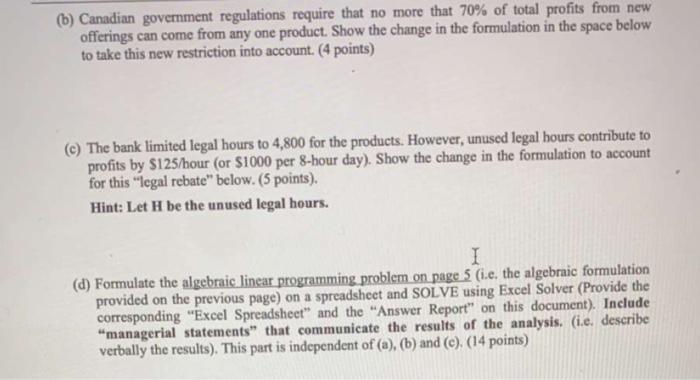

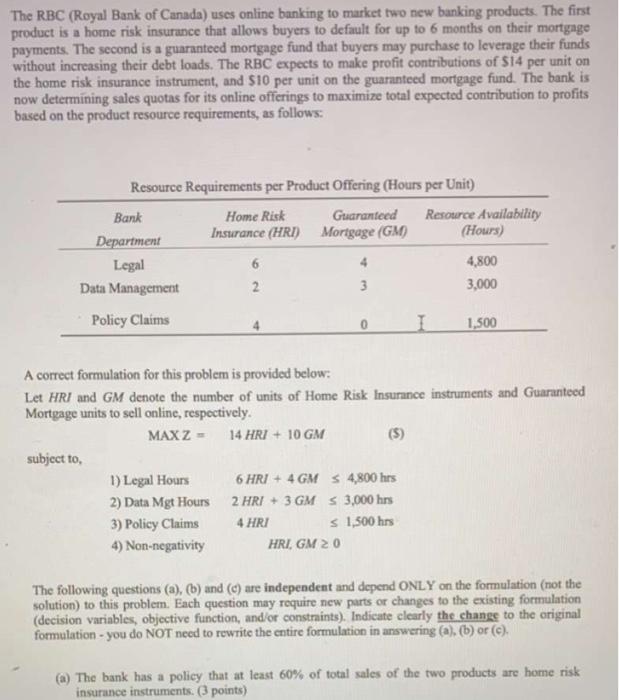

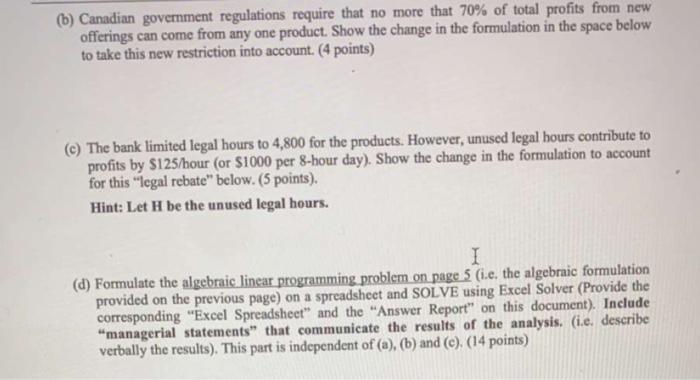

The RBC (Royal Bank of Canada) uses online banking to market two new banking products. The first product is a home risk insurance that allows buyers to default for up to 6 months on their mortgage payments. The second is a guaranteed mortgage fund that buyers may purchase to leverage their funds without increasing their debt loads. The RBC expects to make profit contributions of $14 per unit on the home risk insurance instrument, and $10 per unit on the guaranteed mortgage fund. The bank is now determining sales quotas for its online offerings to maximize total expected contribution to profits based on the product resource requirements, as follows: Resource Requirements per Product Offering (Hours per Unit) Bank Home Risk Guaranteed Resource Availability Department Insurance (HR) Mortgage (GM) (Hours) Legal 6 4 4,800 Data Management 2 3 3,000 Policy Claims I 1,500 A correct formulation for this problem is provided below: Let HRI and GM denote the number of units of Home Risk Insurance instruments and Guaranteed Mortgage units to sell online, respectively. MAX Z - 14 HRI + 10 GM (5) subject to 1) Legal Hours 6 HRI + 4 GM 5 4,800 hrs 2) Data Mgt Hours 2 HRI + 3 GM S 3,000 hrs 3) Policy Claims 4 HRI s 1,500 hrs 4) Non-negativity HRI, GM 20 The following questions (a), (b) and (c) are independent and depend ONLY on the formulation (not the solution) to this problem. Each question may require new parts or changes to the existing formulation (decision variables, objective function, and/or constraints). Indicate clearly the change to the original formulation - you do NOT need to rewrite the entire formulation in answering (a), (b) or (c). (a) The bank has a policy that at least 60% of total sales of the two products are home risk insurance instruments (3 points) (b) Canadian government regulations require that no more that 70% of total profits from new offerings can come from any one product. Show the change in the formulation in the space below to take this new restriction into account. (4 points) (c) The bank limited legal hours to 4,800 for the products. However, unused legal hours contribute to profits by S125/hour (or $1000 per 8-hour day). Show the change in the formulation to account for this "legal rebate" below. (5 points). Hint: Let H be the unused legal hours. I (d) Formulate the algebraic linear programming problem on page 3 (i.e. the algebraic formulation provided on the previous page) on a spreadsheet and SOLVE using Excel Solver (Provide the corresponding "Excel Spreadsheet" and the "Answer Report" on this document). Include "managerial statements" that communicate the results of the analysis. (i.e. describe verbally the results). This part is independent of (a), (b) and (c). (14 points)

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock