Question: please answer A to E. use balance sheet for C,D,E A). Assume that the company was purchased in 2016 for an 8x multiple using $8,400

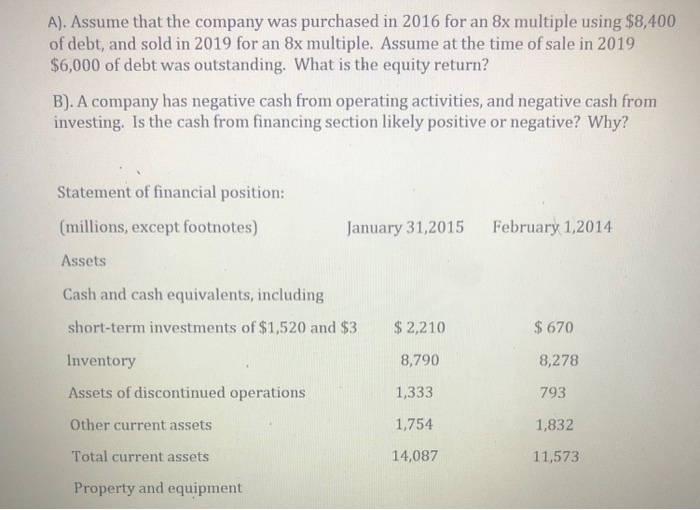

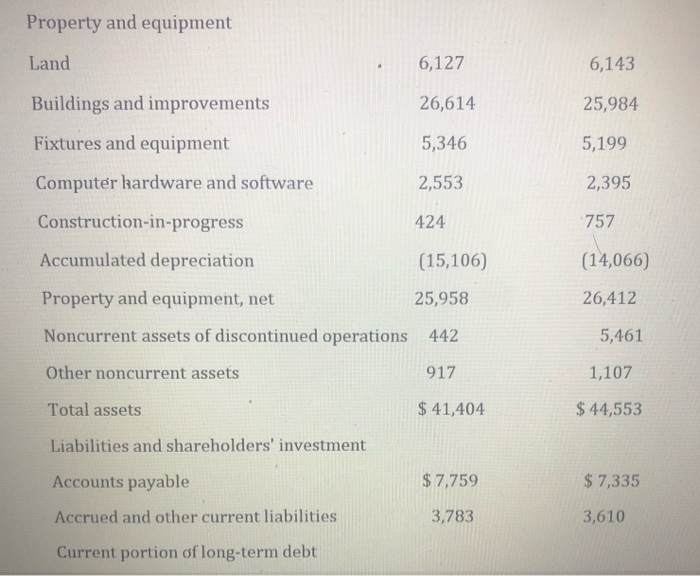

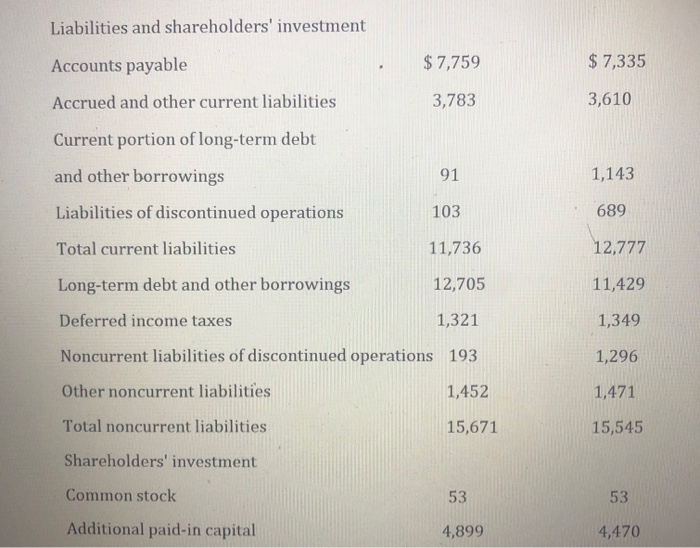

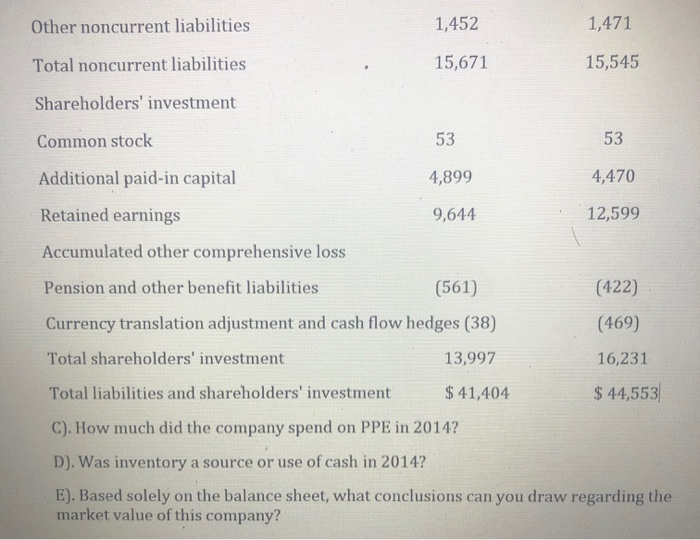

A). Assume that the company was purchased in 2016 for an 8x multiple using $8,400 of debt, and sold in 2019 for an 8x multiple. Assume at the time of sale in 2019 $6,000 of debt was outstanding. What is the equity return? B). A company has negative cash from operating activities, and negative cash from investing. Is the cash from financing section likely positive or negative? Why? Statement of financial position: (millions, except footnotes) January 31,2015 February 1,2014 Assets Cash and cash equivalents, including short-term investments of $1,520 and $3 $ 2,210 $ 670 8,790 8,278 Inventory Assets of discontinued operations 1,333 793 Other current assets 1,754 1,832 Total current assets 14,087 11,573 Property and equipment Property and equipment Land 6,127 6,143 26,614 25,984 Buildings and improvements Fixtures and equipment 5,346 5,199 Computer hardware and software 2,553 2,395 Construction-in-progress 424 757 (14,066) 26,412 Accumulated depreciation (15,106) Property and equipment, net 25,958 Noncurrent assets of discontinued operations 442 Other noncurrent assets 917 5,461 1,107 Total assets $ 41,404 $ 44,553 Liabilities and shareholders' investment Accounts payable $ 7,759 $ 7,335 Accrued and other current liabilities 3,783 3,610 Current portion of long-term debt Liabilities and shareholders' investment Accounts payable $7,759 $ 7,335 Accrued and other current liabilities 3,783 3,610 Current portion of long-term debt and other borrowings 91 1,143 Liabilities of discontinued operations 103 689 Total current liabilities 11,736 12,777 Long-term debt and other borrowings 12,705 11,429 Deferred income taxes 1,321 1,349 Noncurrent liabilities of discontinued operations 193 1,296 Other noncurrent liabilities 1,452 1,471 Total noncurrent liabilities 15,671 15,545 Shareholders' investment Common stock 53 53 Additional paid-in capital 4,899 4,470 Other noncurrent liabilities 1,452 1,471 Total noncurrent liabilities 15,671 15,545 Shareholders' investment Common stock 53 53 Additional paid-in capital 4,899 4,470 Retained earnings 9,644 12,599 Accumulated other comprehensive loss Pension and other benefit liabilities (561) (422) Currency translation adjustment and cash flow hedges (38) (469) Total shareholders' investment 13,997 16,231 Total liabilities and shareholders' investment $ 41,404 $ 44,553 C). How much did the company spend on PPE in 2014? D). Was inventory a source or use of cash in 2014? E). Based solely on the balance sheet, what conclusions can you draw regarding the market value of this company? A). Assume that the company was purchased in 2016 for an 8x multiple using $8,400 of debt, and sold in 2019 for an 8x multiple. Assume at the time of sale in 2019 $6,000 of debt was outstanding. What is the equity return? B). A company has negative cash from operating activities, and negative cash from investing. Is the cash from financing section likely positive or negative? Why? Statement of financial position: (millions, except footnotes) January 31,2015 February 1,2014 Assets Cash and cash equivalents, including short-term investments of $1,520 and $3 $ 2,210 $ 670 8,790 8,278 Inventory Assets of discontinued operations 1,333 793 Other current assets 1,754 1,832 Total current assets 14,087 11,573 Property and equipment Property and equipment Land 6,127 6,143 26,614 25,984 Buildings and improvements Fixtures and equipment 5,346 5,199 Computer hardware and software 2,553 2,395 Construction-in-progress 424 757 (14,066) 26,412 Accumulated depreciation (15,106) Property and equipment, net 25,958 Noncurrent assets of discontinued operations 442 Other noncurrent assets 917 5,461 1,107 Total assets $ 41,404 $ 44,553 Liabilities and shareholders' investment Accounts payable $ 7,759 $ 7,335 Accrued and other current liabilities 3,783 3,610 Current portion of long-term debt Liabilities and shareholders' investment Accounts payable $7,759 $ 7,335 Accrued and other current liabilities 3,783 3,610 Current portion of long-term debt and other borrowings 91 1,143 Liabilities of discontinued operations 103 689 Total current liabilities 11,736 12,777 Long-term debt and other borrowings 12,705 11,429 Deferred income taxes 1,321 1,349 Noncurrent liabilities of discontinued operations 193 1,296 Other noncurrent liabilities 1,452 1,471 Total noncurrent liabilities 15,671 15,545 Shareholders' investment Common stock 53 53 Additional paid-in capital 4,899 4,470 Other noncurrent liabilities 1,452 1,471 Total noncurrent liabilities 15,671 15,545 Shareholders' investment Common stock 53 53 Additional paid-in capital 4,899 4,470 Retained earnings 9,644 12,599 Accumulated other comprehensive loss Pension and other benefit liabilities (561) (422) Currency translation adjustment and cash flow hedges (38) (469) Total shareholders' investment 13,997 16,231 Total liabilities and shareholders' investment $ 41,404 $ 44,553 C). How much did the company spend on PPE in 2014? D). Was inventory a source or use of cash in 2014? E). Based solely on the balance sheet, what conclusions can you draw regarding the market value of this company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts