Question: please answer A&B. Suppose you purchase a 10-year bond with 6.1% annual coupons. You hold the bond for four years, and sell it immediately after

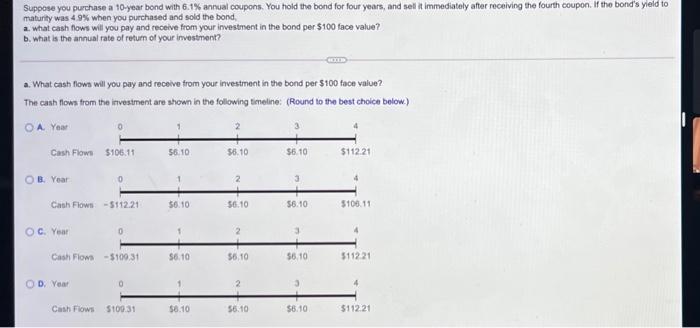

Suppose you purchase a 10-year bond with 6.1% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 49% when you purchased and sold the bond, a. what cash flows will you pay and receive from your investment in the bond per 100 face value? b. what is the annual rate of return of your investment? a. What cash flown will you pay and receive from your investment in the bond per $100 tace value? The cash flows from the investment are shown in the following timeline: (Round to the best choice below) O A Year 0 3 Cash Flows $106.11 56.10 56.10 $6.10 $11221 OB. Year 2 3 Cash Flows -$112.21 $6.10 56.10 56.10 5106.11 OG Year Cash Flows-5109,31 56.10 56,10 $6.10 511221 OD. Your o 2 3 Cash Flows 5100 31 $8.10 56.10 $6.10 $112.21

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts