Question: please answer A-C with the info provided C has 6 parts which are the last 2 pics Question Help Markov Manufacturing recently spent $16.2 million

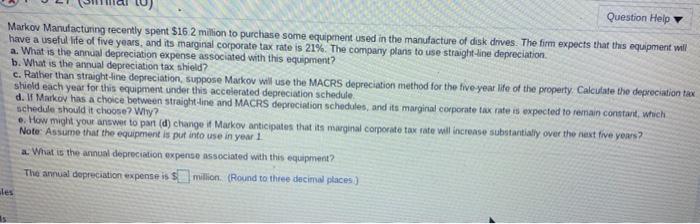

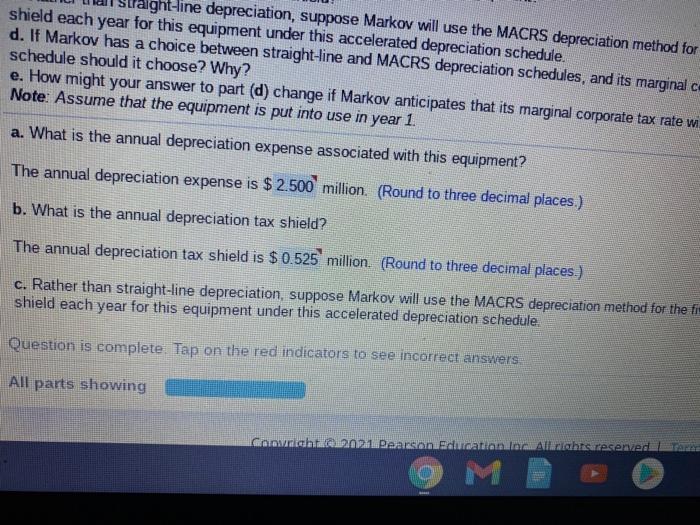

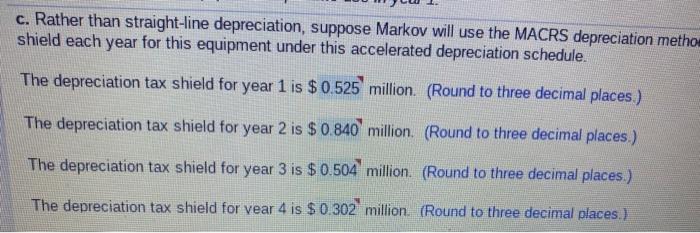

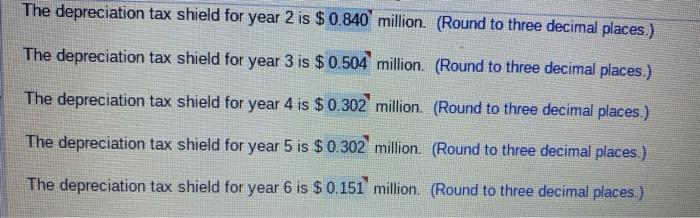

Question Help Markov Manufacturing recently spent $16.2 million to purchase some equipment used in the manufacture of disk drives. The firm expects that this equipment will have a useful life of five years, and its marginal corporate tax rate is 21%. The company plans to use straight-line depreciation. a. What is the annual depreciation expense associated with this equipment? b. What is the annual depreciation tax shield? c. Rather than straight-line depreciation suppose Markow will use the MACRS depreciation method for the five year life of the property Calculate the depreciation tax shield each year for this equipment under this accelerated depreciation schedule d. Markoy has a choice between straight-line and MACRS depreciation schedules, and its marginal corporate tax rate is expected to remain content which schedule should it choose? Why? How might your answer to pan (d) change it Markov anticipates that its marginal corporate tax rate will increase substantially over the next five yours? Note: Assume that the equipment is put into use in year 1 a. What is the annual depreciation expense associated with this equipment? The annual depreciation expense is $ million (Round to three decimal places) t-line depreciation, suppose Markov will use the MACRS depreciation method for shield each year for this equipment under this accelerated depreciation schedule. d. If Markov has a choice between straight-line and MACRS depreciation schedules, and its marginal schedule should it choose? Why? e. How might your answer to part (d) change if Markov anticipates that its marginal corporate tax rate wi Note: Assume that the equipment is put into use in year 1. a. What is the annual depreciation expense associated with this equipment? The annual depreciation expense is $ 2.500 million. (Round to three decimal places.) b. What is the annual depreciation tax shield? The annual depreciation tax shield is $ 0.525' million (Round to three decimal places.) c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation method for the fi shield each year for this equipment under this accelerated depreciation schedule. Question is complete. Tap on the red indicators to see incorrect answers. All parts showing carichi Raarganadinatinalar Anahts reserved 9 M c. Rather than straight-line depreciation, suppose Markov will use the MACRS depreciation methou shield each year for this equipment under this accelerated depreciation schedule. The depreciation tax shield for year 1 is $0.525 million. (Round to three decimal places) The depreciation tax shield for year 2 is $ 0.840 million (Round to three decimal places.) The depreciation tax shield for year 3 is $ 0.504' million. (Round to three decimal places.) The depreciation tax shield for vear 4 is $ 0.302 million (Round to three decimal places.) The depreciation tax shield for year 2 is $0.840 million. (Round to three decimal places.) The depreciation tax shield for year 3 is $0.504 million. (Round to three decimal places.) The depreciation tax shield for year 4 is $ 0.302 million (Round to three decimal places.) The depreciation tax shield for year 5 is $ 0.302 million. (Round to three decimal places.) The depreciation tax shield for year 6 is $ 0.151 million. (Round to three decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts