Question: Please answer according to my provided data A 1 6 - 1 9 Tax Calculations; Enacted Tax Rate Change ( LO 1 6 - 2

Please answer according to my provided data

A Tax Calculations; Enacted Tax Rate Change LO

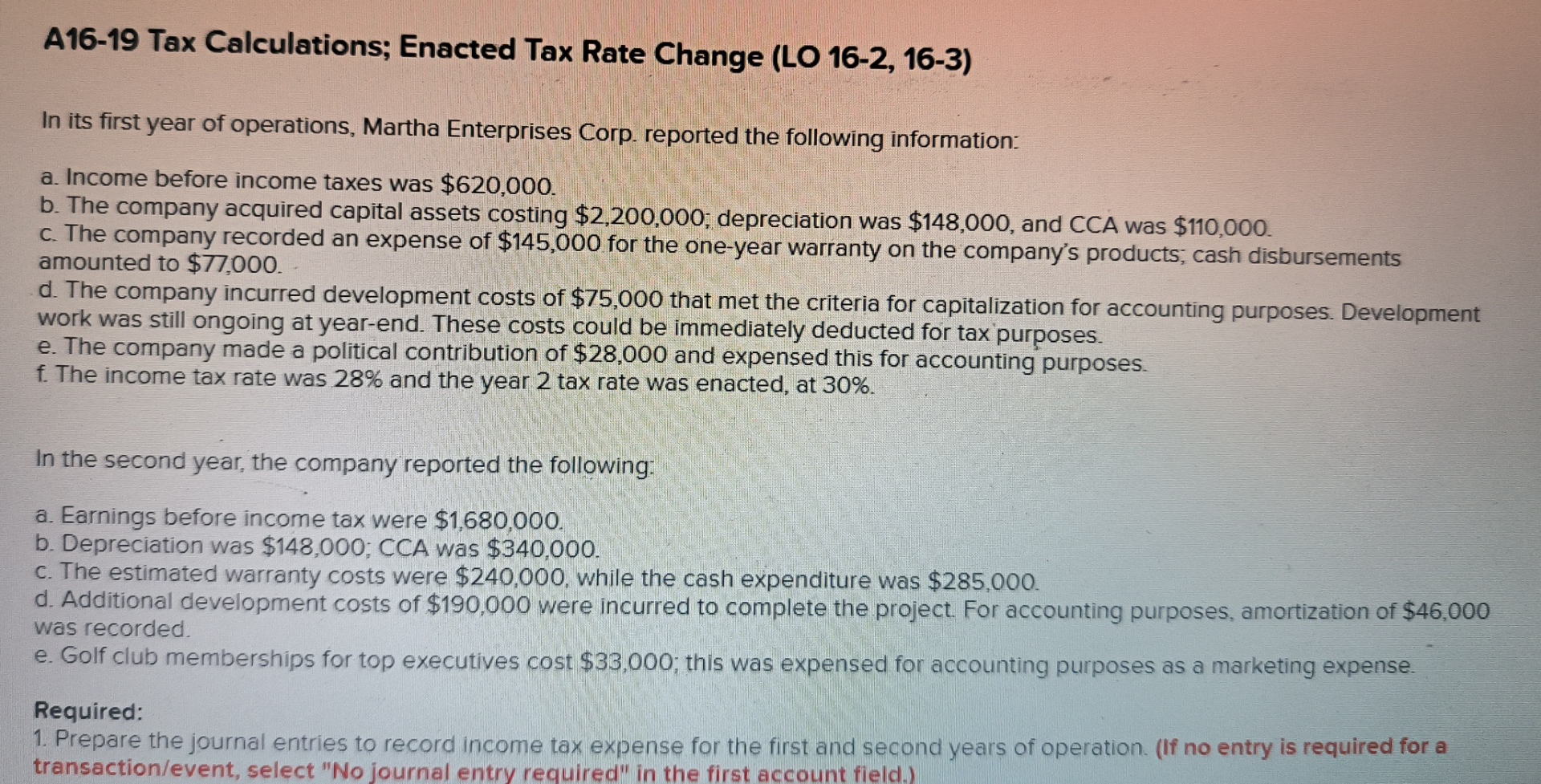

In its first year of operations, Martha Enterprises Corp. reported the following information:

a Income before income taxes was $

b The company acquired capital assets costing $; depreciation was $ and CCA was $

c The company recorded an expense of $ for the oneyear warranty on the company's products; cash disbursements

amounted to $

d The company incurred development costs of $ that met the criteria for capitalization for accounting purposes. Development

work was still ongoing at yearend. These costs could be immediately deducted for tax purposes.

e The company made a political contribution of $ and expensed this for accounting purposes.

f The income tax rate was and the year tax rate was enacted, at

In the second year, the company reported the following:

a Earnings before income tax were $

b Depreciation was $; CCA was $

c The estimated warranty costs were $ while the cash expenditure was $

d Additional development costs of $ were incurred to complete the project. For accounting purposes, amortization of $

was recorded.

e Golf club memberships for top executives cost $; this was expensed for accounting purposes as a marketing expense.

Required:

Prepare the journal entries to record income tax expense for the first and second years of operation. If no entry is required for a

transactionevent select No journal entry required" in the first account field.

A Tax Calculations; Enacted Tax Rate Change LO

In its first year of operations, Martha Enterprises Corp. reported the following information:

a Income before income taxes was $

b The company acquired capital assets costing $; depreciation was $ and CCA was $

c The company recorded an expense of $ for the oneyear warranty on the company's products; cash disbursements

amounted to $

d The company incurred development costs of $ that met the criteria for capitalization for accounting purposes. Development

work was still ongoing at yearend. These costs could be immediately deducted for tax purposes.

e The company made a political contribution of $ and expensed this for accounting purposes.

f The income tax rate was and the year tax rate was enacted, at

In the second year, the company reported the following:

a Earnings before income tax were $

b Depreciation was $; CCA was $

c The estimated warranty costs were $ while the cash expenditure was $

d Additional development costs of $ were incurred to complete the project. For accounting purposes, amortization of $

was recorded.

e Golf club memberships for top executives cost $; this was expensed for accounting purposes as a marketing expense.

Required:

Prepare the journal entries to record income tax expense for the first and second years of operation. If no entry is required for a

transactionevent select No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock