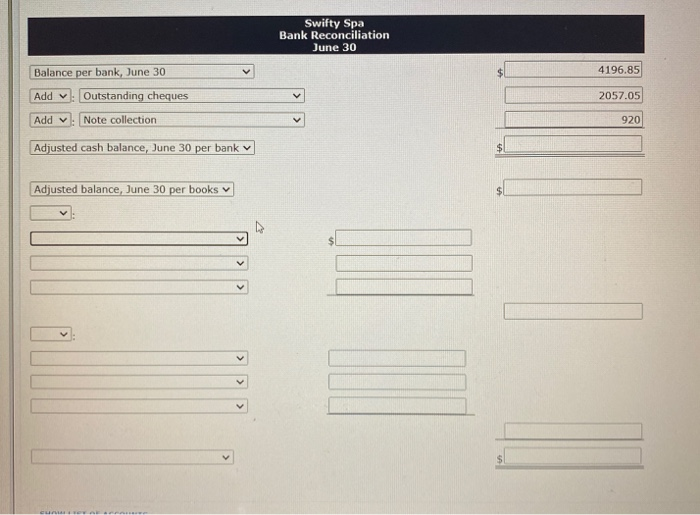

Question: please answer accordingly to the drop down menu please and fill in all sections according to chart. WileyPLUS Problem 7-6 Swifty Spa shows a general

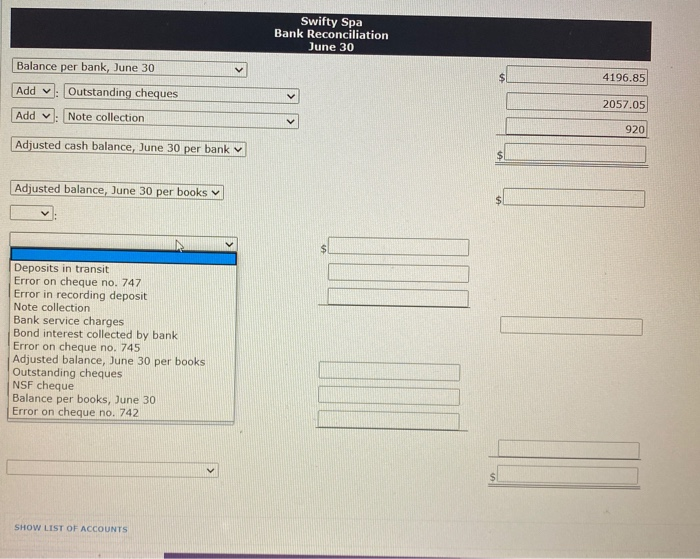

WileyPLUS Problem 7-6 Swifty Spa shows a general ledger balance for the Cash account of $4,196,85 on June 30 and the bank statements of that date indicates a balance of $4.140.00. When the statement was compared with the cash records, the following facts were determined 1. There were bank service charges for June of $30.00 2. A bank memo stated that Bao Dar's note for $920.00 and interest of $38.00 had been collected on June 29, and the bank had charged 54.00 for the collection. Any interest revenue has not been accrued. 3. Deposits in transit June 30 were $2,970.00 4. Cheques outstanding on June 30 totaled $2,057.05. 5. On June 29, the bank had charged Swifty Spa's aclaunt for a customer's NSF cheque amounting to $533.20 6. A customer's cheque received as a payment on account of $99.00 had been entered as 177.00 in the cash receipts journal by Swity Spa on June 15. 7. Cheque no. 742 in the amount of $511.00 had been entered in the books as $452.00, and cheque no, 247 in the amount of $47.70 had been entered as $550.00. Both cheques were issued as payments on account B. In May, the bank had charged a $34.50 Wella Spa cheque against the Swifty Spa account. The June bank statement indicated that the bank had reversed this charge and corrected its error Swifty Spa Bank Reconciliation June 30 4196.85 Balance per bank, June 30 Add Outstanding cheques 2057.05 Add v Note collection 920 Adjusted cash balance, June 30 per bank v Adjusted balance, June 30 per books V CL Swifty Spa Bank Reconciliation June 30 Balance per bank, June 30 Add Outstanding cheques 4196.85 2057.05 Add Note collection 920 Adjusted cash balance, June 30 per bank Adjusted balance, June 30 per books $ Deposits in transit Error on cheque no. 747 Error in recording deposit Note collection Bank service charges Bond interest collected by bank Error on cheque no. 745 Adjusted balance, June 30 per books Outstanding cheques NSF cheque Balance per books, June 30 Error on cheque no. 742 SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts