Question: Please answer accurately the problem early for an upvote Problem 3 (20 Points): Grand Company authorized $150,000 of 5-year bonds dated January 1, 2015. The

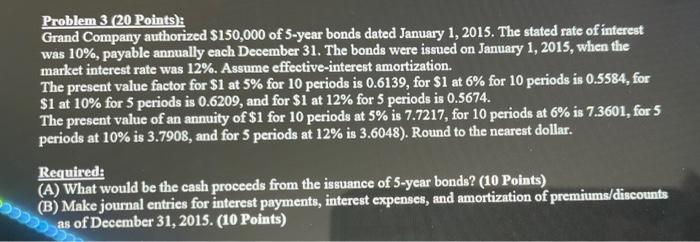

Problem 3 (20 Points): Grand Company authorized $150,000 of 5-year bonds dated January 1, 2015. The stated rate of interest was 10%, payable annually each December 31. The bonds were issued on January 1, 2015, when the market interest rate was 12%. Assume effective-interest amortization. The present value factor for $1 at 5% for 10 periods is 0.6139, for $1 at 6% for 10 periods is 0.5584, for $1 at 10% for 5 periods is 0.6209, and for $1 at 12% for 5 periods is 0.5674. The present value of an annuity of $1 for 10 periods at 5% is 7.7217, for 10 periods at 6% is 7.3601, for 5 periods at 10% is 3.7908, and for 5 periods at 12% is 3.6048). Round to the nearest dollar. Required: (A) What would be the cash proceeds from the issuance of 5-year bonds? (10 Points) (B) Make journal entries for interest payments, interest expenses, and amortization of premiums/discounts as of December 31, 2015. (10 Points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts