Question: Please answer a-d, please can all workings be shown, thank you ools organizational beh...Class 3-Diversity.EICS2014PUMF 1 12 -) 125% Question 1: Application of Time Value

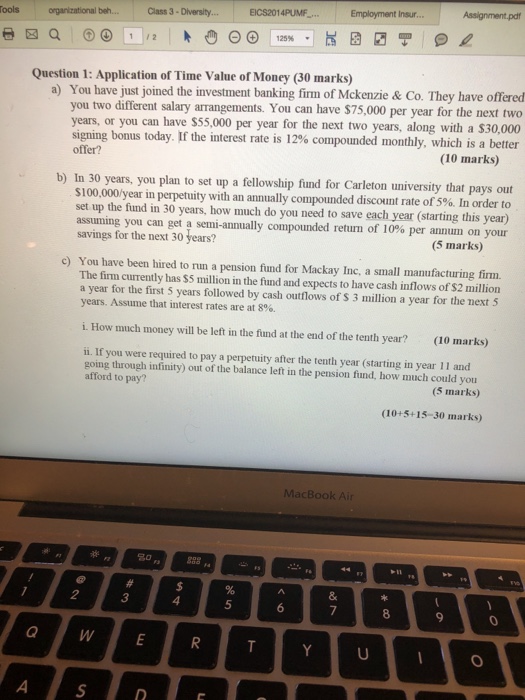

ools organizational beh...Class 3-Diversity.EICS2014PUMF 1 12 -) 125% Question 1: Application of Time Value of Money (30 marks) a) You have just joined the investment banking firm of Mckenzie & Co. They have offered u two different salary arrangements. You can have $75,000 per year for the next two yo years, offer? or you can have $55,000 per year for the next two years, along with a $30,000 signing bonus today. If the interest rate is 12% compounded monthly, which is a better (10 marks) b) In 30 years, you plan to set up a fellowship fiund for Carleton university that pays out $100,000/year in perpetuity with an annually compounded discount rate of 5%. In order to set up the fund in 30 years, how much do you need to save each year (starting this year) assuming you can get a semi-annually compounded return of 10% per annum on your savings for the next 30 years? (5 marks) c) You have been hired to run a pension fund for Mackay Inc, a small manufacturing firm. The firm currently has $5 million in the fund and expects to have cash inflows of $2 million a year for the first 5 years followed by cash outflows of S 3 million a year for the next 5 i. How much money will be left in the fund at the end of the tenth year? (10 marks) going through infinity) out of the balance left in the pension fund, how much could you years. Assume that interest rates are at 8%. ii. If you were required to pay a perpetuity after the tenth year (starting in year 11 and afford to pay? (5 marks) (10+5+15-30 marks) MacBook Air 3 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts